Stablecoin DeFi yield farming in 2025, efforts required and target yield

Background

DeFi summer was 2022, kicked off by Compound. Then in the later years new innovations kept emerg along with new chains and protocols, though some protocols unfortunately lost users and quitted (e.g. Alpaca finance closed, or the whole chain Heco closed, and LUNA/UST ponzi collapse).

Now at July 2025, whether we are expecting another DeFi summer, we see a ton of discussions around how to farm on DeFi, especially around how to utilize stablecoins for yield.

Depending on how frequent you need to trade, or in other words how much time/efforts you can put into DeFi farming, this article will introduce some mainstream ways for managing USDC/USDT on DeFi (so we will skip the LST/LRT that mainly on ETH, or anything that might cause impermanent loss), in the sequence of trading frequency/ yield expectation from low to high.

Pure Passive

Fits those who have a very conservative risk appetite, and not much time to study the trendy scheme or bear the risk of new applications. And happy with a yield slightly above US Treasury bills.

Lending/ borrowing

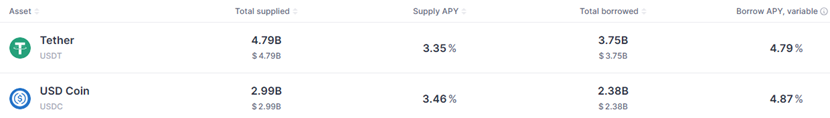

As the pillar of finance industry, lending / borrowing started in DeFi from Compound and it’s still hot now, the champion is now AAVE and AAVE has launched V4 with much easier cross-chain capabilities for easy liquidity migration. Likely in the future, AAVE might launch its own L2 AAVE chain, to fully unify the liquidity.

Lending / borrowing market yield comes from market demand, and demand is normally triggered by higher yield opportunities like airdrop, arbitrage. Sometimes inefficiency in supply also might drive a short-term high yield but will be filled in hours, e.g., in June 2025 HTX withdrew 400 million USDT from AAVE, causing the USDT deposit APY to rise to 24.65%, then in half an hour it dropped to 8.07%.

There are also lending protocols on every chain, e.g., Venus on BSC chain, Suilend on SUI chain, and HyperLend on HyperEVM chain… However, lending / borrowing market is relatively stable, so new chains and new protocol does not generate significantly higher yield.

Stablecoin AMM

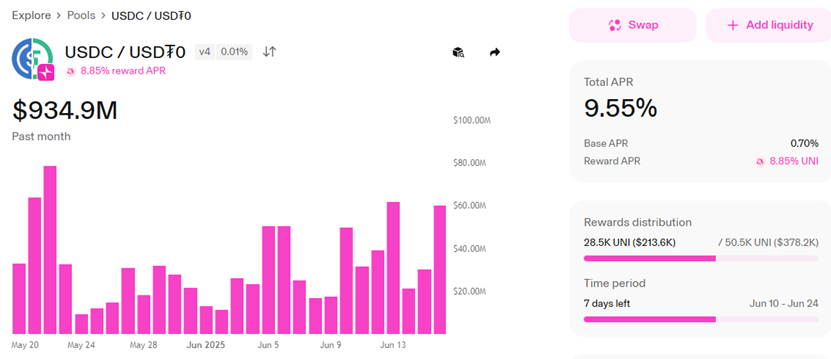

Curve 3pool and Uniswap (V4) USDC/USDT still exist, and liquidity is good. But the yield nowadays is low (most the APY comes from Uniswap’s UNI reward).

To earn higher yield, traders might turn to smaller stablecoins for higher yield, mentioned afterwards.

And with more countries' own currency stable coin issuarance, we would expect the weekend FX market to happen on blockchain.

Yield bearing stablecoins

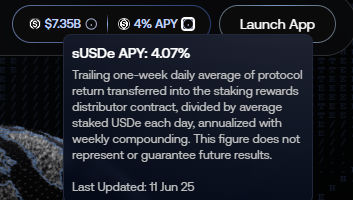

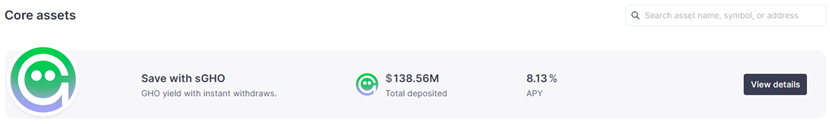

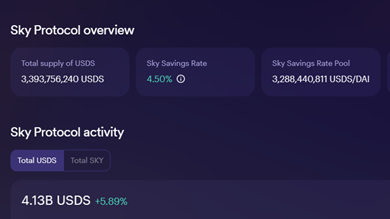

Biggest DeFi native ones are USDE, GHO, USDS and crvUSD which will generate yield by staking them into its native protocol.

- sUSDE yield comes from funding rate arbitrage and US Treasury bills

- GHO can be supplied into AAVE for yield. The concept of sGHO is proposed in Aave Chan Initiative but still in discussion.

- sUSDS yield comes from SKY protocol (previously known as MakerDao), with periodical change on its APY (previously 6.5% to current 4.5% annualized)

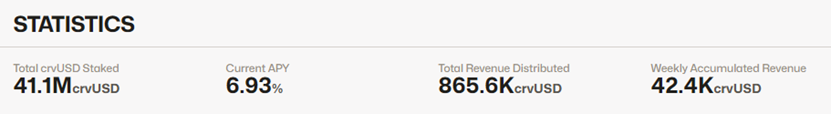

- scrvUSD, issued by Curve Finance

There is a long list but smaller yield bearing stable coins like USD0, lvlUSD, frxUSD, USDY, yUSD, DOLA, USR, BOLD… Also BUIDL, the money market fund by Blackrock tokenized into a blockchain token, initially on ETH and now expanded into numerous chains.

All those stablecoins, as long as they have a pegging scheme and a liquid market to trade or redeem with USDT or USDC or even USD, will at lease follow the interest rate of USDT or USDC because the least thing to do is to borrow this coin and trade into USDT or USDC for trading purpose. And there should some subsidy likely from the stablecoin issuer to incentivize users for adoption so their deposit and borrow rate should be closer than USDT or USDC.

To summarize, you can basically put money into the protocol and do nothing, just wait for the harvest. They are nearly effortless, and their APY is generally stable at 5%-10%.

Monthly-weekly efforts

If you aim for higher yield and you have some time and efforts, below are the strategies that take trading or operations on a weekly or monthly basis, and monitoring on a daily basis.

Lending/ borrowing or AMM in protocols with bonus

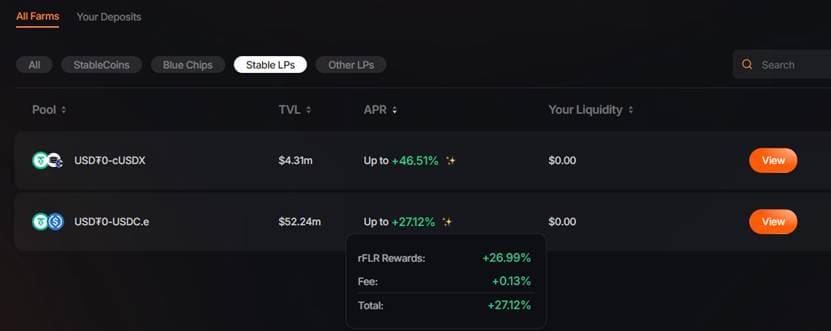

New protocols, when they are in demand of TVL, will launch bonus incentives to attract users. Take an example of the real world. Usually small banks or new brokers will launch incentive to attract new users.For example, now SparkDEX has quite high incentive on USDC/USDT LP.

For example, now SparkDEX has quite high incentive on USDC/USDT LP.

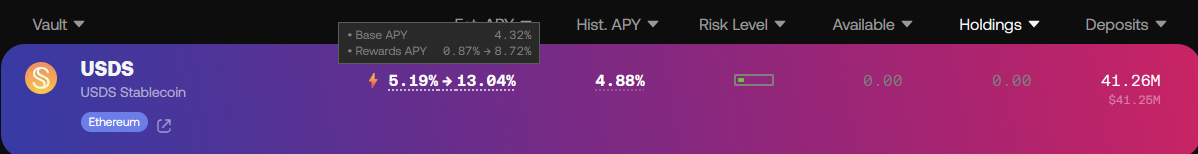

But it's not always small or new protocols. Now Yearn is also incentivizing USDS deposits with 13.04% APY.

Such incentives are offered by new protocols from time to time, usually lending / borrowing protocols’ incentive tends to be less lucrative and less durable than AMM protocols’ incentive.

To participate in such farming, farmers should constantly check the latest incentive programs across chains and protocols, and more importantly mitigate the new smart contract’s technology/ counterparty risk, because there is higher risk of money being hacked for new protocols. A very practical rule is, the protocol should be very safe if the new protocol fully forks a long-existing protocol like Compound with 0 innovations. The more innovation, the more risky the new protocol would be.

Pendle

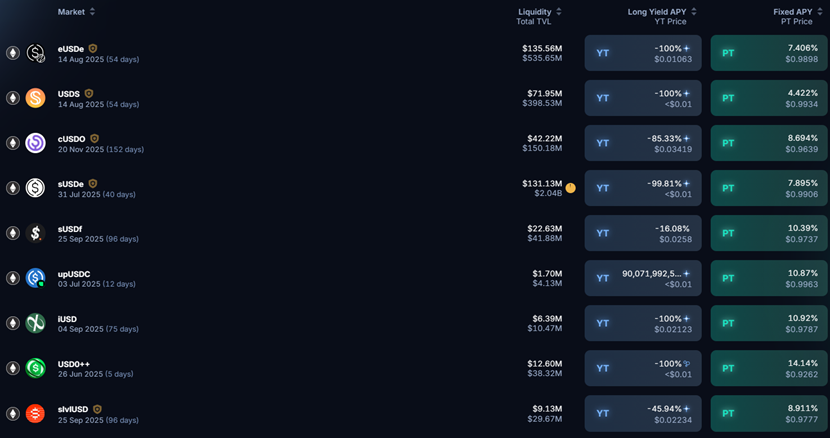

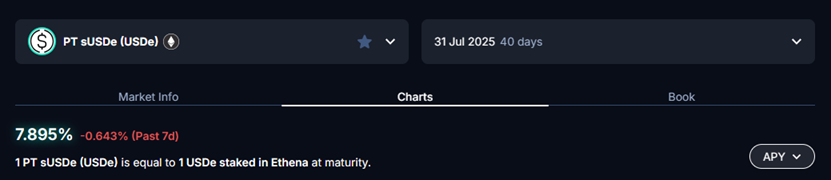

Pendle is not a type of strategy, but the protocol name for trading interest rate derivatives. It has been the hottest protocol in the last 2 years. Users can deposit yield-generating assets into Pendle and mint Principal Tokens (PT) and Yield Tokens (YT). PT represents the principal of the underlying yield-bearing token, while YT represents the yield to the due date.

Active traders can buy or sell the YT token if they have an opinion on the future change on interest. While passive traders, if they want to fix the interest till a due date, can deposit the underlying and get both the PT and YT token, and sell the YT token to active traders.

As shown on https://app.pendle.finance/trade/markets?chains=ethereum&search=usd, it’s USD stablecoins typically are rewarded close or higher to the native yield.

There are similar protocols like RateX, Exponent and Spectra as well, yield is overall higher while liquidity is mainly on smaller stablecoins.

Strategy vaults – on-chain funds

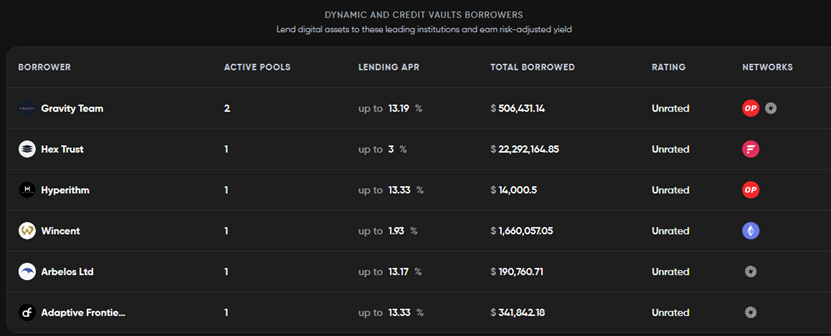

In the past, such strategy vaults are based on borrower’s credit, not transparent and usually fixed yield (could adjust with market conditions) like https://clearpool.finance/borrowers/, more like an OTC loan to reputable institutions contracted on blockchain.

Now the trading vaults are more transparent and they also share performance with allocators.

Some protocols listed ‘official vaults’ either operated by the trading strategy of their own or a community-nominated 3 rd party manager

- Orderly’s treasury vault https://app.orderly.network/staking

- DYDX Megavault https://dydx.trade/vault (operated by Greave Cayman Limited, affiliated to Gauntlet)

- Etherfi market neutral USD vault https://www.ether.fi/app/liquid/usd

Others clearly marked they are operated by 3rd party teams

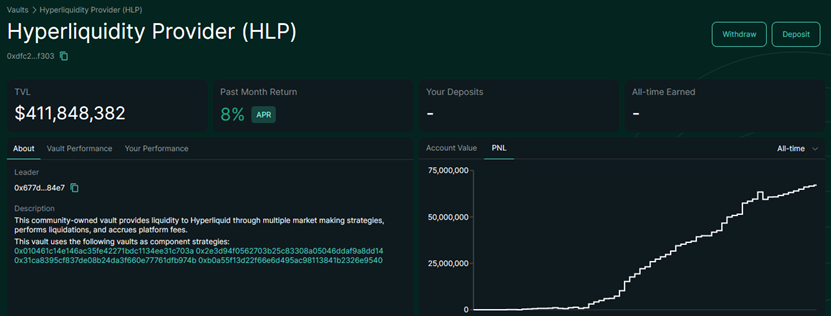

- Hyperliquid user vaults, like https://app.hyperliquid.xyz/vaults/0xac26cf5f3c46b5e102048c65b977d2551b72a9c7

- Drift strategy vaults https://app.drift.trade/vaults/strategy-vaults

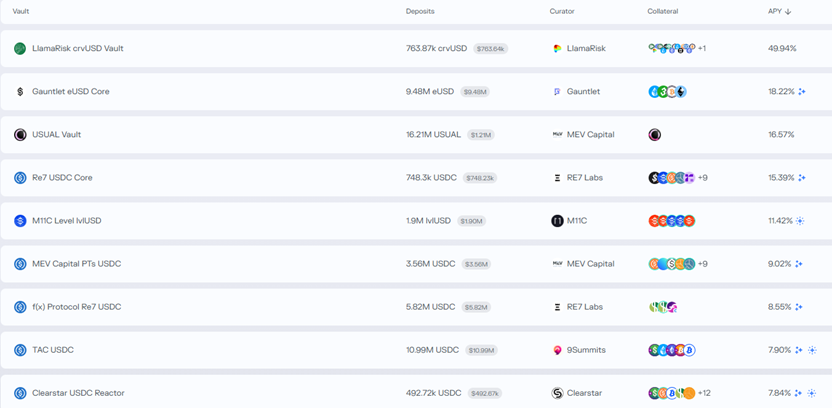

- Morpho Blue Earn https://app.morpho.org/ethereum/earn

- Neutral Trade https://www.app.neutral.trade/strategies

To allocate into strategy vaults is not too different from investing into a DeFi fund, it takes due diligence to the fund manager and sometimes trading to switch managers for higher yield. The APY is generally at 10%-20%.

Daily-real-time efforts

Then there are higher trading frequency strategies, that need real-time monitoring and daily trading, sometimes even programmatic trading.

AMM + Hedge / Cross-market arbitrage

Along the past years, there have been always DeFi AMM LP with good volume and trading incentive. It started from Uniswap LP + CEX hedge, then GMX LP + CEX hedge. Now it’s Jupiter JLP + CEX hedge (better liquidity) or Drift hedge (can be done without moving money from/to another wallet). For serious investors, such strategies should be monitored real-time and use a program to hedge. But it’s still possible to monitor hourly and hedge manually, where the risk will be higher.

Then there’s order book type of DEX, like DYDX where traders can trade and hedge with another CEX and now it’s Hyperliquid and Drift. The methodology is exactly the same with CeFi cross venue arbitrage. And even Hyperliquid and Drift have both spot and perp margin, that enables traders to do same venue funding rate arbitrage. Those arbitrage windows are in milliseconds, hence not possible to be captured by UI manual trade, it has to be a low latency trading program and real-time portfolio and risk management system.

This is very often the strategy of vaults mentioned above, e.g., https://www.app.neutral.trade/strategies/jlpdnv4 or https://www.app.neutral.trade/strategies/hlfundingarb. Those vault managers will aggregate fund from vault investors, and manager such strategies with usually hidden management fee or a performance fee cut from the yield, while they might give away points or airdrop to incentive allocation.

To summarize, these strategies need both research and continuous portfolio monitoring and trading technology. The APY is generally stable at 15%-30% depending on the leverage used.

Loop/ recursive borrowing and lending

Usually lending interest is lower than borrowing, but in DeFi one protocol’s deposit interest could be higher than another protocol’s borrowing cost. Loop / recursive borrowing and lending is to capture such opportunity and arbitrage interest rate difference rather than price difference.

This is how Compound started the yield farming, by giving away COMP token for both lenders and borrowers and the COMP value is higher than the difference of borrowing and lending. Theoretically COMP token should be over sell on the market, so the price will go to a level where lending income – borrowing cost + COMP token incentive should be 0 or below 0 so there’s a cost in doing this, but Compound project team used their own money to buy COMP token on the secondary market to keep lending income – borrowing cost + COMP token >0 for several weeks, so there’s a continuous profit in doing such borrowing and lending loop.

Then there was a period where AAVE expanded to AVAX chain, there’s AVAX token incentive in both supplying and borrowing on AAVE protocol specifically on AVAX chain, and lending income – borrowing cost + AVAX token >0

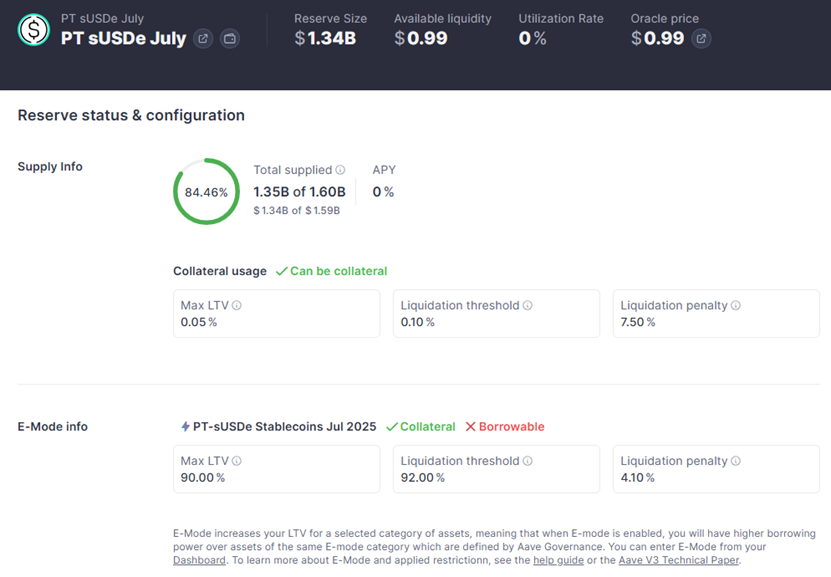

Now there’s very rare case where you are arbitrage within the same borrowing and lending protocol, but there’s still ways to make loop / recursive borrowing and lending across protocols. The popular approach nowadays, is to arbitrage between AAVE and Pendle. Farmers buy sUSDe PT from Pendle, then deposit PT and borrow USDC/USDT from AAVE and then buy sUSDe PT from Pendle again, then deposit into AAVE to borrow USDC/USDT… For yield and risk control consideration, farmers usually trade at 2-3x leverage.

You are expecting to earn

- PT token yield (~8%) minus the borrowing cost (~5%)

- Potential points for airdrop

Suppose you have 100 USDC, PT token yield is 8% annualized, while borrowing cost of AAVE of USDT or USDC is 5%, and you borrow ~70% of collateral each time for enough buffer (the liquidation threshold is 92%)

So, your holding would be

- Margin: sUSDe $100 + $70 + $50 = $220, expecting 8% annualized income

- Loan: $70 + $50 = $120, expecting 5% annualized interest cost

The gross annualized yield would be 220*8% - 120*5% = 11.6%, in reality there’s also gas fees, slippage when trading PT token etc.

The risks are liquidation and interest rate change, so real-time health rate monitor and alerting is essential, so farmer can take necessary actions immediately.

Points/ airdrop farming

In the beginning, those airdrop projects announce eligibility on the same day of distribution, so farmers can only accept the results, e.g., Uniswap, DYDX… For sure, frequent users would get more than normal users.

Then afterwards more projects like Blast and Hyperliquid publicize the daily points or scoring mechanism long time before the airdrop announcement, leaving people enough time to earn point and compete for higher airdrop, so airdrop project can accumulate active users and allocate airdrop to reward real heavy users.

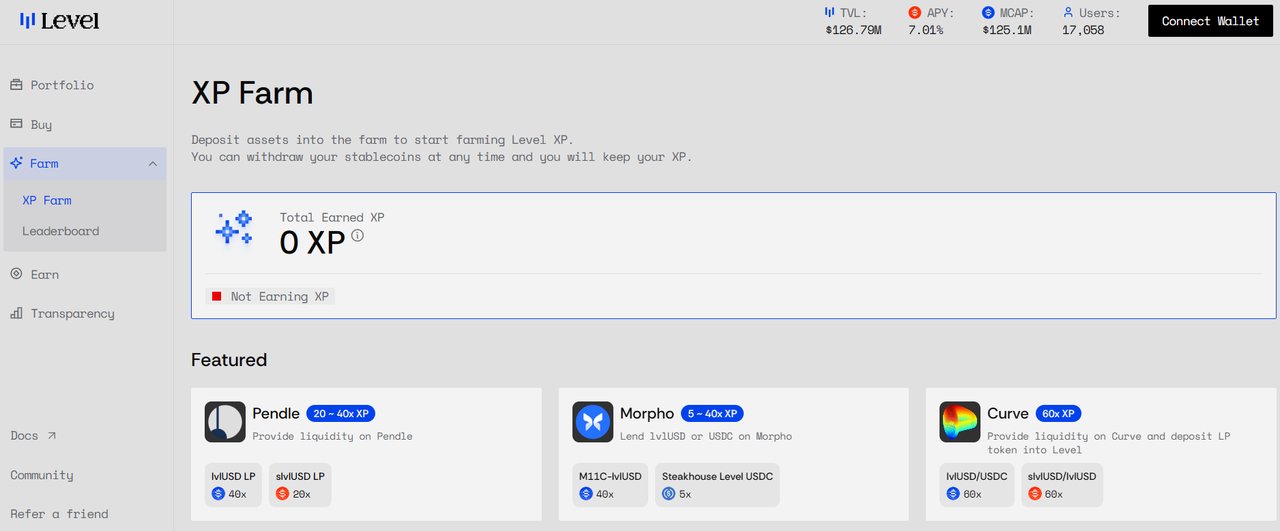

Recent samples are https://app.level.money/farm

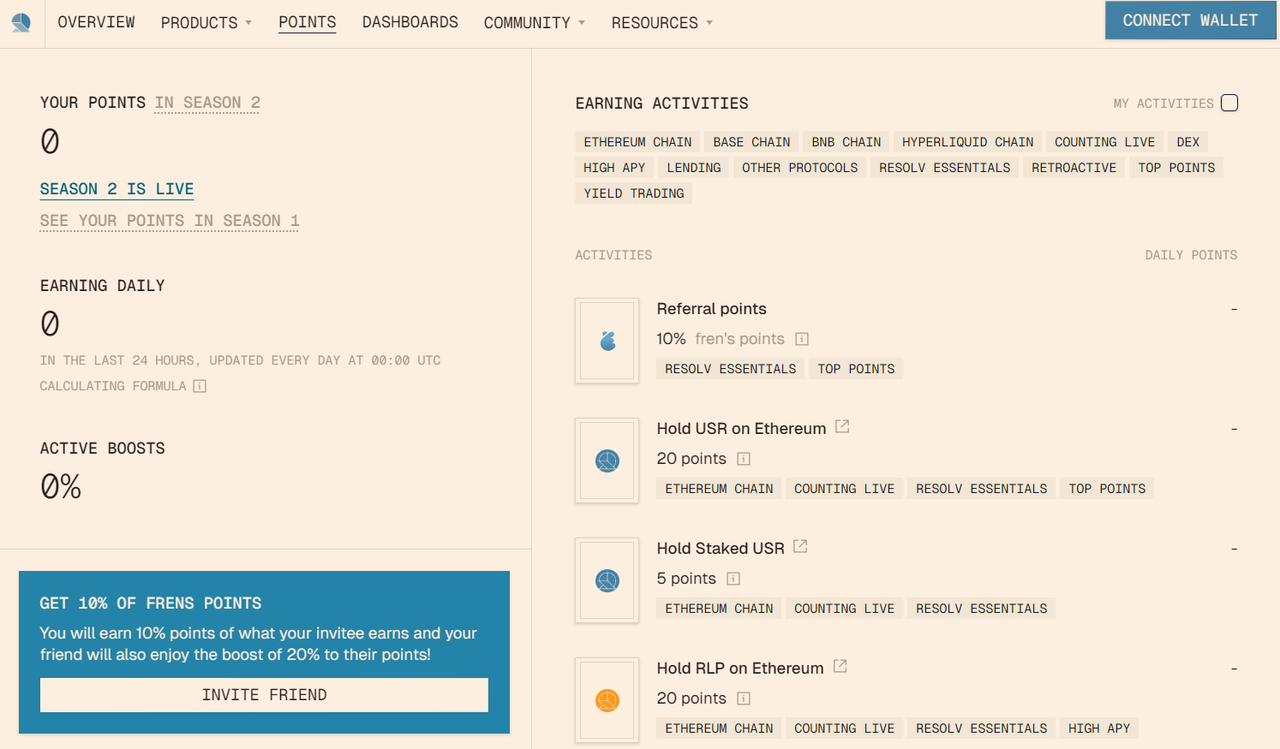

And https://app.resolv.xyz/points

CEX like Binance also launched Alpha program, the Binance points/ airdrop farming program but that's centralized so won't be elaborated here.

In such cases, usually the farmer would maintain at least 10 addresses as an individual, or a studio that hires many people to manage over 1,000 addresses and interact with dApps on a regular basis. Why not use a program to do it fully automated without manual efforts? If the address is ever determined to be a bot address by the anti-witch rules, it would become worthless and lose eligibility to further airdrops, hence those farmers have to behave like real retail users as much as possible.

The APY for points/ airdrop farming is incredibly high, because the principal required is very small - $10k is more than enough for each address, but target yield is 500-1000 each month. But the downside is that the capacity is not big, so it's usually run by small studios rather than large institutions.

Such activities do not require real-time monitoring, but requires heavy research and daily progress check, to know what’s the latest incentive programs and how to earn points with highest ROI.

Summary

| Effort level | Type | Sample protocol | Target APY on USD |

|---|---|---|---|

| Pure passive | Lending/ borrowing | AAVE | 5-10% |

| Stablecoin AMM | Uniswap | 5-10% | |

| Yield bearing stablecoins | Ethena | 5-10% | |

| Monthly-weekly | Lending/ borrowing or AMM in new protocols | SparkDEX | 15-30% but not durable |

| Pendle | Pendle | 7-15% | |

| Strategy vaults | Neutral trade | 5-20% | |

| Daily/ real-time | Loop/ recursive borrowing and lending | AAVE + Pendle | 10-15% |

| AMM + Hedge / Cross-market arbitrage | JLP + Drift | 5-20% | |

| Points/ airdrop farming | Level | 50%-300% |

Overall, stablecoin DeFi yield farming without impermanent loss risk tends to be low-mid risk and low-mid yield. You should normally expect an annualized return of 5-15% by manual trading and might be above 20% by program trading, and usually lower frequency means lower yield, somehow fits the spirit of proof of work.

1Token portfolio and risk management system for digital asset investors

1Token is a SOC2 certified global technology provider for digital asset investment managers, managing over $20 billion in assets for more than 60 clients worldwide.Their award-winning portfolio and risk management system product CAM system serves portfolio managers, risk managers, treasury managers, fund operations and accountants through automated API connections to CeFi and DeFi venues, providing clients real time analytics to high frequency trading, derivatives, DeFi activities and generate reports in various aspects, that could support thousands of accounts and addresses.

For both CeFi+DeFi

Real-time holding and performance

- Table view listing of spot and derivatives holding, exposure and margin status

- Time series graph view and customizable dashboard for each user

- API connectivity for client's further development

Risk analysis and alert

- Real-time exposure, leverage, drawdown monitor

- Alert via Telegram, Slack, email, SMS, phone call

- Scenario simulation of PnL on potential price/vol/date change

EOD record keeping and analysis report

- Hourly snapshots and transaction history

- Reconciliation of balance and transactions

- Various performance analysis reports and routine sending task

Specifically for DeFi

Chain and pool connectivity

- Both EVM and non-EVM chain, and wallet, NFT and DeFi protocols

- Close to real-time updates of holdings

- Fast integration to new protocols

DeFi real-time monitor

- DeFi chain and protocol TVL change alert

- Special DeFi view of positions

- Health ratio monitor and alert

PnL and APY explainer

- Calculate each protocol / LP position's gain/loss and APY

- For combination of LP, breakdown the PnL into protocol / LP position

- Transaction log and tagging by smart contract method info

For general inquiries like authorization requests of the report, product demo, or general collaboration opportunities, please email service@1token.trade

Comments ()