How Token Projects work with Market Makers

Background

Recently Binance new project tokens arose heated discussions by the community.

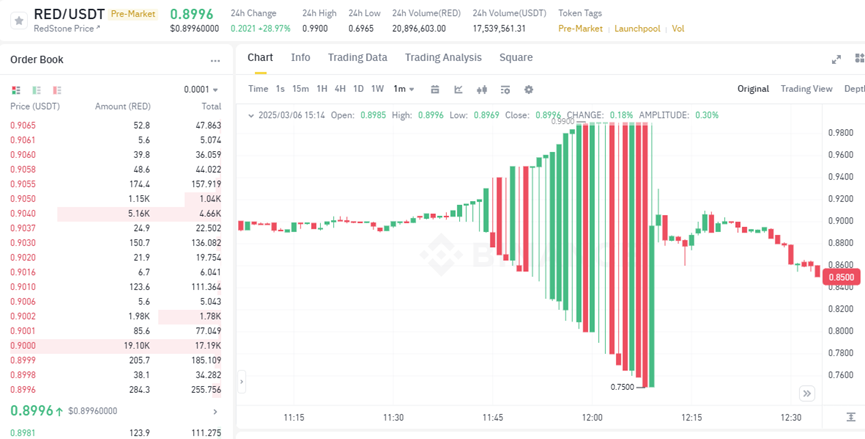

First, it’s the REDStone token’s price chart that looks like a Christmas tree. Apparently it’s not made by normal traders but an error by token market makers.

Then, GoPlus token’s market maker was reported that sold 70 million GPS with 0 buying, and then Binance announced penalty to that market maker without disclosing the name.

About the project token and market makers’ story, there were previously good articles (English) https://wintermute.com/the-good-the-bad-and-the-ugly-of-crypto-market-making-hacker-noon and (Chinese) https://www.techflowpost.com/article/detail_11664.html

Here we will talk in more details, to explain why above incidents happened.

Types of Project team market makers

There are two types market makers for different purpose, one providing liquidity by keeping placing limit orders, and another one trading with the former market maker or trading by themselves to create an active trading image.

You might question why the 2(nd) type is called market maker as they are more consuming liquidity rather than providing liquidity. It’s a valid question. For simplicity, let’s use passive and active market makers in this article.

Passive

Passive market makers are usually big brands like Jump Trading, Wintermute, GSR… who are obliged to fulfill below legit targets:

Bid-ask spread of trading pairs

They will contract their order spread of 0.6% to 0.8% spread. This spread guarantees other trades won’t lose too much from slippage, and meanwhile

Depth of bid and ask

They will contract how much % of the token they have to show on the order book, to ensure the depth chart looks good and meet the potential chunky trades from large traders.

Price difference between different trading venues

When a token is traded in multiple venues, it’ll be confusing for retail traders to see very different prices between venues. So, it’s passive market maker’s job to balance the price and inventory. Usually, they should be the first arbitrager to keep the price aligned.

Previously their obligation is only on centralized exchanges, now every project token needs liquidity provision and price alignment in DEX as well.While they will not commit to any form of below targets

- Price: there won’t be a target price where the token has to reach at a certain time.

- Trading volume: there won’t be a target volume that the token has to trade.

Combined above two points, passive market makers do not draw candle chart with price and volume movement.

Active

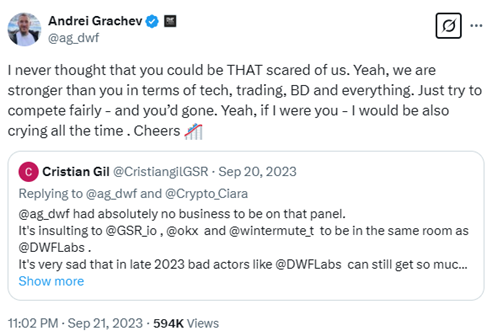

This is a hidden market, with numerous medium sized players where the names are only known by insiders. Usually, big tokens hire separate teams for passive and active purposes, while in small project tokens, active and passive market makers can be one team. There were discussions that some big brands who are supposed to be purely passive would do active market making.

Active market makers are obliged to do below

Wash trading

Wash trading has a simple intention in the beginning, for example when the price chart of an active trading pair looks better than a less active pair. (left is active, right is less active, both are under 1m).

However, high volume wash trading can be misleading for traders, creating an image where there’s sudden large buy flow or sell flow where they don’t actually exist.

Pump and dump

Active market makers might manipulate market price, to create market emotions and mislead other traders.When the project team is releasing positive news, the active market maker will pump the price simultaneously while when retail traders follow later, the active market maker will dump to the retail traders.

How do they work together?

In most cases passive and active market makers work independently. Those two types of market makers do not have to know each other.

Let’s get back to the RED case, what happens in my opinion is that the passive market maker went offline for some reason, while active market maker did not detect anything wrong, and kept its chart drawing program, and hence the limit orders are consumed into a funny chart.

You might also wonder what’s the passive market maker behavior, when the project team plans to pump or dump the coin via the active market maker. Will the passive market maker stay innocent and get a big profit immediately from selling the token at a high price? They are actually not outsiders and the project team will coordinate in between the passive and active market makers. When it’s time to pump, the passive market maker will be informed by project token team to pause its limit orders for a while, or make their orders much smaller until the pump or dump is finished.

What do passive market makers earn?

There are mainly 2 types of deals between project teams and passive market makers.

Fixed stipend

This is not the major approach, just simple to describe.

The market maker gets paid by venues (e.g., Bybit, Gate, Uniswap) and pairs (e.g., XYZ/USDT, XYZ/BTC, XYZUSDT perpetual).

The market maker will not receive money, but just trading API key from the project token’s own exchange sub-accounts. And keep the quant algo running.

Loan & Options

This is the major approach between project teams and passive market makers. Usually the project team will lend tokens to the passive market maker, and the market maker also gets call options at a strike price higher than the current price.

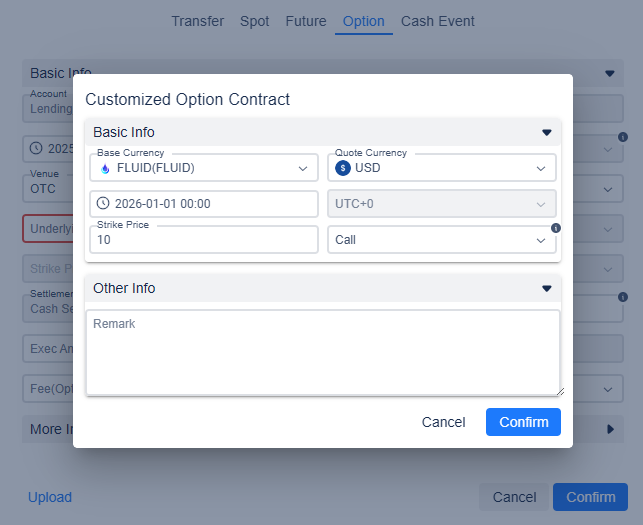

Example, FLUID works with Wintermute https://gov.fluid.io/t/wintermute-inst-fluid-liquidity-provision-proposal/1025 , where Wintermute gets a loan of 700k FLUID tokens with 0 interest, and Wintermute will use those tokens make FLUID token’s market for 1 year, on

- Centralized exchanges that list FLUID (now mainly Bybit)

- DeFi aggregators such as CoW Swap, UniswapX, 1inch, Bebop, Airswap, and Hashflow

And after 1 year, Wintermute should return 700k FLUID @ $10, which means that Wintermute can return either 700k FLUID (if token price is lower than $10), or 7 million USD (if token price is higher than $10), or a mix of FLUID and USD that could equal to either 700k FLUID or 7 million USD.

This is the preferred deal for project teams, as they have more tokens than stablecoin, for them the loan & options deal seems almost free.

How does the passive market maker profit from Loan & Options?

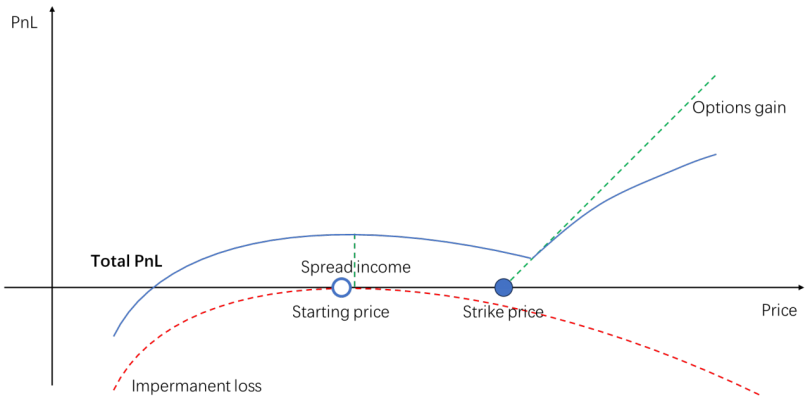

To make it easier to understand, passive market maker’s behavior is very similar to Uniswap V2 or Uniswap V3 with a wide price range, so there’s impermanent loss when price goes higher or lower than the starting price. (note the starting price is usually lower than strike price). Similar to Uniswap LP, passive market makers earn from the spreads.

There are below potential scenarios:

- If the price in the beginning and the price in the end are the same, then the theoretical earning for the passive market maker is the trading volume * spread (trading fee can be neglected as they are mainly makers).

- If the price is higher than the strike price, then the market maker can return in USD or stablecoins, and capture the higher value of the token, which looks like the chart below.

- If the price is between the starting price, then the market maker should still be profitable overall from the income from the market making activities despite the loss from impermanent loss.

- But what if the project token drops too much?

This chart is based on a premise that market making on spot requires equivalent inventory of token and stable coin. In FLUID & Wintermute case, Wintermute should use their own USD(T) to match the value of the FLUID coin. Suppose FLUID token is trading at $6 which makes the loan value $4.2m, Wintermute needs their own treasury of $4.2m to make the market. When price of FLUID token drops, Wintermute is essentially using their own capital to buy the tokens, and that’ll be a loss for Wintermute if FLUID token further drops.

Market makers will not tolerate that risk, especially that risk is very likely to happen. The fore-mentioned GPS token’s market maker gives the answer - the USDT does not come from their own pocket but from selling the token at a favorable price. GPS's market maker’s behavior is not outlier, other market makers do the same more or less, but with hidden approach by selling heavily in the 1st hour when the active market maker pumps the price, then sell gently in the next days, and meanwhile still place buy orders. In such case, the passive market maker obtains the principal to trade two-ways and there’s already profit.

What 1Token does

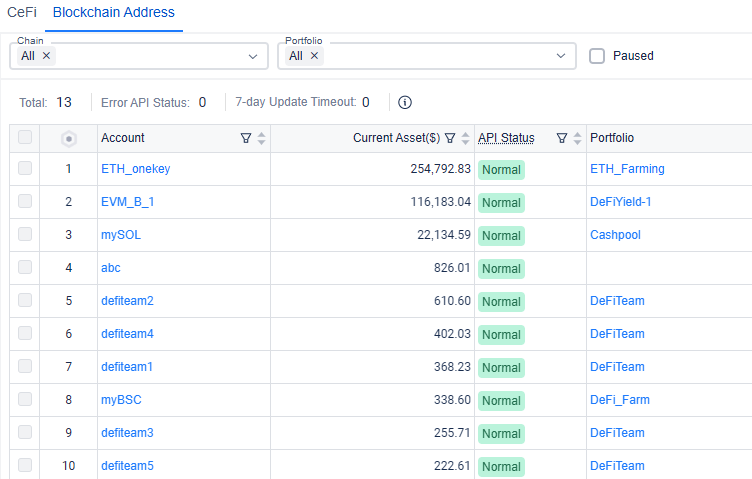

1Token is a SOC2 Compliant software for institutional Crypto Portfolio, Risk, Operations, Accounting and Lending Management, named Hedgeweek's 2024 "Portfolio Management Solution of the Year", serving 60+ top-tier institutional clients in the crypto industry, including SMA Allocators, Multi-Strategies Trading Funds, DMA Prime Brokers, Asset Managers, Lending Institutions, Fund Admins & Auditors across the US, EU, and APAC, collectively managing over $20 billion in assets.

For token foundations

- Keep tracking the wallets and OTC trades

- Record the loans and options

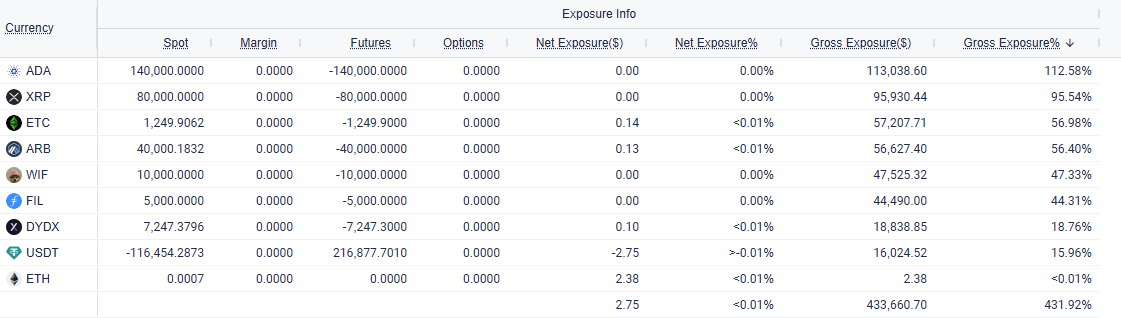

- Transparency on foundation assets and exposure

For market makers

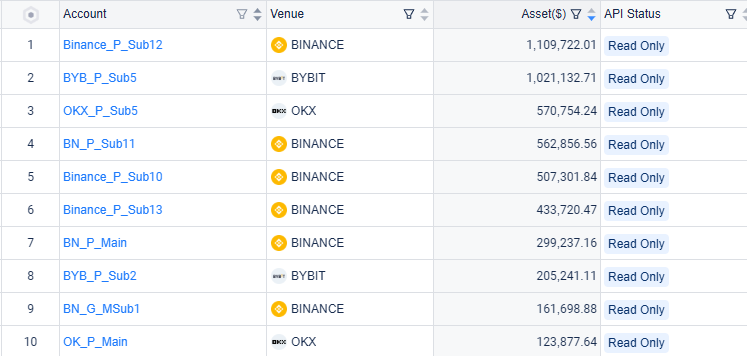

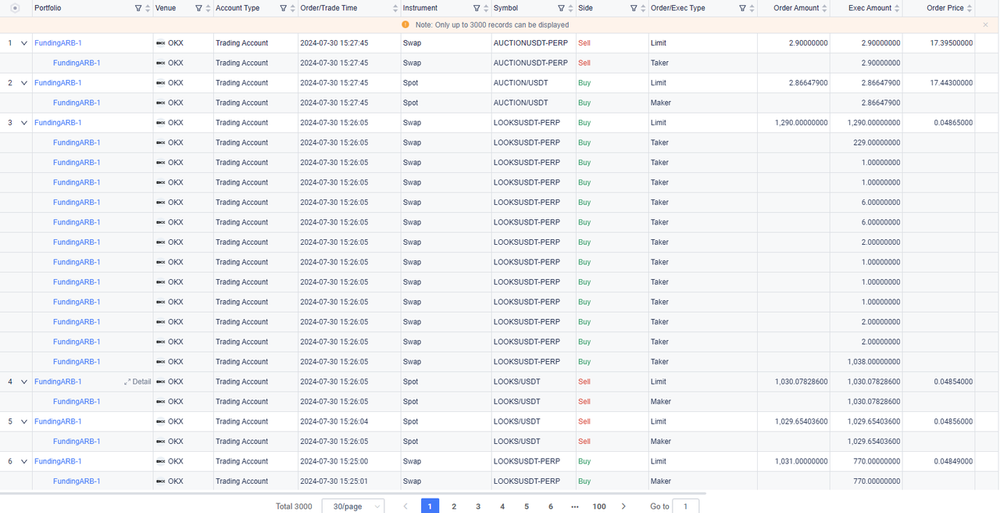

- Read all the exchange accounts by API and record the SAFT, loan & options issued by token projects

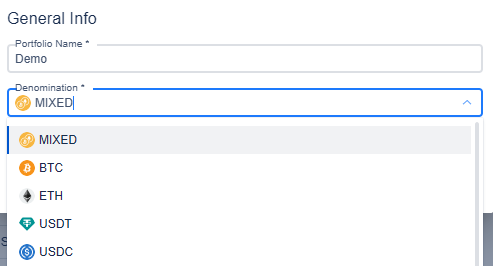

- Calculate risk metrics and PnL in mix denominations

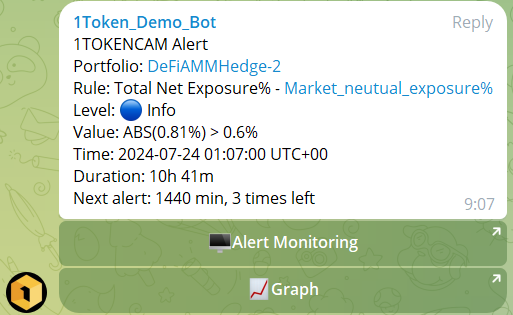

- Alert on rule violations

Overall

Recording keeping

Historical hourly snapshot of balance and position, all transactions reconciled with balance and position change

Statistics

Funding fee, trading volume, trading fee rate

For general inquiries like authorization requests of the report, product demo, or general collaboration opportunities, please email service@1token.trade

Comments ()