Navigating CEX Data: Transactions

1Token Middle-Office Insight Series: Crypto Trading Data & Operations Essentials II

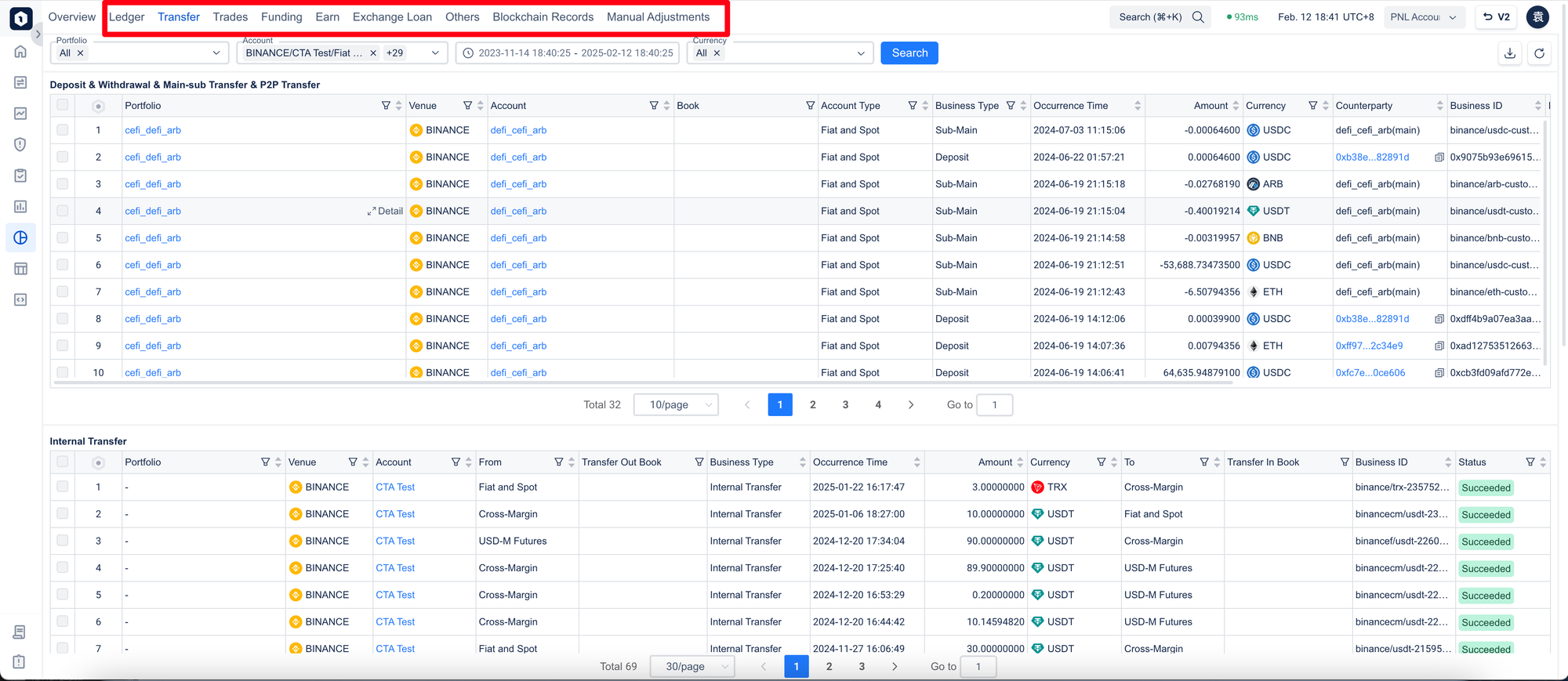

In our previous edition, we focused on exchange asset and position. For financial markets, another critical category of proprietary data is transaction records.

Crypto exchanges differ from traditional exchanges. Beyond providing trade matching, they also handle fund clearing and settlement. Additionally, most major exchanges offer financial services such as wealth management and lending, coupled with Crypto-specific business features. This results in a wide variety of transaction records.

From another perspective, exchanges typically provide two primary types of records for different purposes: transaction records and capital flow. Understanding the relationship between these two is essential for building a comprehensive reconciliation and accounting system.

1. What Transaction Records Do CEXs Provide?

Taking Binance as an example, exchanges offer the following services, each corresponding to multiple records:

| Business Category | Subcategory | Associated Records |

|---|---|---|

| Trading | Spot | Execution records |

| Trading | Margin | Execution records, margin interest records |

| Trading | Futures | Execution records, delivery/liquidation/auto-deleveraging records, perpetual contract funding fee records |

| Trading | C2C, small asset conversion | C2C transaction records, small asset conversion records |

| Wealth Management | Simple Earn/structured products | Subscription/redemption records, profit distribution records |

| Lending | Loan/VIP loan | Loan principal records, collateral records, interest payment records |

| ... | ... | ... |

Beyond business records, exchanges also provide a specialized category: capital flow statements.

These statements abstractly describe transaction records across business types, documenting asset quantity changes at specific timestamps, triggered by events, along with updated cash balances.

Example: 2025-01-01 12:00 Deposit 1 BTC → Cash Balance: 2 BTC

Typically, front/middle office users prioritize business records, while back-office users focus on capital flow statements.

Given the current market environment, which features a fair number of crypto exchanges, each possessing unique development and operational characteristics, significant variations can exist in their data records. Consequently, each platform requires an individualized analysis to identify the most appropriate records for reconciliation and financial processing.

Through years of collaboration, 1Token has established dedicated communication channels with major exchanges, developing a robust workflow for record integration → reconciliation → issue resolution, delivering comprehensive data ingestion and governance services for institutional clients.

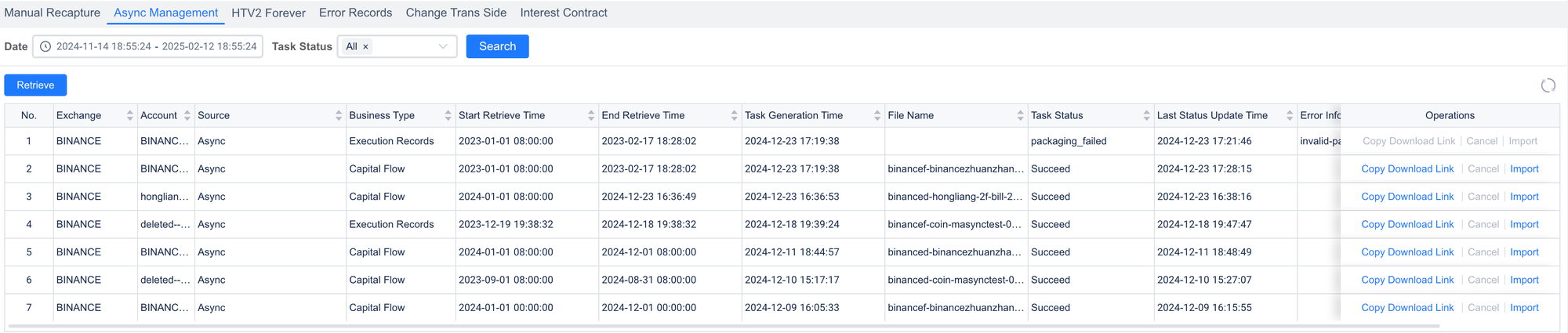

2. Methods for Acquiring Transaction Records

Technically, exchanges generally provide multiple avenues to obtain historical records:

| Method | Use Case |

|---|---|

| Exchange UI Download | Most common method for manual data retrieval via exchange interfaces |

| Websocket | High-frequency execution records for real-time systems (e.g., OEMS, PMS with transaction databases) |

| REST API | Scenarios requiring full data integrity over immediacy (e.g., data lake systems) |

| Async API | Historical data beyond REST API limits; currently supported by limited exchanges (primarily for accounting and data lake use cases) |

To address diverse business requirements, 1Token supports Websocket, REST, and Async API integrations.

Summary: The Key to Building Institutional-Grade Crypto Data Infrastructure - A Deep Dive into Exchange Records and Data Governance

In the crypto exchange, transaction records and capital flow statements form the foundation for institutional clients to build reconciliation, accounting, and risk management systems.

1. Challenges of Highly Non-Standardized Exchange Data

- Business heterogeneity: Varying product offerings (e.g., Binance’s "Simple Earn" vs. OKX’s "Earn") necessitate customized field and logic adaptation.

- Technical gaps: Some exchanges only provide UI downloads without API support; limited Async API coverage demands custom historical data solutions.

- 1Token’s approach: Standardized governance workflows (integration → verification → remediation) transform raw data into auditable, analysis-ready assets, reducing client onboarding costs.

2. Data Ingestion: Balancing Real-Time and Batch Processing

- Real-time: Websocket feeds for millisecond-latency use cases (e.g., algo trading risk checks).

- Batch: REST/Async APIs for end-of-day accounting batch processing.

- 1Token’s hybrid architecture: Combines real-time and offline interfaces with automated anomaly resolution, ensuring full-scenario coverage through a single integration.

3. Industry Insight: Anchoring Value in Data Infrastructure

Institutional pain points lie not in data access but in transforming fragmented data into auditable, actionable assets. 1Token delivers value through three core competencies:

- Business expertise: Distinguishing nuances like perpetual contract funding fees vs. futures settlement logic.

- Technical mastery: Overcoming API limitations across exchanges.

- End-to-end service: Data onboarding → reconciliation monitoring → SLA-driven support.

We aim to become the definitive data gateway for institutional connectivity to crypto exchanges.

Written by Yuan Bo | Edited by KT

For media inquiries or details about 1Token's product capabilities, please contact: service@1token.trade

Learn how 1Token's Middle Office System supports financial institutions (crypto funds, auditors, and fund admins) in crypto data collection and trade reconciliation: https://1token.tech/products/crypto-trade-reconciliation

Comments ()