Navigating CEX Data: Assets & Positions

1Token Middle-Office Insight Series: Crypto Trading Data & Operations Essentials I

In crypto markets, accurate financial metrics are critical. From margin reconciliation to real-time PnL calculations, a consistent framework helps prevent errors. Understanding asset structures, particularly margin and derivatives positions, is essential for reconciliation processes and accurate calculation of profits and losses (P&L).

As a Crypto Fund Portfolio Management Software provider, 1Token brings in-depth knowledge of crypto trading and fund administration. This article explores two key concept, Cash Balance and Equity, and explains how Unrealized PnL (UPnL) is settled. By outlining key differences, challenges, and best practices, we aim to help crypto funds' middle-office teams, fund auditors, and fund admins enhance oversight and streamline reconciliations.

Cash Balance and Equity

Cash Balance and Equity are pivotal metrics in portfolio management and trading strategies. A clear understanding of their distinctions is integral to developing PMS, middle-office systems, and accounting solutions.

Definitions

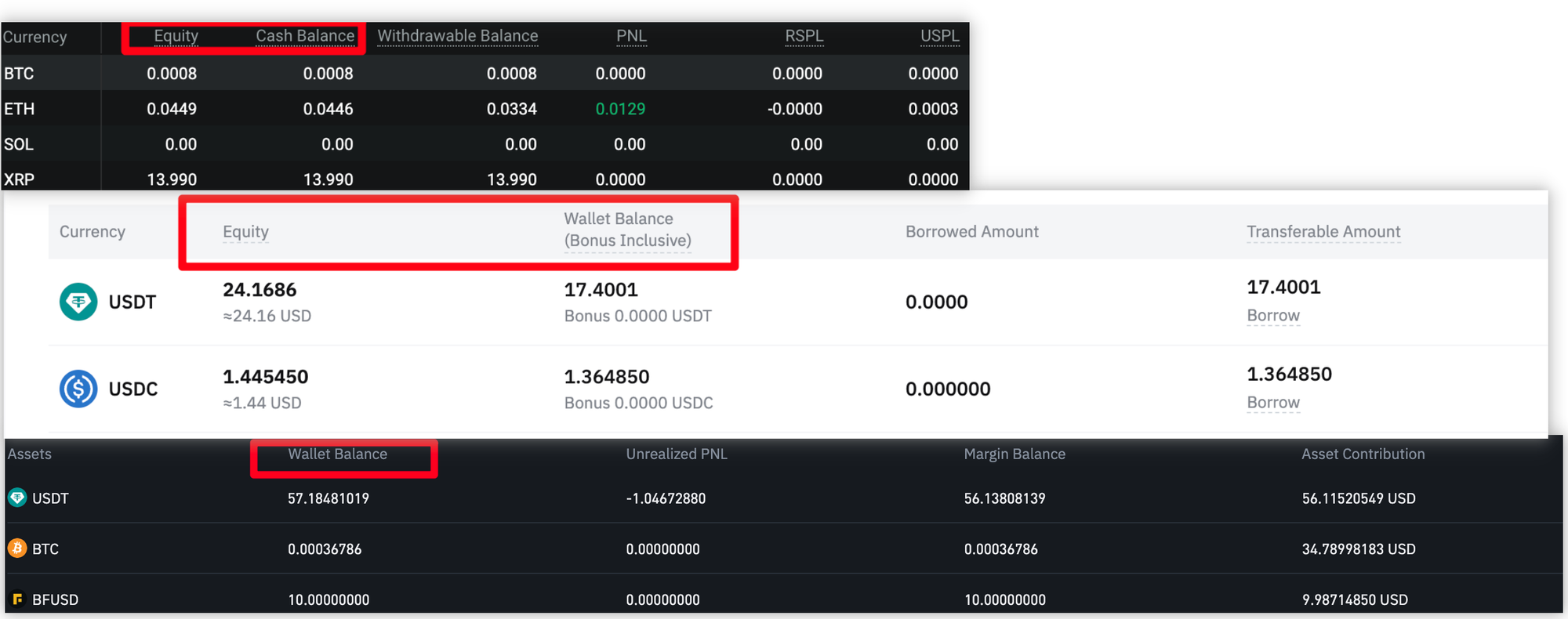

- Cash Balance: Represents the actual assets held in an account, including deposited amounts, spot market transactions, and Realized PnL. Unrealized PnL is excluded.

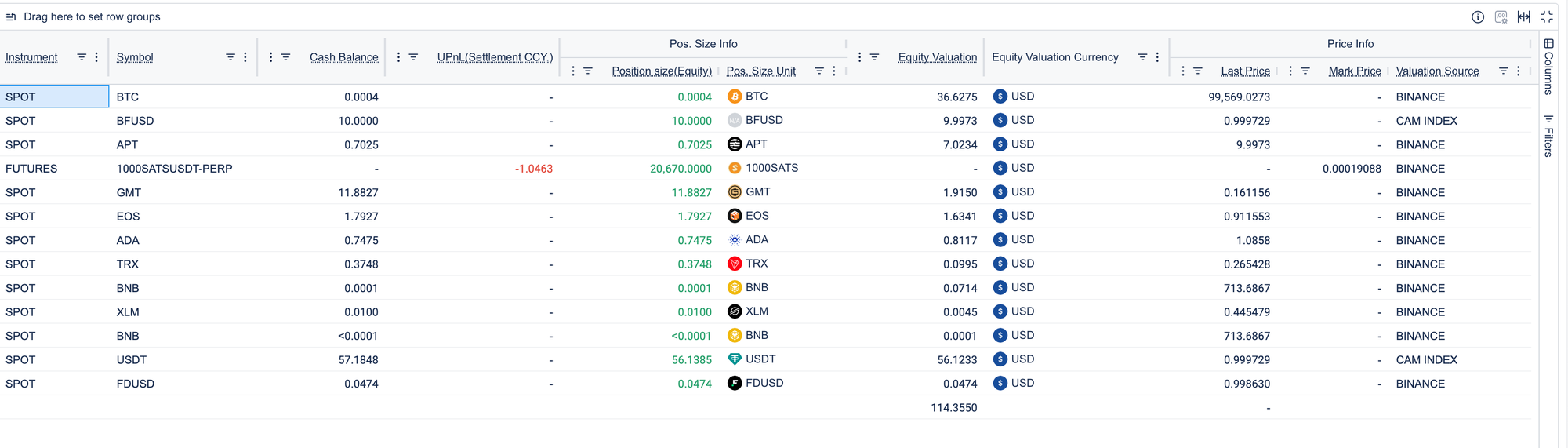

- Equity: Denotes the total value of an account, comprising Cash Balance and Unrealized PnL for contracts denominated in the current settlement currency. Formula:

Equity = Cash Balance + Unrealized PnL

In contrast to traditional finance, crypto markets allow tokens to be traded against one another, effectively making every token a "cash equivalent" with its respective Cash Balance and Equity.

Key Distinctions

- Cash Balance: A static measure, updated only when deposits, withdrawals, fees, or Realized PnL occur.

- Equity: A dynamic value, reflecting real-time market movements in an account’s overall worth.

The variance between these metrics stems from the Unrealized PnL of open positions.

In the operation of a crypto fund, front-office and middle-office teams focus on different priorities:

- For fund front office (traders, portfolio managers..), Equity is a real-time indicator of position value.

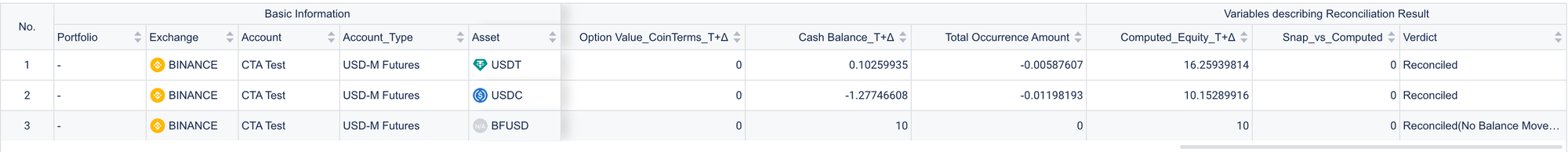

- For fund middle office (operations, fund accountants..), Cash Balance is critical for reconciliation. The reconciliation process follows this formula:

Opening Cash Balance + Transaction Records = Closing Cash BalanceAccurate reconciliation ensures complete transaction records, enabling downstream analysis and compliance reporting.

Settlement Model for Unrealized PnL

The settlement of Unrealized Profit and Loss (UPnL) represents a critical process in derivatives trading. Different exchanges adopt diverse settlement methodologies. For instance, Deribit employs a periodic settlement approach, while Binance opts to settle only upon position closure.

Why is UPnL Subject to Periodic Settlement?

The periodic settlement mechanism (e.g., daily or hourly settlement) is typically designed to mitigate risks and streamline system management:

- Risk Mitigation: Periodically settling UPnL as Realized PnL helps reduce systemic risks arising from extreme market volatility.

- Liquidity Management: Post-settlement, UPnL directly impacts the Cash Balance, enabling users to withdraw funds or adjust positions more efficiently.

- Margin Protection: In margin trading, periodic settlement contributes to ensuring the accuracy of account Equity, preventing liquidation risks due to inaccurate floating P&L calculations.

Traditional futures exchanges, such as the CME (Chicago Mercantile Exchange), typically employ a daily settlement mechanism (Mark-to-Market).

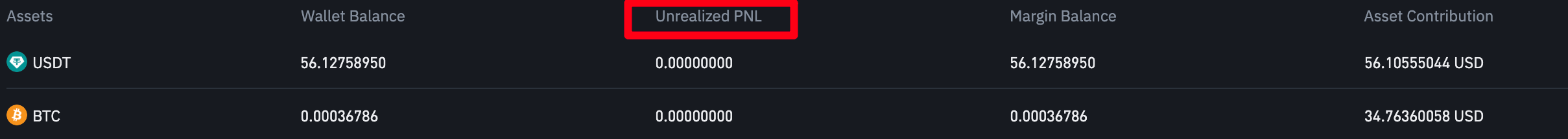

Why Doesn't Binance Implement Periodic Settlement?

Binance and other crypto trading platforms adopt a "real-time settlement" model, where UPnL is continuously calculated dynamically instead of being periodically converted to Realized PnL. The rationale behind this design includes:

- User Experience: Real-time settlement avoids account fluctuations caused by fixed settlement periods, allowing users to view accurate account Equity at any given time.

- Technical Agility: Crypto markets exhibit high volatility and trading volumes. Real-time UPnL calculation can alleviate the system's batch settlement load.

- Minimized Trading Disruptions: Periodic settlement may incur additional trading fees or slippage, while Binance's real-time settlement enables users to adjust positions more freely.

Different settlement models also present varying requirements for reconciliation and P&L analysis. Based on the characteristics of the crypto, 1Token calculates real-time UPnL for periodically settled exchanges (e.g., Deribit, Bybit) in addition to utilizing the exchanges' raw data, enhancing data comparability across different counterparties.

Written by Yuan Bo | Edited by KT

For media inquiries or details about 1Token's product capabilities, please contact: service@1token.trade

Learn how 1Token's Middle Office System supports financial institutions (crypto funds, auditors, and fund admins) in crypto data collection and trade reconciliation: https://1token.tech/products/crypto-trade-reconciliation

Read next

Crypto Quant Strategy Index VIII Nov 2025

Portfolio simulation for digital asset FoF and MoM

Comments ()