Bitcoin DeFi Yield Farming in 2025: Landscape, Strategies, and Institutional Access

Co-PR with Monarq Asset Management

Background

For years, Bitcoin has been seen as digital gold—valuable, secure, yet not generating income. Unlike stablecoins or ETH, the Bitcoin L1 itself runs on proof-of-work, so it doesn’t support staking or earning yields. The chain was also not built to support smart contracts, making it not a natural fit in the decentralized finance (DeFi) ecosystem.

In the past, BTC holders wanting to earn yield had to deposit BTC on centralized exchanges and use it as margin for trading, hedge into delta-neutral trades, or lend it to the exchange itself. However, these methods are centralized and don’t align well with DeFi.

2025 has been a transformative year for Bitcoin’s decentralized finance ecosystem (known as BTC.fi), and BTC yield farming on-chain is gradually becoming a reality. There are several ways to deploy BTC into DeFi and earn passive or active income. This article highlights the main methods to earn yield with BTC in DeFi, ranked from lowest to highest effort and risk. Some examples involve wrapped BTC (such as WBTC or cbBTC), while others use native BTC protocols.

BTC.fi metrics

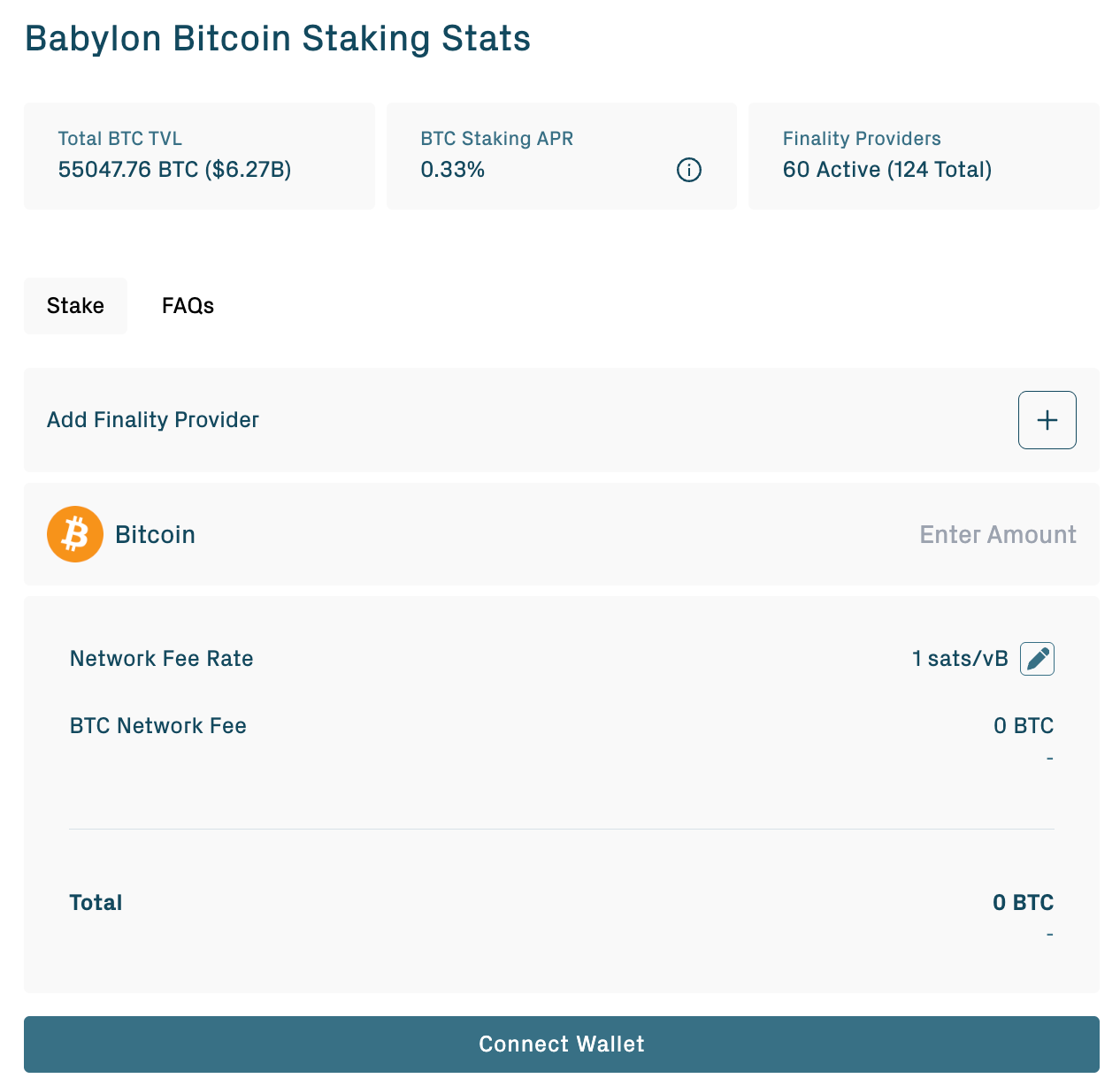

As of September 2025, Bitcoin’s TVL (Total Value Locked) in smart contracts across various protocols is approximately $8 billion, according to DefiLlama. This accounts for a small fraction (~0.4%) of the total BTC supply. A large portion of this TVL comes from new protocols like Babylon, which accounts for $6 billion out of the $8 billion.

The BTC.fi Infrastructure

Wrapped BTC: The most common way for Bitcoin to earn yield today is to be “wrapped” into an EVM-compatible token, which can be used on DeFi applications on Ethereum and Solana. Centralized institutions like Bitgo and Coinbase accept BTC and issue the wrapped versions (WBTC and cbBTC, respectively). The real-world analogy is where users go to a trusted financial institution and issue money orders with cash. In the BTC wrapping process, native BTC is the cash, wrapped BTC is the money order, and the issuer of the wrapped BTC is the trusted financial institution.

Bitcoin Layer 2s are essential infrastructure for adding programmability to the Bitcoin ecosystem, which enables DeFi functionalities. There are two main types of Layer 2s: Rollups and Sidechains.

Layer 2 rollups are protocols built on top of the Bitcoin blockchain that move transaction execution to a separate rollup chain or layer, and periodically settle the net results back to the main chain. These L2s use Bitcoin's security for consensus, and all transaction data and state changes are verified and confirmed by the Bitcoin blockchain. Several new DeFi protocols in crypto fall into this category, including Babylon, Core, Alpen Labs, SatoshiVM, Citria, and others.

Sidechains are independent blockchains that have their own consensus mechanisms and connect to the Bitcoin blockchain through a two-way peg. This enables assets to be transferred between Bitcoin and the sidechain where transactions are actually carried out. Sidechains operate their own validator sets, and transactions are not verified by the Bitcoin network. Some sidechains may record hashes of block headers or similar data on the Bitcoin L1 chain as a "checkpoint." Examples include older chains like Rootstock, Stacks, Liquid, and newer “defi-ready” chains such as Bitlayer, Mezo, BEVM, Fractal, Botanix, Merlin, and others.

EVM-compatible Bitcoin Layer 2 solutions are a subset of Layer 2 systems that support the Ethereum Virtual Machine (EVM) while utilizing some features of the Bitcoin Layer 1 network. These enable developers to run existing EVM dApps written in Solidity on these chains.

Bitcoin staking is a process where BTC is used to secure other proof-of-stake networks. Traditional PoS staking secures the same network where tokens are staked (for example, ETH staking secures Ethereum). Bitcoin staking, on the other hand, uses BTC to secure external PoS networks called Bitcoin Supercharged Networks (BSNs). Babylon is currently the leading BTC staking protocol.

Bitcoin Restaking: Bitcoin restaking is similar to ETH staking, where the same BTC stake can secure multiple networks at the same time. This creates a shared security model where one Bitcoin deposit can earn rewards from several sources.

What to use

Here’s a summary of different Bitcoins:

When exiting, users must unwrap, redeem, unstake, or bridge BTC back — often with slippage, fees, and bridge delays. Therefore, planning exit liquidity is just as important as farming yield.

How to get Wrapped Bitcoin tokens

Here are some of the common methods of converting BTC on the Bitcoin L1 chain to wrapped versions, which can be used in Defi

- Converting into WBTC

WBTC is the longest-standing and most popular wrapped BTC, widely supported on Ethereum and Layer 2 solutions. WBTC is issued and custodied by a joint venture between BitGo and BiT Global, and governed by a DAO composed of custodians, merchants, and approved institutions. Among all wrapped Bitcoins, WBTC has the deepest liquidity in the secondary market, with the WBTC/BTC trading pair available on every major centralized exchange, such as https://www.binance.com/en/trade/WBTC_BTC.

Current supply: 127.2k WBTC.

- BTCB from Binance

On Binance, BTC withdrawals can be made through Binance Smart Chain, and the received coin will be BTCB issued by Binance (similar to Binance’s money order), while the native BTC remains in Binance’s reserve. Although BTCB has the second-largest supply, it’s not widely used, and its main purpose is in

Current supply: 65.3k BTCB

- Wrapping into cbBTC by Coinbase

cbBTC is the ERC-20 BTC wrapped token provided by Coinbase, the largest fully regulated exchange, and has been transformative in increasing the use of BTC in EVM DeFi applications. To create cBBTC, a user sends BTC to their Coinbase account and swaps it for cbBTC. That is, cBBTC is a centralized token (similar to WBTC and BTCB), which makes minting and redeeming easy but also exposes the user to a single point of failure (centralized exchange). Current supply: 46,600 cbBTC.

- Liquid Staking into Babylon via Lombard

Babylon is a BTC staking protocol with its own chain called the Babylon Genesis Chain. Users can lock native BTC in a self-custody manner on Babylon to earn yield in BABY tokens while maintaining BTC exposure.

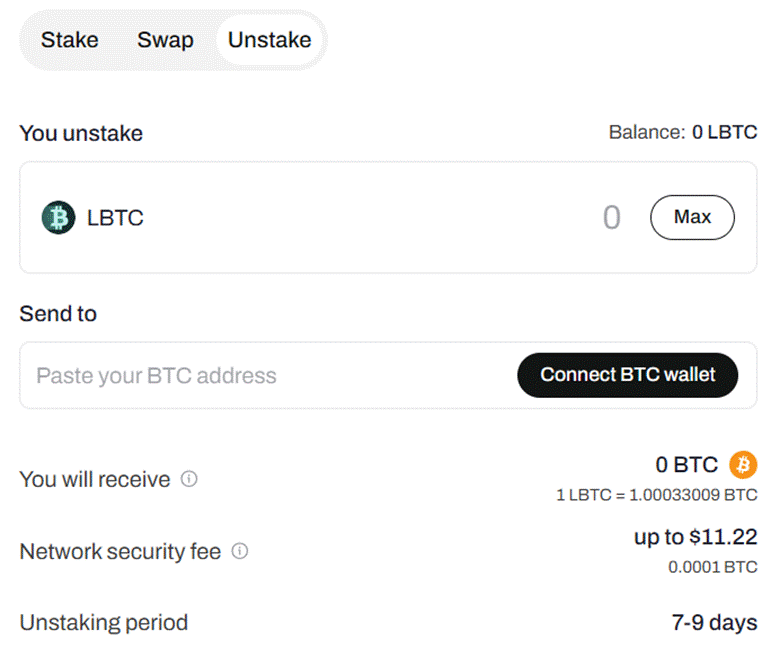

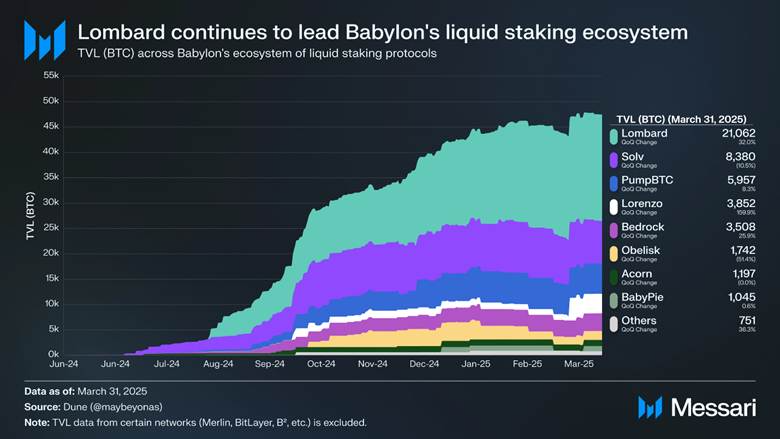

To unlock liquidity while still earning staking yields, liquid staking protocols have been launched on the Babylon chain. The largest of these is Lombard Finance, where users receive LBTC from staking with Lombard for further DeFi yield farming. However, LBTC is still new and has limited protocol integrations compared to other wrapped BTC.

On Babylon, there are similar staking protocols like xSolvBTC by Solv, pumpBTC by PumpBTC, stBTC by Lorenzo, uniBTC by Bedrock, with lower TVL than Lombard.

Current supply: 12.8k LBTC (Total supply on Babylon 49.5k BTC)

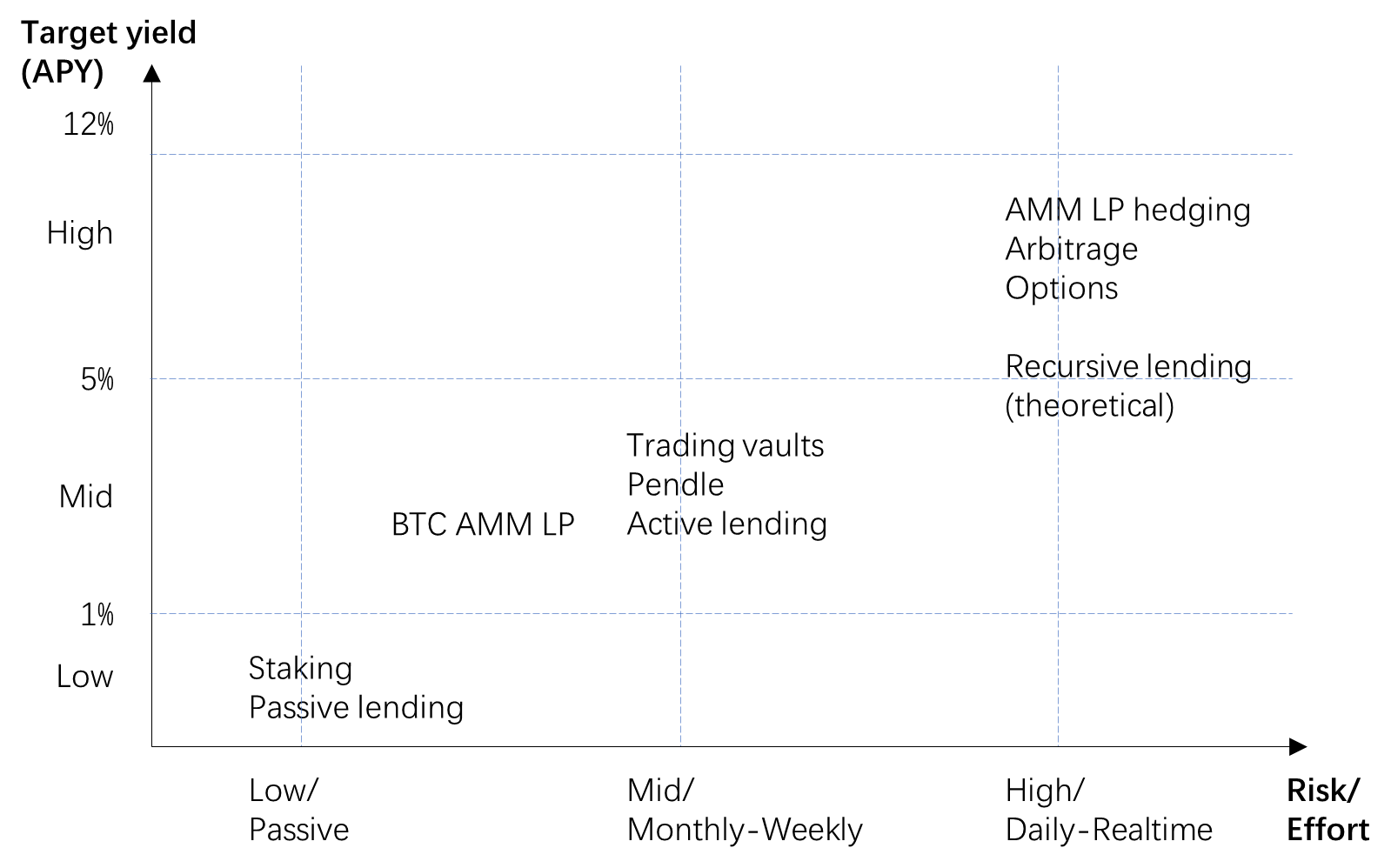

Strategy Categories: Yield vs Effort Matrix

Now we have wrapped, staked, or restaked BTC that can be used in DeFi protocols. Let’s explore where and how to farm. Similar to our last article https://blog.1token.tech/stablecoin-defi-yield-farming-in-2025-efforts-required-and-target-yield/, we categorize BTC yield strategies into three main groups: low, mid, and high effort, risk, or yield. Usually, higher yields involve more effort and greater risk. These categories correspond to different types of investor profiles and infrastructure needs.

Low Effort / Low Risk / Low Yield [APY range: 0.1 - 1%]

1.BTC Staking

Bitcoin staking involves locking BTC in a Taproot time-limited script, with the staker’s “receipt” of this locked BTC delegated to finality providers of other proof-of-stake networks to secure the network. The staker’s BTC never leaves the Bitcoin blockchain and remains controlled by the staker’s private keys.

The most popular way to stake Bitcoin today is through the Babylon Protocol. The staker receives a base yield of 0.33% APY plus BABY tokens as incentive rewards.

2.BTC Liquid Restaking (LRTs)

Re-staking is the process which the same BTC stake can secure multiple networks simultaneously. In practice, the process works as follows:

- User deposits their BTC into an LRT protocol such as Lombard or Etherfi.

- The LRT protocol then “stakes” this BTC into Babylon and mints a Liquid Restaking Token (LRT), which accrues yield/rewards from Babylon and can also be further used in the Defi ecosystem.

- Lombard’s LRT is called LBTC, and Ether.fi’s token is called eBTC. Along with another protocol called SOLVBTC, LBT, C, and EBTC comprise over 80% of the Bitcoin restaking universe today.

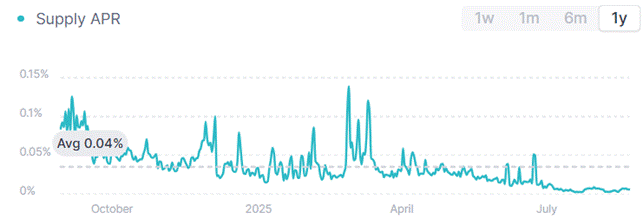

- LBTC’s trailing 30-day yield is 80% APY today

- Redeeming LBTC or eBTC has a 7-9 day cooldown period.

3. Passive Lending

The user supplies WBTC, cbBTC, or other wrapped/staked BTC on lending protocols like AAVE, Morpho, etc., and earns yield from other users who borrow the lent BTC. This supply yield is usually on the lower side, since BTC derivatives are typically deposited as collateral to borrow other assets, rather than as an asset to be borrowed.

Overall steps look like below

- Start with wrapped BTC (WBTC or cbBTC) or an LRT (LBTC, etc.)

- Deposit into AAVE or into a specific Morpho market

- Start earning borrow interest automatically

- Redeem anytime up to the available liquidity in the pool

Mid Effort / Mid Risk / Mid Yield [APY range: 1 - 5%]

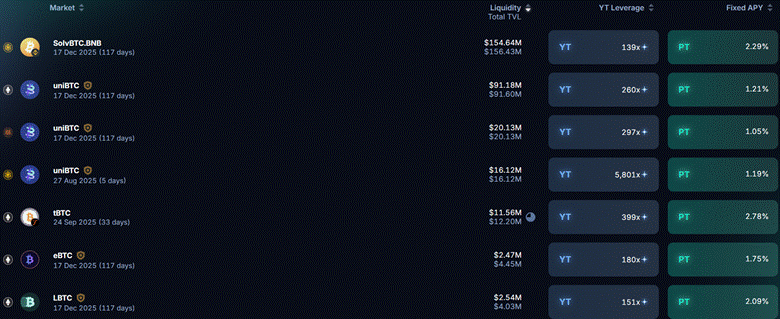

1.Pendle Markets and Pools

Pendle is a yield trading protocol that is one of the hottest DeFi protocols today. Pendle takes a yield-bearing token such as LBTC from Lombard, and converts it to a principal token (PT_LBTC) and a Yield token (YT_LBTC). All future yields accrue to the YT token, whereas the PT tokens receive a fixed yield (like a zero coupon bond). So a user can:

- Buy the PT token and lock in a fixed yield OR

- Trade the YT token to speculate on future APY

Historically, Pendle liquidity was concentrated on USD stablecoins and various ETH tokens. Today, the liquidity for BTC assets is gradually increasing as Bitcoin's capital market develops.

Overall steps look like below

- Stake BTC into Lombard and receive LBTC

- Identify the interesting market on Pendle (eg. PT_LBTC_17Dec 2025)

- Deposit LBTC into this PT token to lock the yield

- Alternatively, use the LBTC to buy/sell YTs to speculate on yields

- At maturity, redeem PT to reclaim original LBTC

Pendle Pools are AMM-type contracts which include both the PT-tokens as well as the wrapped yield tokens, thereby allowing the user to earn fixed yield, yield points, as well as trading fees, unlike the Pendle Market described above.

2. BTC AMM Liquidity Provisioning

An Automated Market Maker (AMM) pool is a type of decentralized exchange that operates on smart contracts, rather than order books. A user can become a liquidity provider (‘LP’) by depositing equal values of the tokens into a pool, and in return earn a share of trading fees and other potential rewards from the pool.

A medium-risk/medium yield strategy involves depositing liquidity into a Uniswap pool with correlated Bitcoin assets, such as cBBTC/WBTC, with minimal risk of impermanent loss. The Uniswap WBTC-cBBTC pool is currently yielding an APY of 2.04%

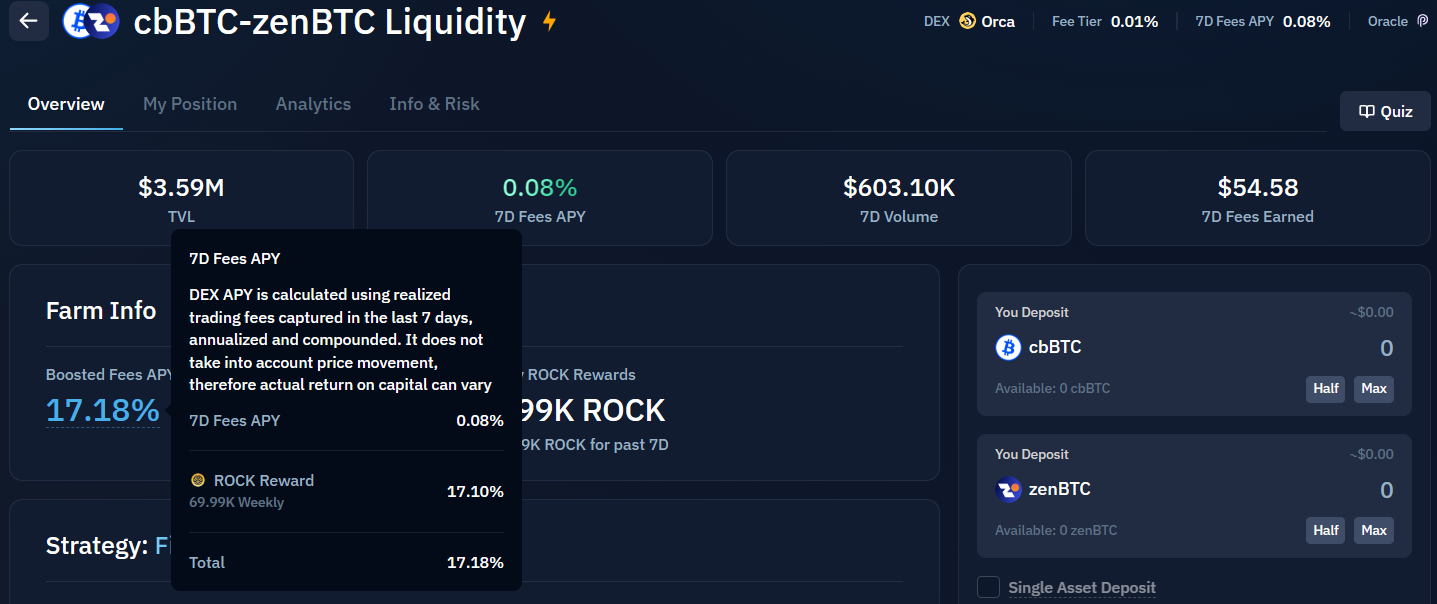

For higher yields, the user can consider newer protocols, which tend to be incentivized with underlying points/token rewards. For example, the Kamino cbBTC-zenBTC pool below has a 17% APY primarily generated from ROCK reward tokens (a bridge token to the SOL chain is required)

Overall steps look like below

- Wrap BTC to cbBTC and WBTC

- Stake both into Uniswap V3 pools

- Earn trading fee passively, but monitor for any depeg scenarios

- Redeem anytime.

3. Vaults

Vaults are automated smart contracts that aggregate user deposits and execute yield strategies across multiple lending markets and pools. A vault is usually curated by a vault manager and may use a mix of mid-to-high risk/yield strategies.

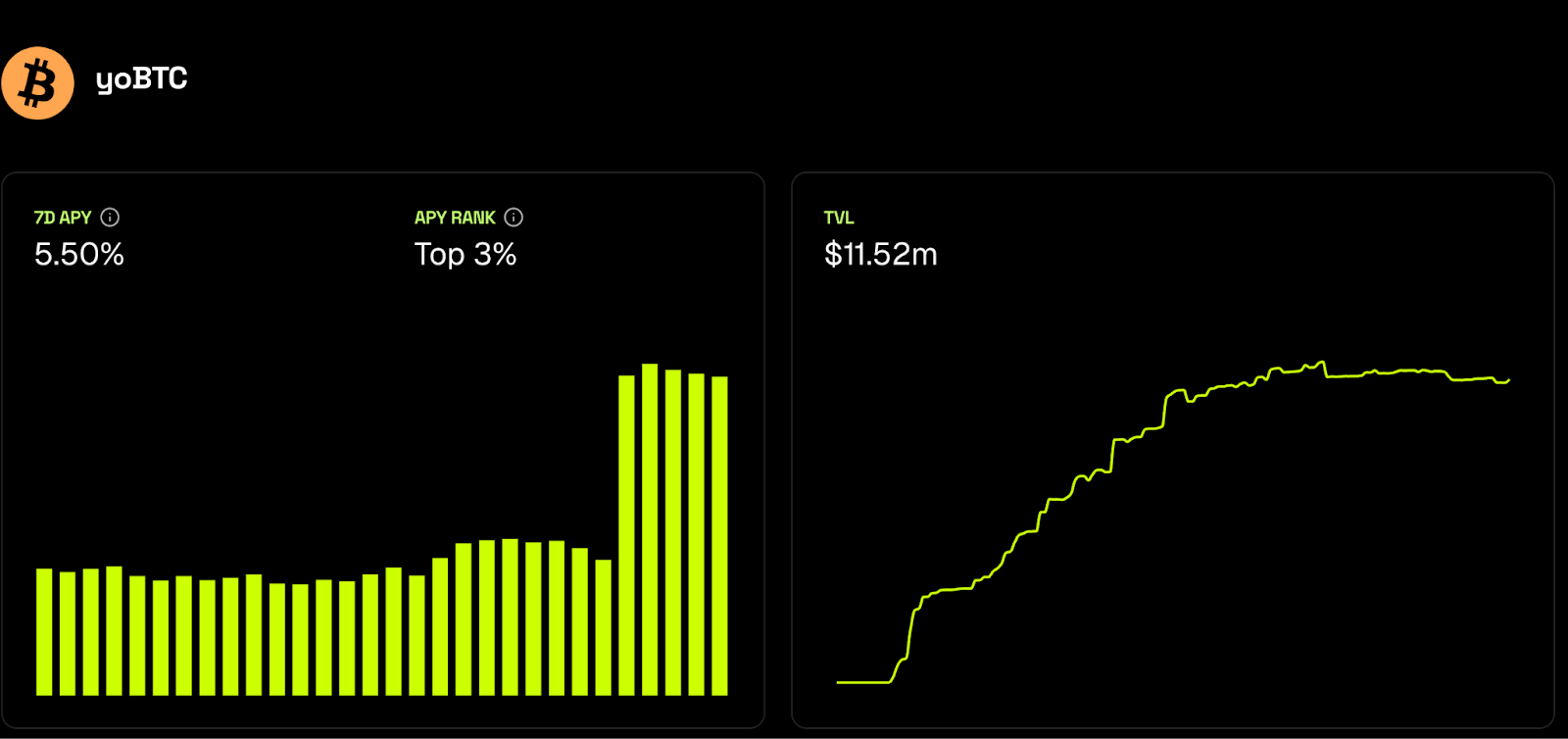

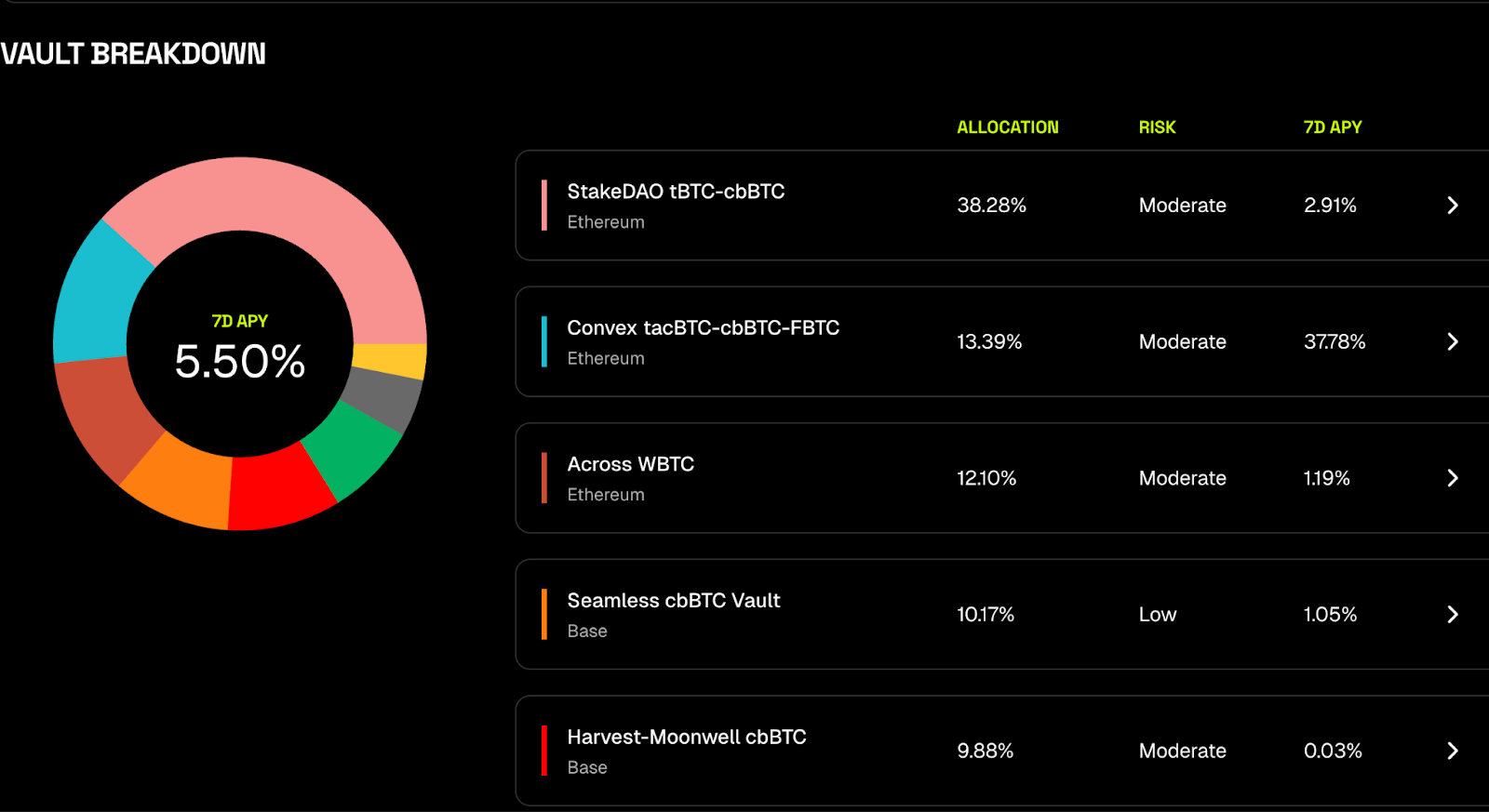

For example, the yoBTC vault from yo.xyz has been generating 5.5% APY and allocates the deposited BTC into the following strategies:

Overall steps look like below

- Wrap BTC to cbBTC (a bridge to the Base chain is required)

- Deposit cBBTC into yoBTC;

- Redeem the yoBTC anytime (vaults usually have a 1-7 day redemption period)

- Unwrap cBBTC back to native BTC

High Effort / High Risk / High Yield [APY range: 5 - 14%]

1.Spot & Futures Arbitrage

This is one of the classic strategies to earn yield by monetizing the futures premium over spot and/or earning the funding rates from perpetual futures contracts.

There are mainly 2 types of BTC-denominated arbitrage strategies on DeFi

- Same venue arbitrage for funding fee income: capture positive BTC perp funding by going long spot and short perp (or vice versa). Can be executed across Hyperliquid, DYDX, or Drift.

- Cross-venue arbitrage for price and funding fee difference: provide liquidity by placing limit orders for BTC/USDC pair on a DEX (e.g., Drift, Hyperliquid), hedge exposure on a perp DEX or CEX. Profit could come from maker fee rebate, trading profit, funding fee difference, and potential farming rewards.

Both strategies, when scaled, require quantitative trading software or other forms of systematic trading to enter and exit positions. Smaller trades can be executed manually. Despite the self-custody feature with a hot wallet, the strategy and trading technology are similar to CEX funding arbitrage.

Details can be found at https://blog.1token.tech/crypto-fund-101-funding-fee-arbitrage-strategy/.

2.BTC.fi Protocols and Vaults

As mentioned earlier, several new Bitcoin Layer 2s have emerged recently, each with its own set of native applications on-chain, with unique yield opportunities. Some are described below:

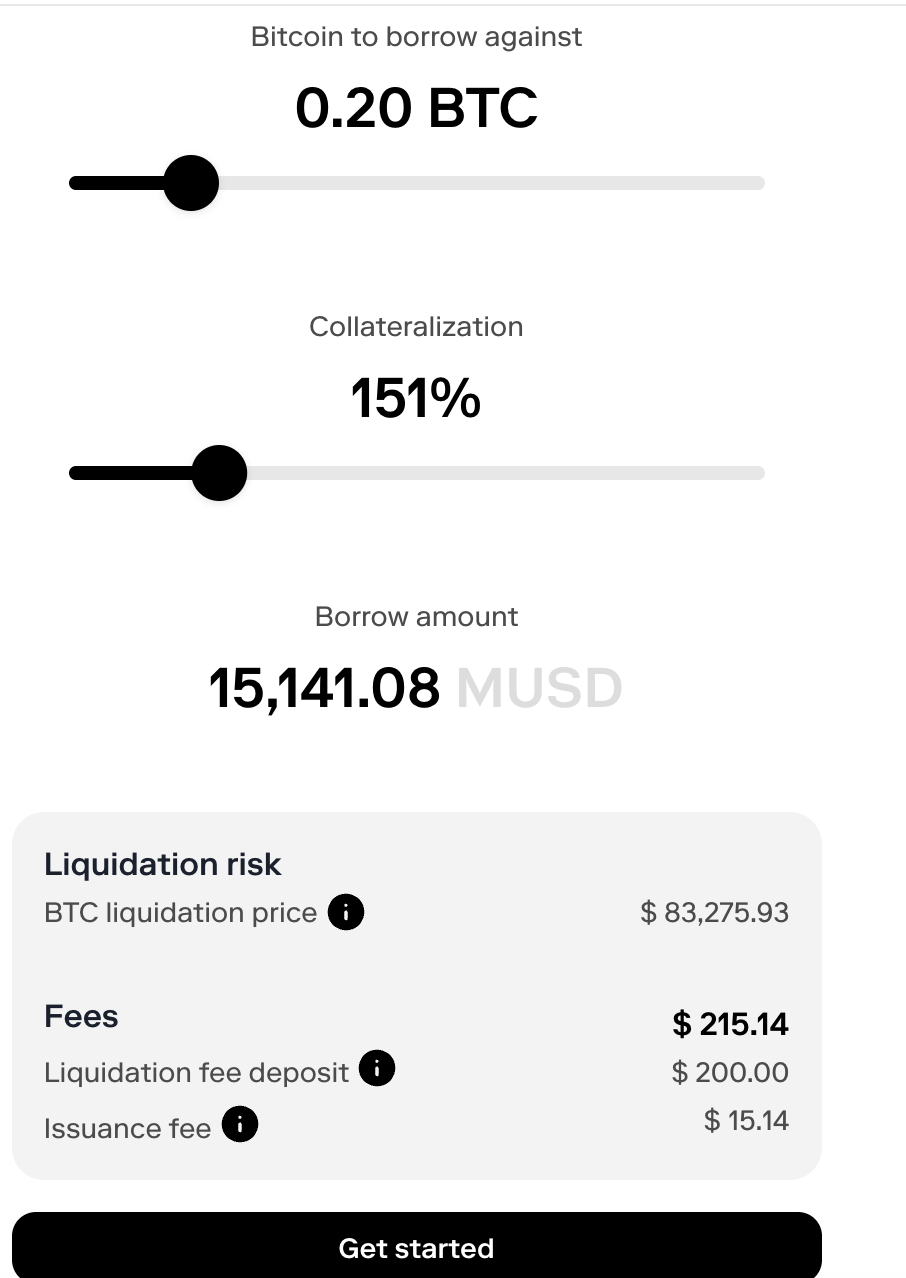

Mezo:

Mezo is a new protocol inspired by MakerDAO. Users deposit BTC on the Mezo app (on Bitcoin L1) and can borrow mUSD on the Mezo chain. The borrow rate is appealing (1% today), and users can then yield farm any of the USDE protocols on Pendle.

Overall steps look like below

- Deposit BTC into the Mezo app on Bitcoin L1.

- Mezo bridges this over to tBTC on the Mezo chain and allows you to borrow mUSD against it

- Bridge mUSD to Ethereum using wormhole

- Swap mUSD to USDC on Curve

- Deposit the USDC into a PT market to earn the higher yield there (eg. PT cUSDO is yielding 11%+)

- To redeem, have to follow the same sequence of steps in reverse.

- Risks are: depegging of mUSD to USDC in the Curve pool and slippage while bridging back and forth between Mezo and mainnet

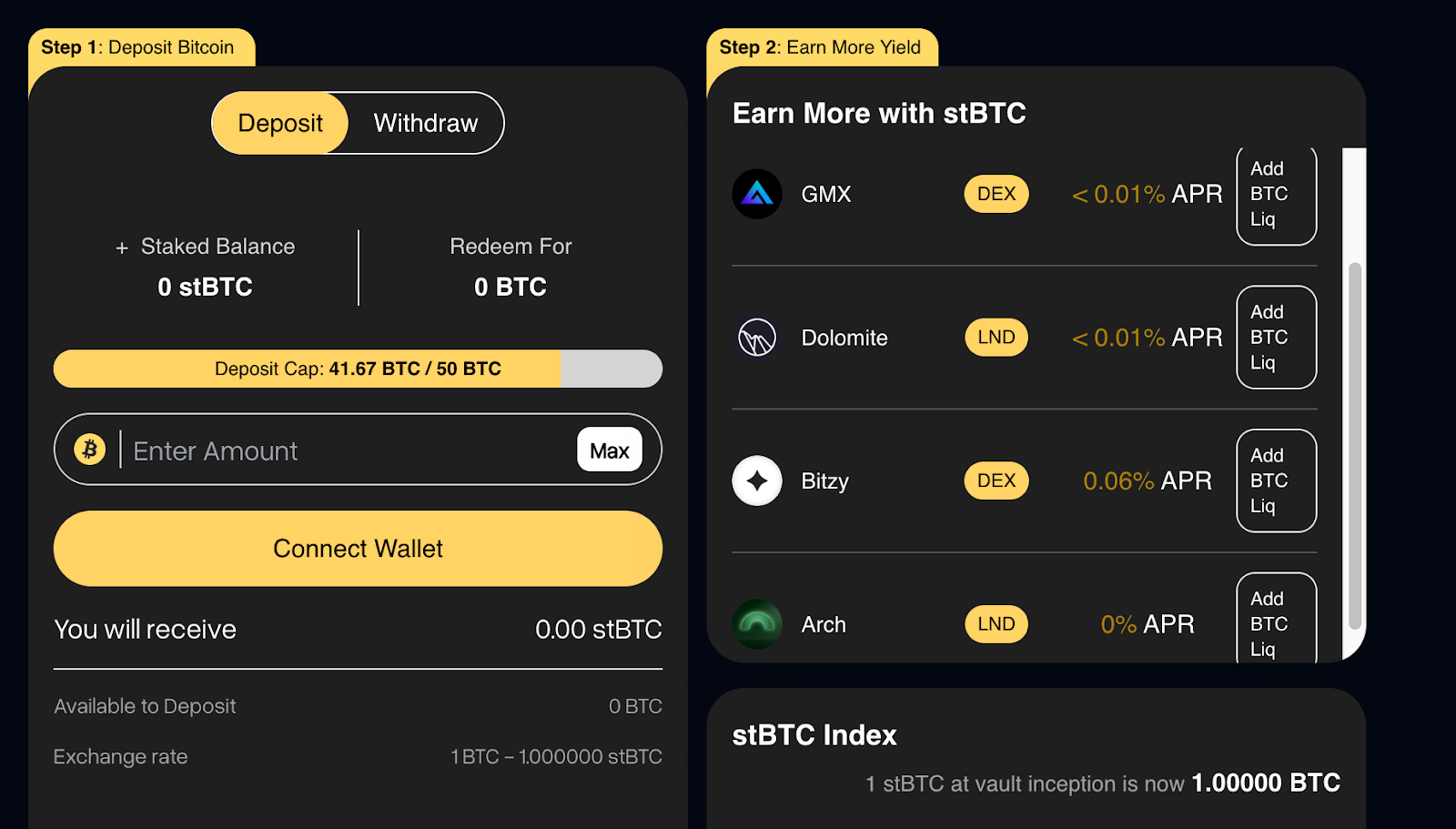

Botanix:

Botanix (also known as Spiderchain) is a new EVM-compatible Bitcoin Layer 2 that is fully decentralized and based on Proof-of-stake. Botanix launched its mainnet in August 2025 with a range of DeFi applications that all generate yield.

Overall steps look like below

- Bridge your BTC to Botanix L2 using the Botanix bridge

- Stake the BTC on Botanix and receive stBTC

- Deposit the stBTC into dapps like Bitzy and earn more yield

It should be noted that the protocol is still early and yields are still on the lower side. We expect TVL to grow as SpiderChain gets mainstream adoption.

3.AMM LP hedging

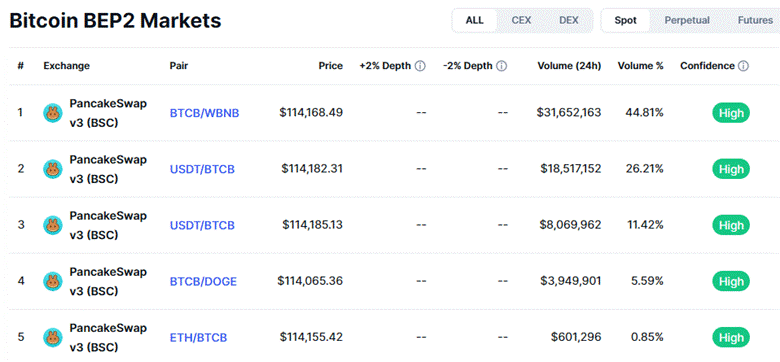

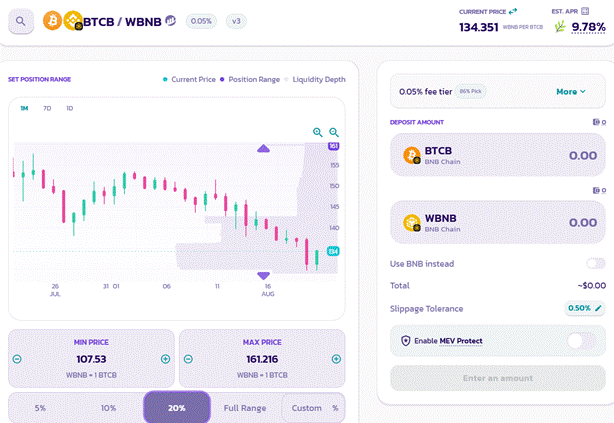

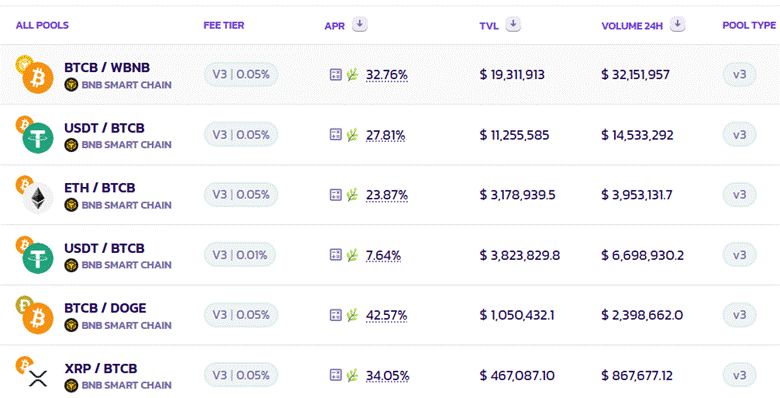

This involves providing liquidity to an AMM pool while dynamically hedging against impermanent loss. For example, BTCB on Binance can be deposited with WBNB into a Pancakeswap BTCB-WBNB pool, with an LP range of ±10%, which today yields a 9.78% APY. Hedging can be easily managed through a perpetual swap on Binance CEX or Hyperliquid to avoid exposure to centralized exchanges.

For small capital, smaller pools like the ETH/BTCB pool and the BTCB/DOGE pool should be very attractive, while large capital will significantly lower the APR of LP.

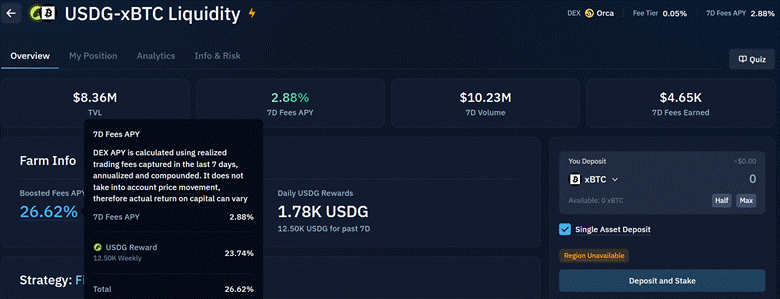

LP yield can be higher with short-term incentive rewards, like the ones below on Kamino, which receives incentives from USDG.

Overall steps look like below

- Provide liquidity in the ETH/BTCB pool (e.g., Pancakeswap)

- Hedge price exposure via perp

- Monitor price, funding, and fees continuously

- Adjust hedge size regularly to stay delta neutral

- Profit comes from LP fees + farming incentives - hedge cost

4. Options Trading

Popular options trading on DEX are below

- Sell covered calls or puts on BTC option DEXes. Main trading venues are Derive, AEVO, Kyan (coming soon, previously Premia), and Stryke (previously Dopex, trading halted due to a previous exploit).

- Trade BTC options spreads using Derive or Aevo. Build delta-neutral or convexity-focused positions. Requires active rebalancing and vol forecasting.

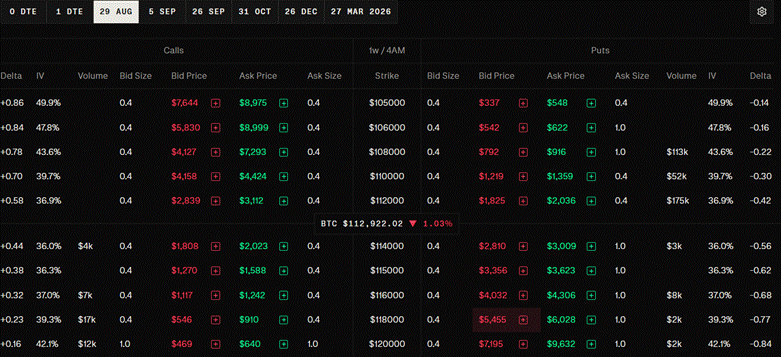

Both are suitable for mid-frequency users who have solid knowledge of options and employ disciplined delta hedging or stop-loss strategies. Typical yields range from 4% to 8%, tied to BTC volatility.

Aside from the difference between smart contracts and centralized custody, a key distinction when trading options with Deribit is that the liquidity is limited, which may lead to an extra premium from limit orders when selling options.

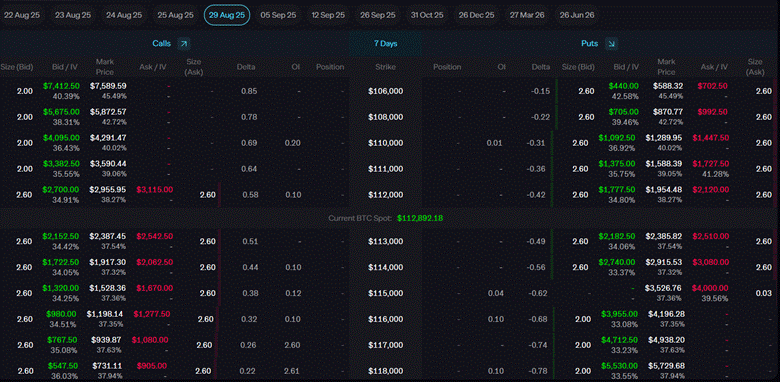

Below are the BTC options order book snapshots from Aug. 21, with expiration on Aug. 29.

Overall steps look like below

- Deposit WBTC into vault (e.g., Aevo) as trading collateral

- Trade covered calls or put spreads, ideally with limit orders

- Earn option premium if price doesn't breach strike, stop loss or delta hedge if price breaches strike

- Yield depends on implied volatility and market movement

Risks: BTC rallying above the strike may limit upside. Also, as mentioned earlier, trading options on DEX with a limit or market order will lead to a significant yield difference due to the wider spread. It’s a trade-off between yield, efficiency, and risk.

Additional discussions

1.Looping

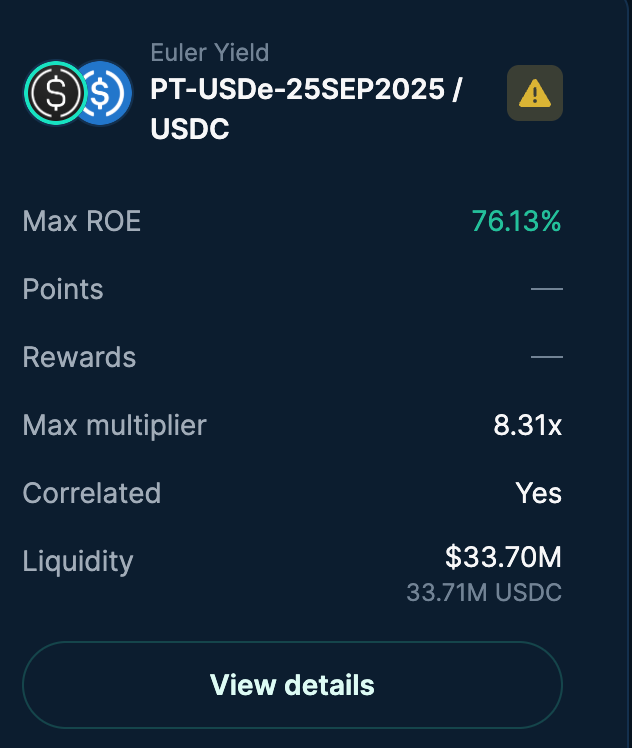

Recursive borrowing and lending (also known as Looping) is a popular modern strategy that involves minting a yield-bearing token (e.g., PT_sUSDE), depositing it into a Morpho market as collateral, borrowing USDC, buying more of the PT token, and repeating the process. For example, a recursive strategy with 10 loops on Euler can yield a 70% APY, as shown below.

This model works well with stablecoins to enhance fixed yields. However, there are two issues with this strategy when used with BTC:

- BTC PT tokens are generally not accepted as collateral. There was a time when Morpho accepted BTC PT as collateral, but now neither AAVE nor Morpho Blue accepts PT tokens as collateral, so this strategy will not work until the collateral is recognized

- Even if the PT tokens are accepted, they currently yield 1-3% APY, while the cost of borrowing USDC or USDT is 4-6%. Therefore, this trade is unfavorable in the current environment.

The only looping options available are correlated BTC pairs, such as depositing cbBTC and borrowing LBTC:

2.Points & Airdrop farming in the BTC ecosystem

While most points and airdrop programs focus on ETH or stables, a few BTC-native or BTC-integrated protocols may offer incentives:

- Babylon: possible staking rewards

- cbBTC: early usage may be tracked by Coinbase

- Aevo: BTC option vault participation could be rewarded

- Hyperliquid: BTC trading earns points

- Botanix / Arch Network: BTC L2s that may drop tokens

These should be treated as bonus rewards, not core APY sources.

Summary

A table of the above strategies

Making Informed Decisions: Risk Factors to Watch

Yield farming is not completely safe; your earnings or entire investment can be impacted if things go wrong. Aside from the risks of self-custody, here are some additional risk tips:

- Bridge security

cbBTC and WBTC rely on custodians. LBTC and tBTC use newer staking or threshold methods. Bridge hacks have historically caused major losses.

- Smart contract exposure

Vaults, LP strategies, and Pendle involve multiple contracts. Review audits and total value locked.

- Market conditions

Funding rate arbitrage and options vaults perform better in volatile or trendless markets. Bull markets may reduce the yield on option premiums.

- Liquidity

Exiting looped or structured positions during high volatility can be hard. Avoid large slippage events by sizing conservatively.

Company intros

Monarq Asset Management

Monarq Asset Management, formerly MNNC Group, is a multi-strategy digital asset investment manager focused on generating consistent, risk-adjusted returns through all market conditions. Managed by former executives from firms such as LedgerPrime, Tower Research, and BlockTower Capital, the team offers extensive experience in quantitative trading, volatility strategies, and digital market structure.

Leveraging a foundation of delta-neutral and directional strategies, Monarq utilizes a disciplined, data-centric investment approach spanning centralized and decentralized markets. By integrating institutional-grade financial rigor with native blockchain infrastructure, the firm is positioned to meet the evolving demands of today’s sophisticated institutional investors.

1Token

1Token is a SOC2 certified global technology provider for digital asset investment managers, managing over $20 billion in assets for more than 70 clients worldwide. Their award-winning portfolio and risk management system product CAM system serves allocators, portfolio managers, risk managers, treasury managers, fund operations and accountants through automated API connections to CeFi and DeFi venues, providing clients real time analytics to high frequency trading, derivatives, DeFi activities and generate reports in various aspects, that could support thousands of accounts and addresses.

The Authors

Sanat Rao is the Chief Investment Officer of the Bitcoin fund at Monarq Asset Management,

Phil Yang is the Head of Solutions at 1Token

Comments ()