All about Liquidity: How Crypto Exchanges Work with Market Makers

What is liquidity? What is a market maker? How do exchanges attract liquidity? Read more about it in our latest article.

Follow us

Prelude

As mentioned in previous articles, crypto exchange is the core player in the cryptocurrency & digital asset market that combines multiple roles in traditional finance, with diversification to compete with each other.

How crypto exchanges attract more users and excel from the competition? The competencies can be trading pairs, trading cost, security, liquidity, UI/UX, earn... Among which liquidity is one key factor that institutions would consider when choosing crypto trading venues.

What is liquidity?

To understand what liquidity is, the most straightforward metric is expected slippage. It is the difference between the current market mid-price and the average price from actual execution. The key factors behind this are the spread (the difference between the bid and ask price) and the depth (the amount of buyers and sellers available at various prices).

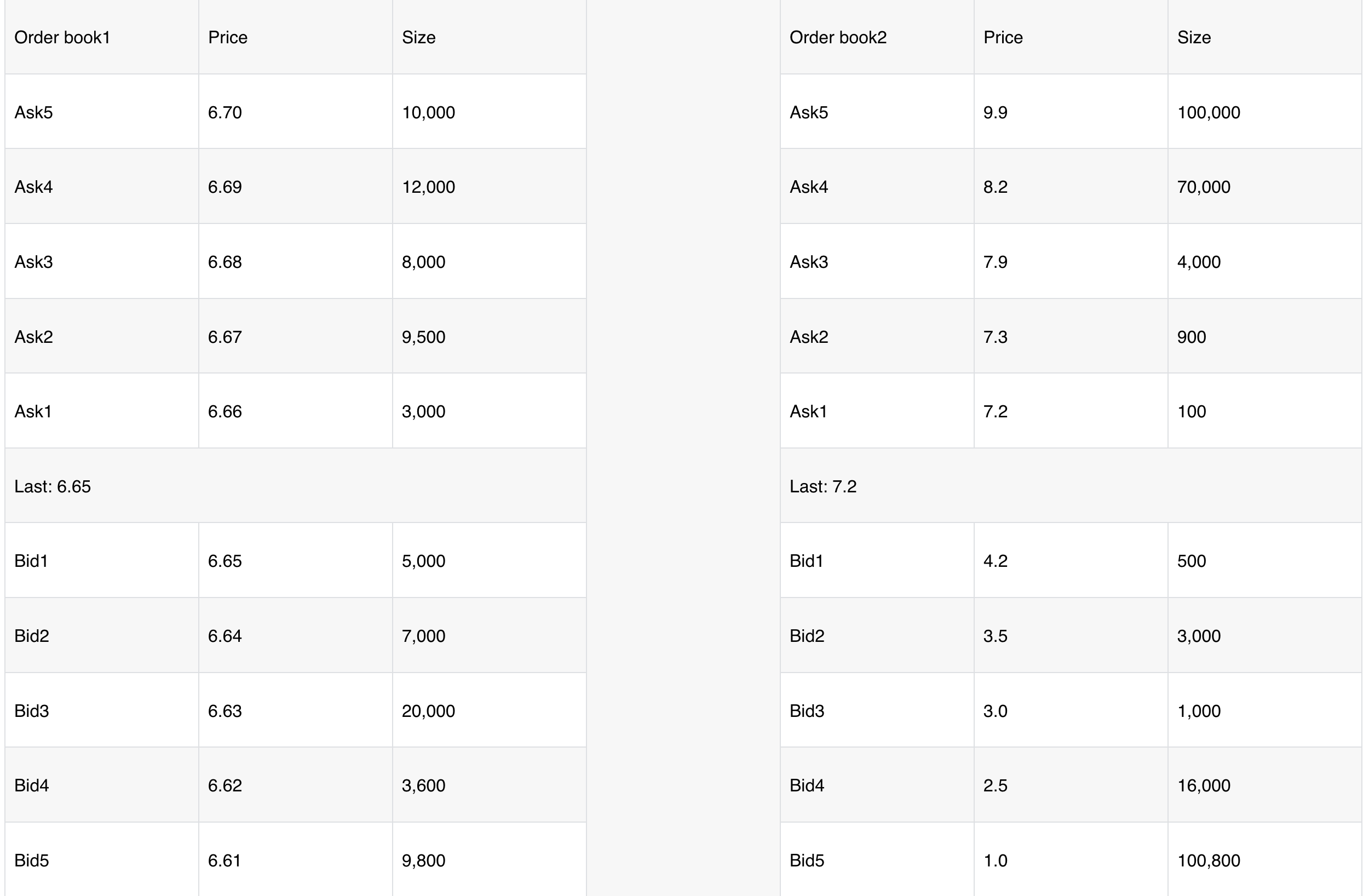

Imagine which order book below you would prefer to trade on

Similarly, in a cryptocurrency exchange, liquidity means buying and selling efficiently in terms of time and cost. A highly liquid cryptocurrency exchange will have many buyers and sellers of each cryptocurrency listed on the platform, allowing traders to enter and exit positions with tiny price slippage.

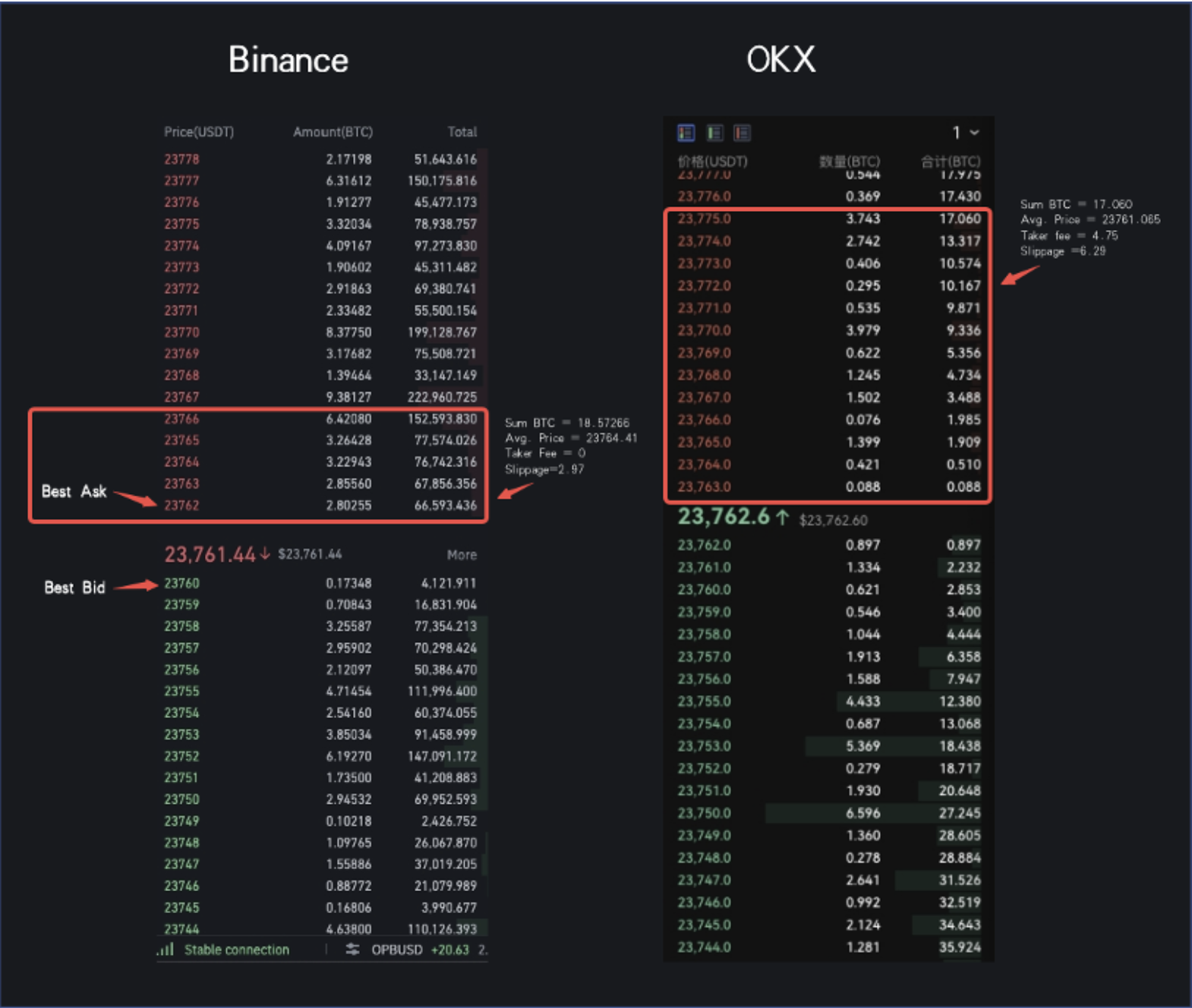

For instance, these are the order books for BTC/USDT on Binance and OKX at the same point in time. We can see that buying 18.57 BTC in Binance will lead to approximately a slippage of 2.97 USDT (0 taker fee in Binance*) and buying 17.06 BTC in OKX will lead to a slippage of 6.29 USDT (0.02% taker fee**), meaning that Binance has higher liquidity in BTC/USDT than OKX at this particular moment.

Comparison of BTC/USDT liquidity on Binance and OKX

* 0 taker fees BTC spot trading pairs on Binance

**Take the lowest spot taker fee on OKX (0.020%)

For exchanges that want to achieve higher liquidity, a common practice is to enlist the services of market makers.

What is a market maker?

A market maker is an entity or an individual that provides liquidity by continuously placing limit orders on both bid and ask.

In TradFi (forex, stock, ETF markets, etc.), market makers are those big brands like Goldman Sachs, Two Sigma, Citadel...

In the crypto market, crypto market makers fall into two categories:

- TradFi high-frequency trading firms expanding into the cryptocurrency market and becoming market makers: Jump Trading, Tower Research, DRW Cumberland.

- Crypto native firms grow to become market makers: B2C2, Wintermute.

Crypto exchanges like Binance, Bitfinex publicly show trading leaderboards, spot, futures/ perpetual swap, options... where crypto-native firms actively market their competence, e.g., https://www.binance.com/en/futures-activity/leaderboard

How do exchanges attract liquidity - Market maker Program

Exchanges evaluate market makers' performance with below criteria

- Spread: The closer a market maker's quote (both bid and ask) is to mid-market, the better.

- Depth: The bigger the size of the quote (both bid and ask), the better.

- Uptime: The longer the qualified quoting time on both sides, the better.

- Trading scope: The more trading pairs covered in the 'market maker Pair List', the better.

Or simply consider maker trading volume, or maker volume participation rate of the exchange.

In return, exchanges incentivize market makers with better conditions in

- Connectivity: higher rate limit, low latency endpoints

- Commission: maker/taker fee

- Financing: zero/low-interest loan (or credit line)

Some exchanges even grant exchange equity or options to market makers.

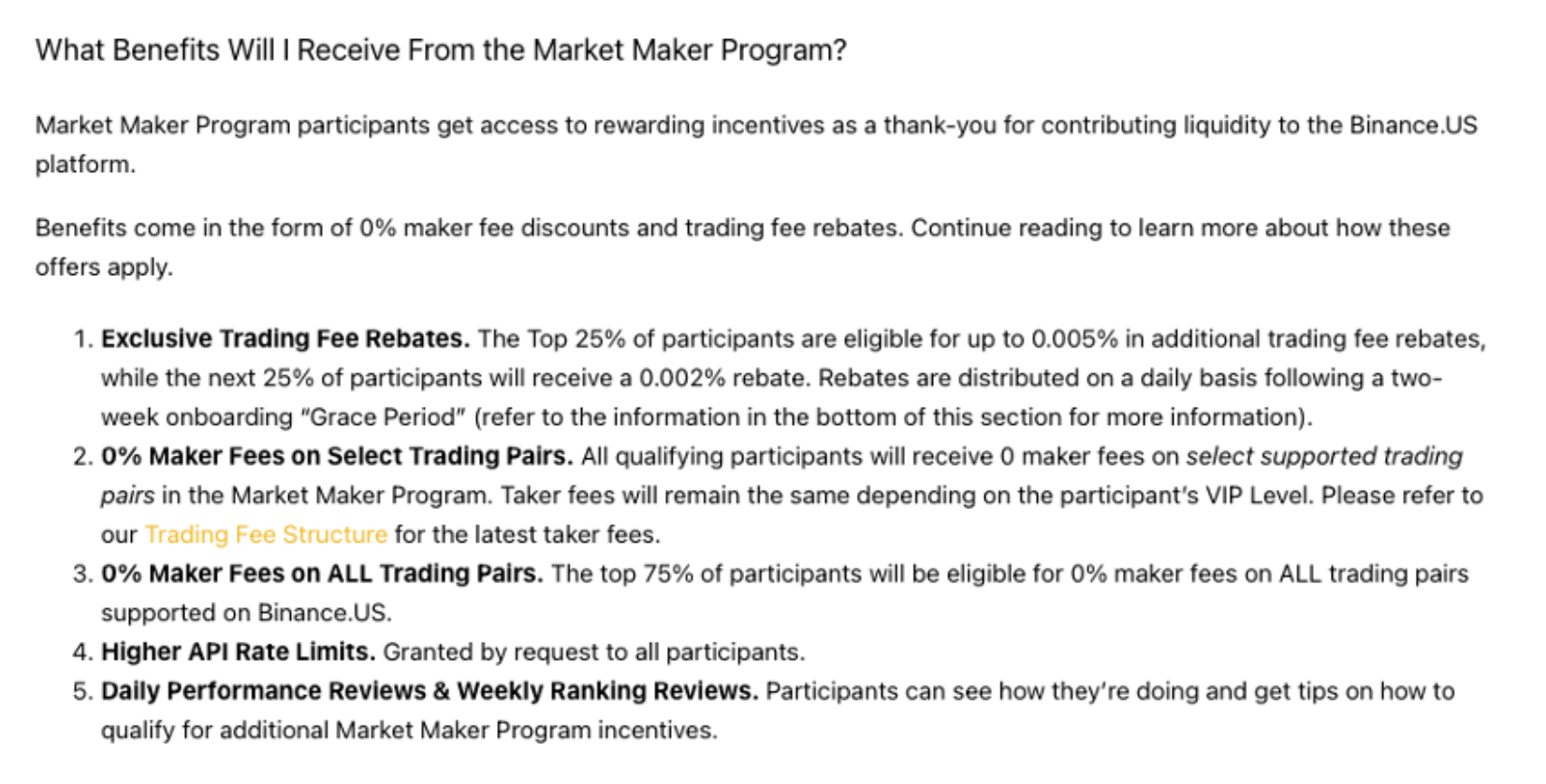

Here are the benefits of participating in Binance.US market maker:

Benefits of Binance.US market maker Program

Market Making Program Evaluation Type

There are different ways that exchanges evaluate.

- Simple - result drive

As maker volume is a simple and direct way of measurement.

Exchanges evaluate market makers on maker volume, either by absolute value, percentage of the exchange, or ranking of all traders, e.g., Kucoin market maker incentive plan.

- Medium - simple scorecard

Exchanges evaluate market makers with a scorecard, to incentivize certain behavior that is preferable by the exchanges, e.g., to make market for specific trading pairs with different weights (weight will be adjusted strategically from time to time), e.g., Binance.US market maker Program, COIN-M Futures market maker Program, Futures market maker Program.

- Complex - scoring system

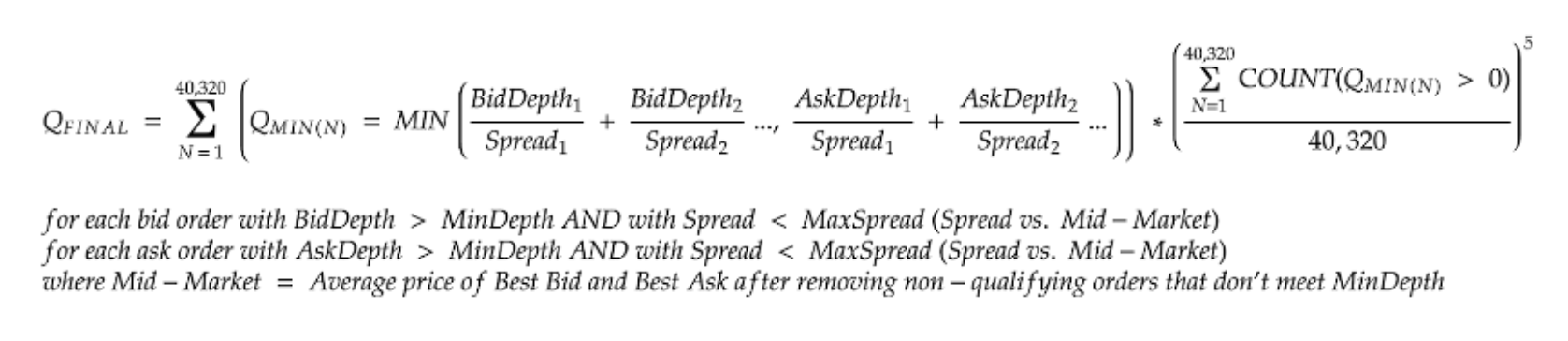

Market maker will be incentivized according to a formula, e.g., dYdX

The 1st version dYdX Liquidity Provider (19/08/2021) formula was phenomenal at its launch, and was copied by several exchanges immediately.

Foluma from DYDX Market Making Liquidity Provider Rewards.

1Token Introduction

This article is from 1Token, a crypto native tech vendor since 2015.

1Token offers a one-stop tech solution for crypto-financial institutions, that is:

For various financial service lines -

Buy-side: Fund, Asset manager, FoF, DAO treasury, VC

Sell-side: Lending, PB, OTC, Custody

3rd party: Fund admin, Auditing firm

Supporting key functions -

Front-office: Sales and Trading

Middle-office: Operations, Portfolio, Risk Control

Back-office: Clearing and Settlement, Finance and Treasury, Trade reconciliation

Covering all web3 assets -

CeFi spot and derivatives (perps, futures, options, traded in Exchanges or OTC)

Others like the loan, DeFi, SAFT, mining...

Integrated to all venues -

Exchanges, OTC, Custody, DeFi protocols

1Token software is used by 40+ large institutions globally, like Abra, Antalpha, LTP, Matrixport, Pintu, and top exchanges.

Comments ()