Will ETH ETF approval boost sentiment like BTC?

WazirX lost $234.9M in a hack. SEC approves spot ETH ETFs to trade on July 23. Following Binance, OKX restricts DMA PBs.

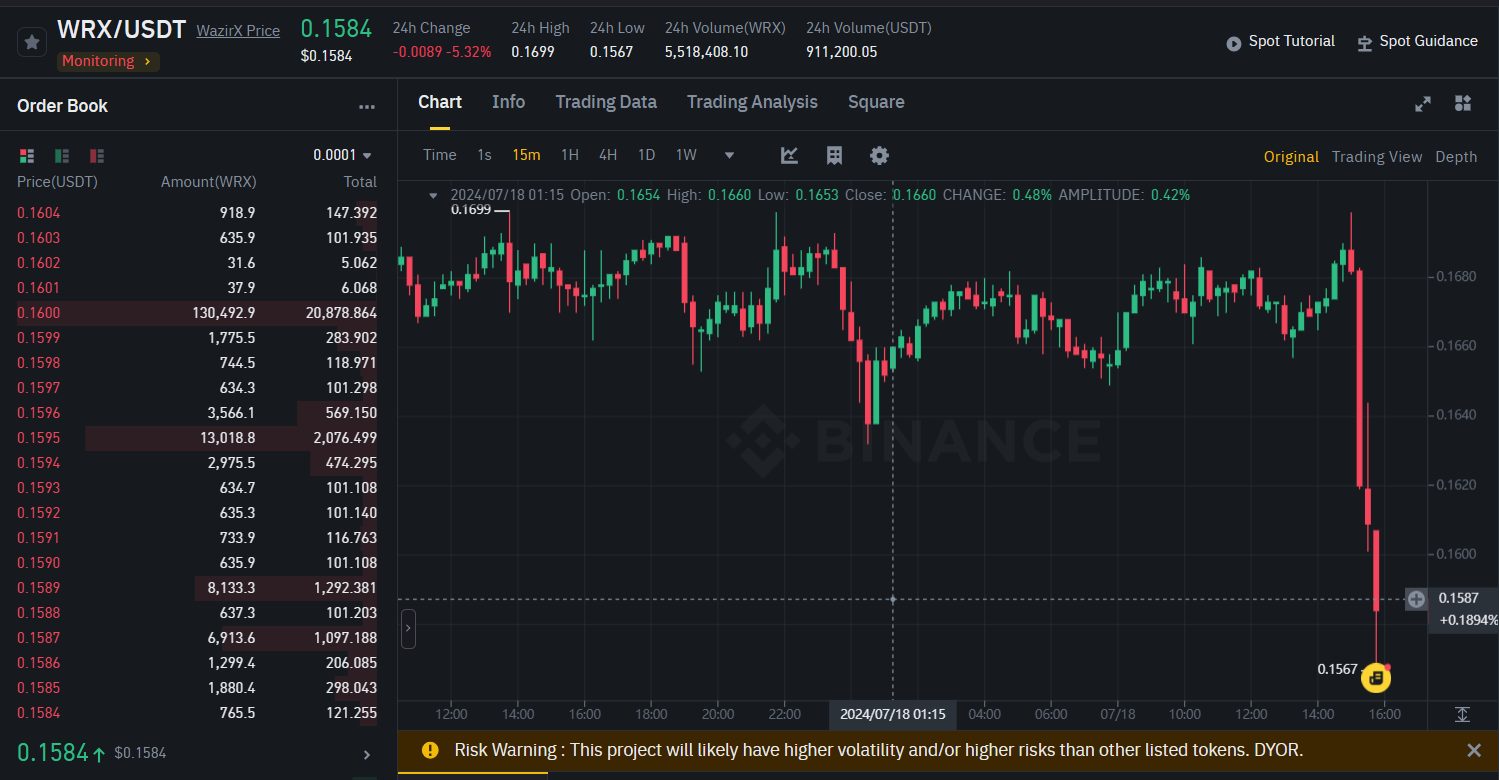

Indian exchange WazirX hacked by $235m

Cyvers Alert posted on X https://x.com/CyversAlerts/status/1813834131165286464

that WazirX's Safe Multisig wallet on the ETH network has suspicious activities, where a mix of assets valuing $234.9M have been moved to a new address and swapped into ETH in TornadoCash. Surprisingly the exchange token has not dropped too much in 30 min after the report.

Spot ETH ETF likely to begin trading July 23

The U.S. Securities and Exchange Commission has given preliminary approval to at least three of the eight asset managers (most likely BlackRock, VanEck and Franklin Templeton) hoping to launch exchange-traded funds tied to the spot price of ether to begin trading next Tuesday, three industry sources said. The approval hinges on applicants submitting final offering documents to regulators before the end of this week, the sources said. One said that all eight are expected to launch simultaneously.

OKX follows Binance to restrict DMA PB

OKX, the second-largest exchange after Binance, recently asked prime brokers for details of subaccounts including the names of the entities or individuals that control each subaccount and the jurisdiction in which they are located.OKX said it needs the information by July 17, and warned failure to do so may result in undisclosed subaccounts being restricted from trading and/or subaccount closure. This is exactly the same action Binance took a year ago, but in a quicker pace. It is likely there will be a shorter process for OKX to announce fee tier restrictions to DMA PBs.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()