What’s Web3 Venture Capital and what’s special?

Web3 venture capital offers exciting opportunities for startup teams and investors, with the potential for significant growth and unique token-based exits. Discover the various types of Web3 VC firms, their investment characteristics, and the life cycle of Web3 VC investments in our latest article.

Follow us

What is Web3 Venture Capital?

Venture capital has been the business accelerator to start-up companies with high potential, by funding those companies at an early stage with low valuation and benefiting from portfolio companies' growth. In Web3 space, there are numerous start-up teams and a clear exiting path by token issuance, which are both perfect for VC business.

Besides the traditional VC / PE that covers all sectors and with partial coverage of Web3 projects like Sequoia, there are dedicated Web3 Venture Capital (Web3 VC) like a16z, Pantera, FBG Capital who actively fund early-stage startups that build tech on blockchain or business on blockchain based digital assets.

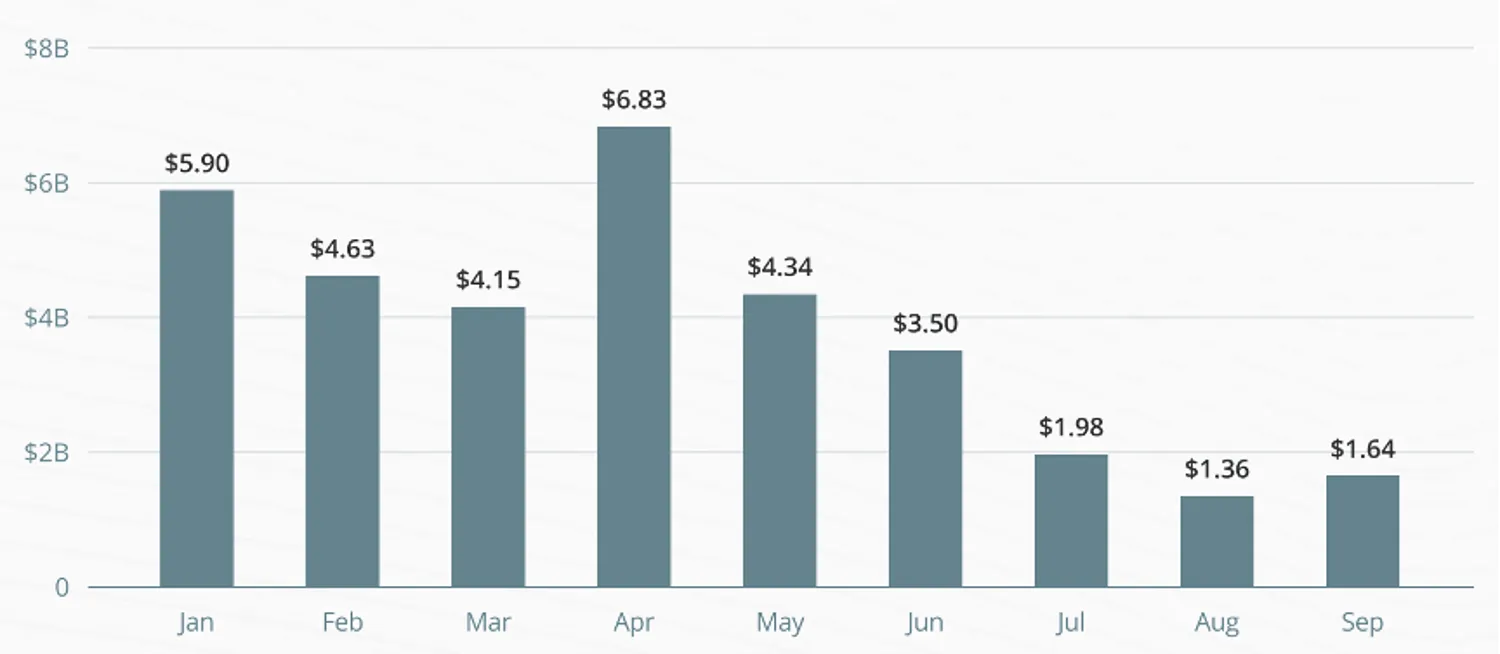

In 2022, there were 1,477 deals with a total investment of 34.33 billion USD in the first three quarters [2]. Although Luna and 3AC tragedies cooled down investors’ enthusiasm and pointed to a decrease in venture capital inflow in Q3 and FTX collapse may even deteriorate the situation in Q4, we will still see a long-term upward trend for the annual market data at the end of this year.

2022 Q1-Q3 Web3 venture capital and acquisition deals

Source: ‘Venture Capital Research 2022 Q3 Overview’ by Cointelergaph and KeyChain Ventures

Besides investments in the primary market, Web3 VC firms could also invest in liquid tokens and trade in the secondary market, hence the balance sheet is composed of omni-assets (e.g. equity, native tokens, liquid tokens, etc.), in various venues (e.g., different centralized exchanges, custodians, banks, blockchains and protocols, etc.).

1Token, as a crypto native tech firm and veteran from traditional financial market, will share insights on Web3 VC and challenges in its life cycle management.

Types of Web3 VC firms

Players in Web3 VC can be categorized into 2 types: traditional ventures with partial coverage in Web3 space, and crypto-native ventures.

Traditional ventures bring the traditional fund (usually large) to Web3, and show the following tendency

- Concentrated deals (large ticket size, small number of portfolios)

- Long decision making process and careful due diligence

So their investment is usually interpreted as strong recognition to a team / project.

On the other hand, crypto-native players can be more complex. There are mainly 3 types: primary investment firm (e.g. a16z, Pantera, etc.), market maker (trading firms), the VC arm of exchange (e.g. Binance Labs, Coinbase Ventures, etc.). Each of them has its own edge.

| Type | Main business | Example | Value |

| Primary investment firm | VC investment, can be prop fund or external fund | a16zPantera | Wide connections in the community Insights and experience in shaping the business model and tokenomics to scale up the portfolio comapny |

| Market maker | Quant trading and market making, usually invest with prop fund | GSRWintermute | Liquidity provision for trading related projects (e.g., DEX)Market making for tokens |

| VC arm of Exchange | VC business unit under crypto exchange | Binance LabCoinbase Ventures | Early access to token listingLarge platform to attract |

Characteristics of Web3 VC Investments

Compared to classic VC deals, Web3 venture investments have their own characteristics.

- Both primary market and secondary Market

Web3 VC firms's participance in secondary market sets them apart from traditional VCs. Web3 VC firms typically maintain their own liquid funds, or a book of liquid tokens. This could be either to acquire undervalued tokens from the secondary market, further diversifying their investment portfolios, or in times when the primary market does not offer good targets, these Web3 VC firms can earn yield from the secondary market. So buy-and-hold and yield strategies are nowadays Web3 VC's standard allocations, where Web3 VCs is acting like a mixture of VCs and hedge funds in traditional market.

- More diversified investment approaches

Traditional ventures mainly invest in the company’s equity, while Web3 ventures are mainly targeting at tokens.

Web3 VC firms could invest in one of a mixture of Simple Agreement of Future Equity (SAFE), Simple Agreement of Future Tokens (SAFT), and liquid tokens. Among all investments, SAFT is the most popular for its convenience of cashing out.

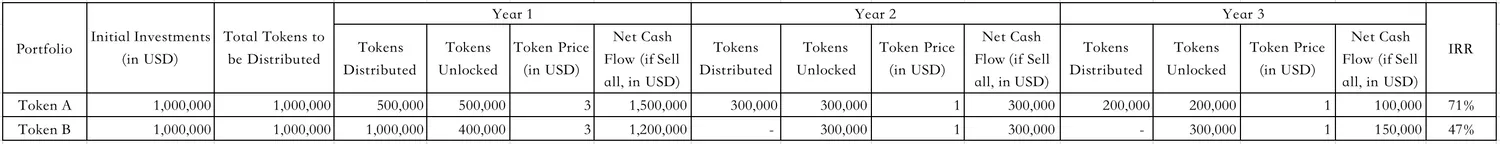

- Unique factors to be considered in investments???

Apart from the projects' short-term profitability, long-term vision, team background, products, markets, ecosystem and so on, there are unique factors in token/ SAFT investment scenarios that need to be considered. ‘Tokenomics’ as an example, is the economics of a token, which includes everything from the token supply, issuance and utility, etc. With the same investments, total distributed tokens and token value, different vesting schedules and token unlock arrangements listed in the 'Tokenomics' can lead to completely different IRRs.

Let's take an example

- Same investment: A Web3 VC invested in both portfolio A and B with the same investments of 1 million USD.

- Same total distributed tokens: Portfolio A and B will distribute 1 million token A and B in total.

- Same token value: Token A and B will be of same price during the vesting period.

- Different vesting and unlock schedules: 50% of token A is liquid in Year 1, 30% in Year 2 and 20% in Year 3. While 40% of token B is liquid in Year 1, 30% in Year 2 and 30% in Year 3.

- Different IRR: IRR of portfolio A turns out to be 71% and IRR of portfolio B is only 47%.

- Shorter cycle and faster exits

In equity/ SAFE investment scenarios, the exit strategies are traditional, like Initial Public Offering (IPO), Merger and Acquisition (M&A), Management Buy-Outs (MBO)... Either of these exits takes a long process, since it needs to go through multiple reviews and even the regulators’ approval.

While in token/ SAFT investment scenario, the cycles between investments and exits are much shorter. Exit strategies in these cases can be Initial Exchange Offering (IEO), Initial Decentralized Exchange Offering (IDO), Security Token Offering (STO) and Over The Counter (OTC) trades with management / other players.

Unlike IPO, token listing of IEO and IDO are unregulated (STO is emerging but still minor). Tokens are immediately liquid once released (because there's DEX). To prevent investors exiting immediately, projects usually set tokenomics and vesting terms to keep the party on.

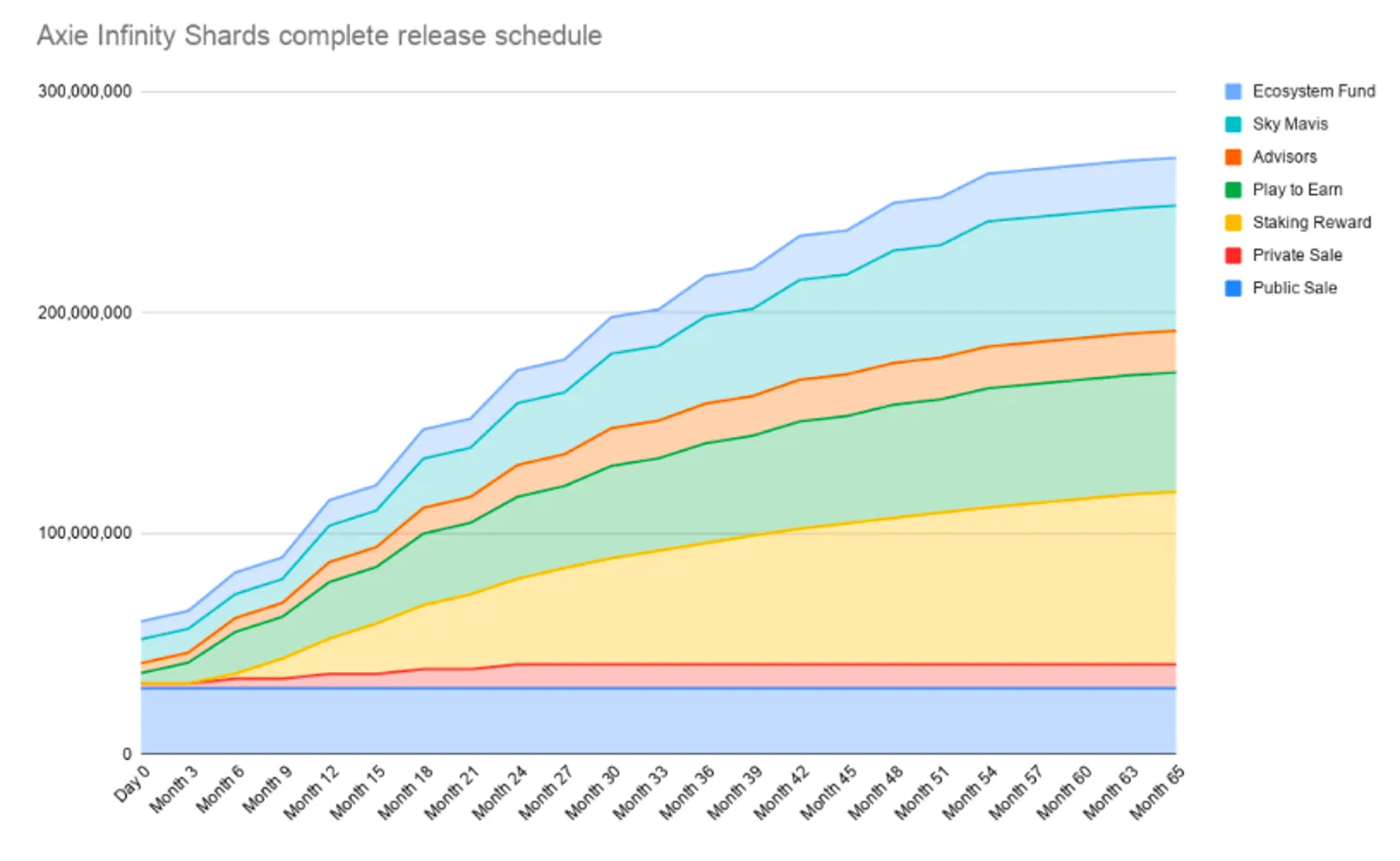

Take AXS private sales round investors as an example [3]:

- Investors invested $864,000 on May 1, 2020 with an average price of $0.08.

- According to AXS tokenomics on its whitepaper [4], 20% of the private sale tokens will be unlocked during the AXS public sale. The rest of the private sale tokens will be unlocked quarterly over the next 2 years.

- AXS IEO happened on November 4, 2020.

It means private sales investors will have 20% liquid token after 6 months (cliff), and the rest 80% will be released to liquid in the next 2.5 years.

- Large deal quantity and small check size

Web3 ventures invest 10x or more portfolios than classic ventures, and meanwhile project companies involve many more investors for each round.

Web3 startups are moving fast in development and fundraising, so VC cannot make perfect due diligence. For max. return and min. risk, Web3 VC have to cover more projects, rather than being cautious and missing potential star projects. Large ventures easily invest in hundreds of companies in their portfolio (e.g. Coinbase ventures, Pantera, etc.).

Startups also tend to work with more investors. As mentioned above, founders do care about funding, but they also expect to cooperate with investors to help build and scale their ecosystem.

Web3 VC Life Cycle

The whole life cycle of a Web3 venture fund mainly consists of 4 stages: Fundraising, Investments, Operations, Exits.

Fundraising

There could be multiple fundraising channels for Web3 ventures:

- Regulated venture fund entity: Accredited investors only

- Proprietary fund: Internal capital, Employees of the manager and its affiliates as investors, Employees as notional investors (actual investors being their relatives or friends), etc.

Investor profile management, KYC, subscription and redemption management

At Investor onboarding stage, the client profile needs to be well kept. Meanwhile, a Know Your Clients (KYC) process with workflow will be inadequate for compliance purposes. The ideal process should be with the following 4 steps: obtaining materials from investors, internal review, approval, and record keeping.

Correct bookkeeping of investors subscriptions at the beginning (most venture funds are closed funds), shares transitions during the running period, investors redemptions at the closing stage will be essential. So VC firms can clearly calculate the return for each investor and carry interest when it goes to the closing stage of a venture.

Regular reporting to investors

Regular reporting to accredited investors is crucial. It is not just for satisfying the compliance requirements, but also building up transparency and trust between fund managers and investors.

Normally an investor report should consist the following sectors:

- Fund summary: fund size, deployed capital, number of investments, realized proceeds, key indicators (IRR, MOIC, etc.)...

- Performance: graphs and charts demonstrating the performance trend

- Portfolio summary: a list of full portfolios with key indicators of investments

- Key updates: fund-related or portfolio-related updates managers like to provide.

Investment

There are 3 layers in venture investment which need to be well managed and correlated: Funds/ Proprietary Fund, Portfolios and Underlying Assets.

Bookkeeping of funds / proprietary fund

Regulated funds can be in complex structure (feeder fund- master fund- funds), and can offer multiple classes. Proprietary funds can also be allocated to different portfolios by multiple portfolio managers. So there could be various business scenarios that need to be under bookkeeping, for compliance and fund accounting purposes. Therefore, a management tool needs to provide enough flexibility to support different business scenarios.

Recording portfolios investment information

As mentioned, Web3 ventures invest in lots of portfolios. So keeping good track of the investment info of all these portfolios matters:

- Investment information: investment date, amount and currency, pre-trade and post-trade valuation, shares holding...

- Key terms of the agreement: SAFE/ SAFT details, anti-dilution clause, exit clauses, preferential liquidation rights, others…

- Legal and financial files: agreements, portfolio’s deck, whitepaper, other legal documents…

Tracking underlying assets

Underlying assets of the portfolios are equity/ SAFE, tokens/ SAFT or a mix. It’s essential to book them properly at investment stage, especially the initial valuation of them:

- For equity/ SAFE/ SAFT: The initial investment (the cost) is always viewed as the intrinsic value of the tokens before the token goes listing.

- For liquid tokens: Normally based on real-time price from centralized/ decentralized venues. It may differ for each VC firm when it comes to which price source is used as a valuation source. But overall, the majority of them are using the price from CMC, or the median price of major Centralized Exchanges (CEX) as the Fair Market Value (FMV).

Operations

Fund accounting for funds / proprietary funds

Like all large fund houses focusing on secondary market trading, inhouse operation team of venture capitalists should also perform fund accounting so that they can compare with the fund admin reports. Middle officers should take care of the following points to get the correct NAV, management fee, waterfall carried interests, etc. :

- Multiple-layers fund structure

- Subscription and redemption

- Fees accrual and amortized

- Regular re-valuation of equity/ SAFE and tokens/ SAFT (Please view ‘Re-valuation of underlying assets’)

- Different fund shares, which lead to different investor bases, minimum subscriptions, management fees, and carried interests…

- Liability/ Loan recording for the scenario of employees being notional investors while actual investors being their relatives or friends

- Others

Valuation of assets

Web3 VC firms need to frequently monitor and adjust the valuation of the portfolios (equity/ SAFE and tokens/ SAFT) in daily operations, since

- The crypto market is highly volatile.

- There is a large deviation between tokens' market price and intrinsic value when they just go public.

- Performing haircuts helps better reflect the tokens' intrinsic value in such situations. Meanwhile, setting a premium will also help evaluating the token value, when there is good news within the ecosystem / projects.

After the ‘FTX Collapse’ on Nov 8, 2022, Sequoia, Paradigm, Softbank and Temasek all marked down their FTX investment to zero. Meanwhile, asset managers who have exposure to ‘FTT’ (FTX utility token) also performed huge haircuts or marked zero for the token value.

Token vesting and unlock schedule

Tokenomics in the whitepaper determines the token vesting schedule and unlock arrangements.

The Vesting schedules of portfolios differ. Most tokens are non-linearly distributed with cliffs (meaning investors receive tokens on specific dates, rather than receiving a portion of them gradually), while few are linearly distributed.

AXS Allocations and Unlock schedule

For token unlock, there are 3 common ways in general:

- Tokens will be only distributed at the mutually agreed token unlock dates.

- Tokens will be distributed at Day 1, but locked by smart contracts.

- Tokens will be distributed and unlocked at Day1, but both parties mutually agreed not to sell until a specific date.

It can be overwhelming for operation managers to reconcile cash flows and portfolio managers to remember all token unlock schedules, when it comes to 100+ portfolios. A management tool with the following features can help increase efficiency in their daily work.

- Future cash flow prediction (token receivables)

- Auto-reconciling whether cash flow matches with token receivables

- Alerts on mismatch after token distribution

- Reminders for token unlock

In some special cases, portfolios may negotiate to change the token distribution dates. Therefore, the vesting schedule and future cash flow also needs to be easily modified.

Yield generation (further)

Web3 projects usually try to let token holders to hold by incentivize staking in liquidity pools. As a passive yield generation, VC firms might participate based on their judgement to market. In such scenarios, the portfolio manager needs to understand the performance split into 2 sources: primary market investment and secondary market trading, while the operations team needs to understand the cash flow split between vesting receivable and income from Investment.

Internal analysis and reporting

Internal analysis reports will be comparatively more detailed than investor reports. Apart from key indicators (AUM, MOIC, IRR, investments, proceeds, FMV, etc.), internal analysis reports will also include investor breakeven analysis, etc..

Exits

We have talked about exit strategies in Web3 venture deals. Specifically, how and where will VC firms sell the tokens at exits?

Where to exit

- CeFi: exchange or OTC. If the token is listed in CEX, there's a way to sell on the central limit order book. There are different OTCs provide RFQ or execution service for tokens as well.

- DeFi: Some new coins didn't get listed in CEX, but they are usually found in the permissionless DEXs like Uniswap, Pancake Swap or Biswap, etc.

How to exit

If the tokens have not been listed, but liquid at DeFi protocols, 'Swaping' helps with the exits.

If the tokens have been listed on CEXs or DEXs, currently Web3 ventures are selling them in 2 ways:

- For ventures with their own trading team: Sell the tokens themselves with smart TWAP algo.

- For ventures without a trading team: Find market makers to sell the tokens for them and the market makers will either quote a price with haircut, or charge an execution service of 0.5-1.5% of the total executed value.

In either way, traders always trade with an algo to split the orders instead of selling all tokens at once to avoid huge market impact. Time Weighted Average Price (TWAP) and TWAP with random order sizes will be core algos used. And one single Order and Execution Management System (OEMS) with connection to multiple trading venues will be helpful to traders.

1Token covers Web3 VC life-cycle management

Covering the whole business cycle, 1Token provides a one-stop solution for Web3 ventures.

Fundraising Stage

- Investor profile management and KYC workflow

- Subscription and redemption management

- Regular investor reporting

Investment Stage

- Bookkeeping funds/ proprietary funds (supporting funds with complex structure, e.g. Feeder-master-fund, funds with different shares, etc.)

- Recording investment information of portfolios (supporting both fund's portfolio view and investment manager's portfolio view)

- Tracking underlying assets

Operation Stage

- Fund accounting on both liquid fund and illiquid fund

- Revaluation adjustment for underlying assets

- Token vesting notice and token unlock alerts

- Internal analysis reports

Exit Stage

- Liquidity analysis for token selling in multiple venues

- Realized and unrealized gain tracking

- Calculation of carry interest

1Token has API integration with 80+ centralized counterparties (mainstream exchanges, custodians, banks, etc.), 20+ blockchains and 100+ protocols, and 1Token can support API connection to more counterparties based on clients' needs.

Founded by a crypto-native team with 7+ years of experience in crypto quant trading, 1Token provides one of the best institutional-grade financial software for crypto institutions to manage portfolios, risk, and accounting.

Our team would be keen to meet potential strategic investors who share a deep knowledge of financial SaaS, and are actively investing in the crypto finance vertical.

For further conversations, please feel free to reach out to our head of Capital Markets - Annie Li (annie.li@1tokentech.com).

Quick Facts:

- Currently supporting 40+ global crypto institutions

- Top client profile incl. 3/5 top crypto exchanges, Animoca, Ant Alpha, Alfa 1, LTP, Matrixport, Nickel Digital, Nexo etc.

- $12M raised from Sumscope, Gate, Matrixport, Folius, and K3 Ventures

Reference:

[1] ‘Venture Capital Research 2021 Overview’ by Cointelergaph and KeyChain Ventures:

https://research.cointelegraph.com/reports/detail/venture-capital-report-2021-overview

[2] ‘Venture Capital Research 2022 Q3 Overview’ by Cointelergaph and KeyChain Ventures:

https://research.cointelegraph.com/reports/detail/venture-capital-report-q3-2022

[3] Axie Infinity (AXS) Tokenomics from CoinGecko:

https://www.coingecko.com/en/coins/axie-infinity/tokenomics

[4] Official Axie Infinity Whitepaper:

https://whitepaper.axieinfinity.com/axs/allocations-and-unlock/private-sale

Comments ()