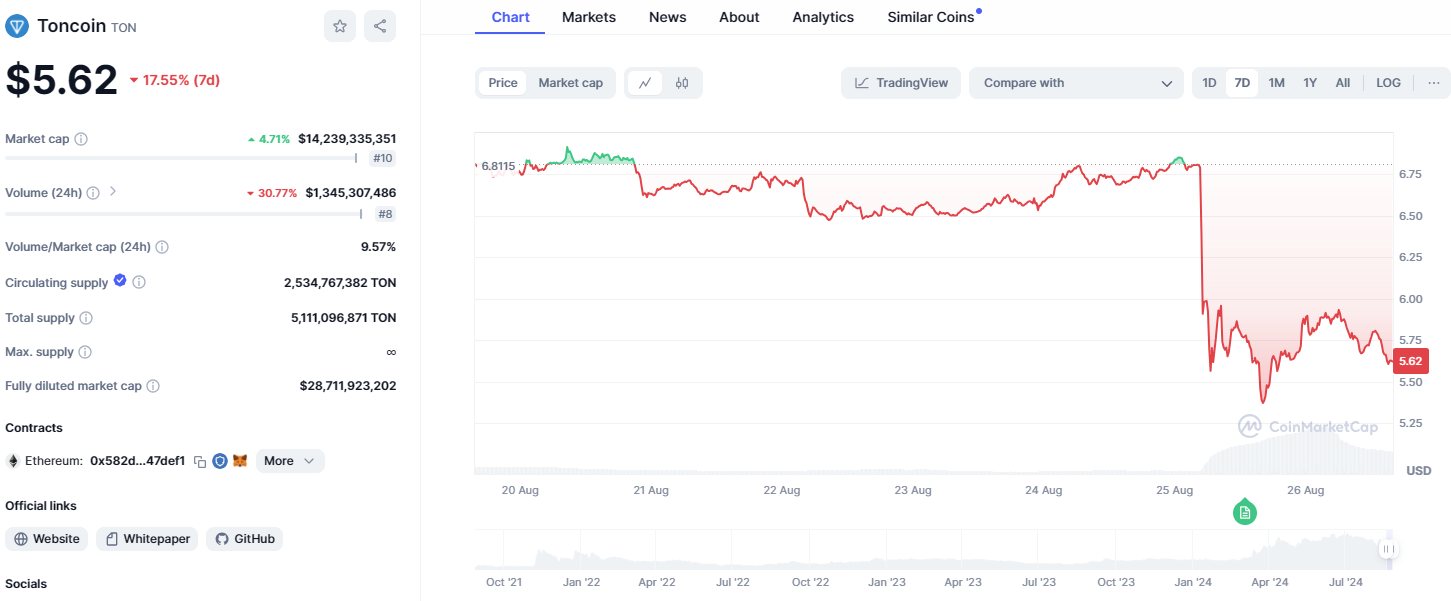

Telegram CEO's arrest leads to 14% drop in Toncoin

MakerDAO rebrands as Sky, introducing SKY and USDS tokens, while Cryptocurrency trading platform supports Paypal for US crypto purchases. Telegram CEO Pavel Durov's arrest impacts Toncoin’s value.

MakerDAO rebrands as Sky, and DAI rebrands as USDS

According to https://x.com/SkyEcosystem/status/1828405625828843710, MakerDAO revealed its rebranding to Sky along with the new names of its upgraded tokens, SKY and Sky Dollar (USDS) on Aug. 27.SKY is a new governance token being upgraded from Maker’s MKR, while USDS is the latest version of the stablecoin DAI. While DAI and USDS can be swapped on a 1:1 parity, each MKR token can be exchanged for 24,000 SKY.MakerDAO also announced boosted token rewards for early users by completing the steps on http://Sky.money, and become eligible for boosted Sky token rewards.

Crypto.com adds Paypal as payment option in US for crypto purchases

Cryptocurrency trading platform Crypto.com announced on Wednesday that U.S. users now have the option to use Paypal as a payment method for purchasing cryptocurrencies.This integration allows users to link their Paypal and Crypto.com wallets, facilitating transfers from Paypal to Crypto.com for buying a wide range of crypto tokens.This feature will soon be available in additional markets beyond the U.S, according to the annoucement.

Telegram CEO Pavel Durov arrested in France

According to French media outlet TF1, Telegram co-founder and CEO, Pavel Durov was apprehended upon arriving in France from Azerbaijan on his private jet.Toncoin price falls about 14% after the event.

On 8/28 Wednesday, reports that Paris prosecutors have officially charged Pavel Durov, with French judges setting his bail at €5 million ($5.5M). Under the bail conditions, he must remain in France, though prosecutors claim he has “nothing to hide.”

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()