SEC Rejects SOL Spot ETF: What’s Next for Crypto ETFs?

The SEC rejected $SOL spot ETFs, with no new crypto ETFs expected under the current administration. BitGo launched a retail platform with a Bitcoin giveaway for U.S. users. South Korea delayed its crypto tax until 2027, with new regulations starting in 2025.

SOL spot ETF got rejected

FoxBusiness journalist Eleanor Terrett tweeted that I’ve confirmed that the (US) SEC has notified at least two of the five prospective issuers that it will reject their 19b4 filings for the $SOL spot ETFs. The consensus here, I’m told, is that the SEC won’t entertain any new crypto ETFs under the current administration.Maybe with Trump's newly nominated SEC head, things will change in 2025. David Sacks, the AI and crypto czar of Trump government, is known as supporter of SOL. Anyway, for now there will be only BTC and ETH spot ETF.

BitGo launches dedicated retail platform

BitGo, the leading infrastructure provider of digital asset solutions trusted by institutions since 2013, today announced the official launch of its dedicated retail platform, providing retail customers access to BitGo’s comprehensive suite of regulated and secure digital asset trading, staking, wallets, and qualified custody services.The platform is now live for all global investors and available for sign-up at bitgo.com/welcome. Eligible U.S.-based investors who sign up for BitGo’s retail platform will have the opportunity to win a full bitcoin.BitGo has long been serving institutional clients. However, competition in this space has increased in recent months, with new players entering the market to meet the growing demand from institutional investors.

What a week in South Korea

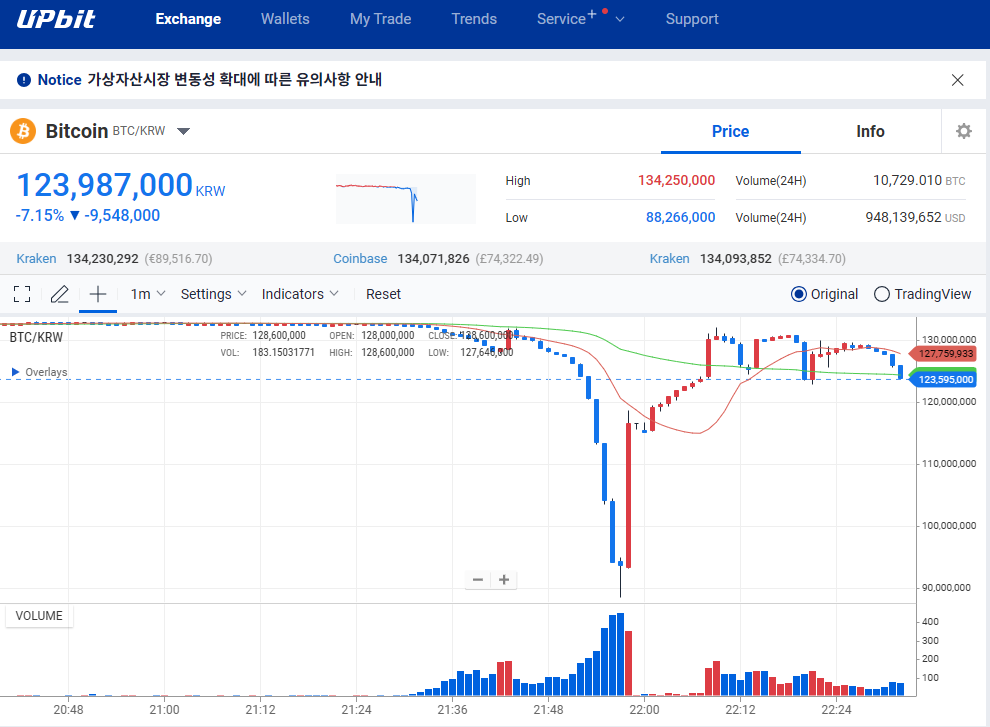

South Korea has always been the most active markets, and this week is unexpectedly big there.On the good side, the South Korean government has once again delayed the capital gains tax on digital assets and its implementation is expected to be pushed to 2027. Originally scheduled for January 2025, the tax has been postponed several times because of political rivalries and questions about the effect of the tax on the regional cryptocurrency market.On the neutral side, Financial Services Commission Establishment Act Amendment Decree Passed by State Council, effective from Jan.1 2025, virtual asset operators such as Dunamu (Upbit), Bithumb, and Coinone, which are subject to inspection by the Financial Supervisory Service, will be subject to supervision share levied starting next year, just like general financial institutions.On the bad side, potentially due to political situation, there was a big dump and pump on Korean exchanges which is not seen on international markets.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

Comments ()