S&P Downgrades Tether to Lowest Rating

CW48 S&P downgraded Tether’s USDT to its weakest rating due to exposure to riskier assets and limited reserve transparency. Hyperliquid’s first $300M HYPE unlock is set for Nov 29. Meanwhile, Binance and Perpdex introduced equity trading, enabling tokenized access to major U.S. stocks.

S&P downgrades Tether to lowest rating

S&P Global Ratings downgraded Tether's USDT stablecoin, aka largest stablecoin, to its weakest score (5) due to increased exposure to risky assets and reserve disclosure gaps.

The report highlighted concerns over USDT's backing, noting that bitcoin now accounts for 5.6% of its reserves, while the over-collateralization rate is 3.9%, hence the chance of lower prices potentially leading to USDT being undercollateralized.

Tether's CEO Paolo responede on X that "Tether instead built the first overcapitalized company in the financial industry, with no toxic reserves. And yet is and remains extremely profitable."

See original report: https://www.spglobal.com/ratings/en/regulatory/delegate/getPDF?articleId=3486415

HYPE token 1st cliff unlock

HyperliquidX 's first cliff unlock is scheduled for Nov 29 (Saturday): ~$300M worth of HYPE token (2.66% of circ. supply) from core contributors.

This will be the initial unlock since TGE in Nov 2024. According to their Medium post, core contributor tokens were locked for 1 year post-genesis, with most vesting completing between 2027-2028.

See the full unlocking schedule: https://tokenomist.ai/hyperliquid

Equities trading in crypto exchange

Binance App now shows stocks in the Web3 wallet area.

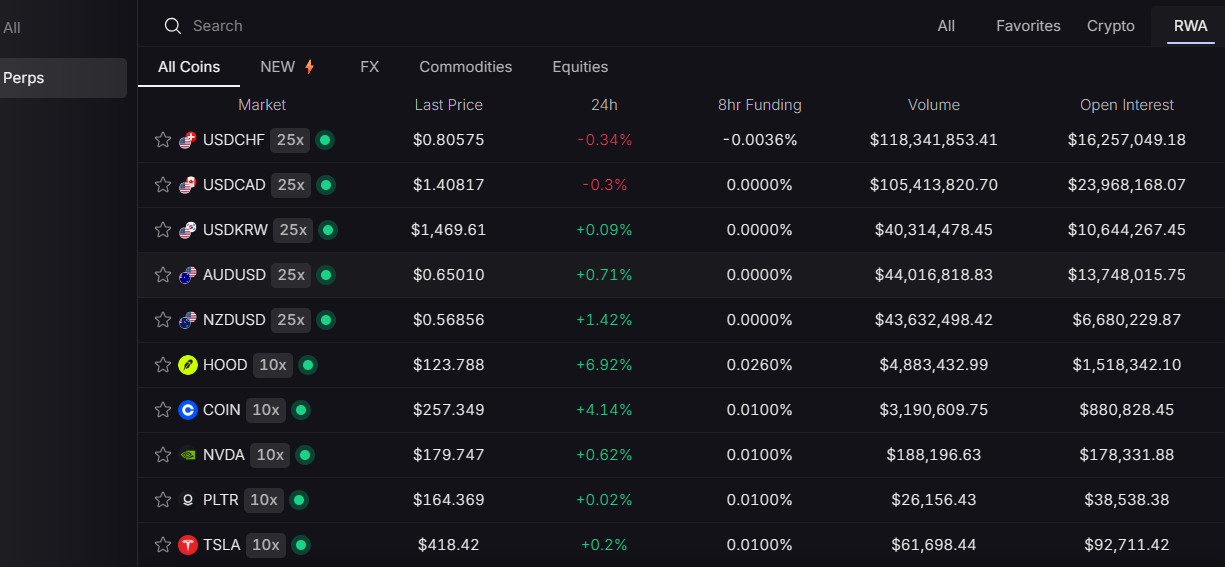

Meanwhile, Perpdex Lighter launches trading Coinbase ($COIN), Robinhood ($HOOD), Nvidia ($NVDA), Palantir ($PLTR), and Tesla ($TSLA) with up to 10x leverage. Both markets will have an initial 10M OI cap, the pricing oracle comes from Chainlink, all liquidations will be handled by XLP, and follow US trading hours: 9AM - 4:30PM ET. Details see https://docs.lighter.xyz/perpetual-futures/real-world-assets-rwa

About 1Token:

1Token is a digital asset investment management platform providing Crypto PMS, RMS, and Portfolio Accounting Software, managing over $20 billion in assets for more than 80 clients worldwide.

All-in-one support designed for allocators, portfolio managers, treasury managers and fund operations and accountants, seeking transparency and control.

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()