Bitcoin Bull Run Burns Billions and Shrinks Exchange Supplies

Robinhood Expands Crypto Trading Services to Europe

Robinhood, a trading and brokerage firm, announced the launch of its Robinhood Crypto app for eligible customers in the European Union (EU) on December 7th. The platform will allow traders to buy and sell more than 25 cryptocurrencies and will be the only custodial crypto platform to offer customers a percentage of their trading volume back every month, paid in Bitcoin.

The new crypto app will charge zero trading fees on over 25 cryptocurrencies and provide transparency by allowing customers to view the spread, including the rebate received by the company from sell and trade orders within the app.

The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans.

– Johann Kerbrat, General Manager of Robinhood Crypto

This expansion suggests a growing interest and demand for cryptocurrency trading services in Europe. Robinhood's entry into this market could increase competition among crypto trading platforms, potentially leading to improved services and lower fees for European users. It also reflects the company's confidence in the long-term viability of the cryptocurrency market despite its volatility.

Binance Withdraws Abu Dhabi Investment Fund License Application

Binance, a cryptocurrency exchange, has withdrawn its application for an investment fund license in Abu Dhabi. The license, which Binance chose to withdraw on its own initiative, would have allowed the exchange to manage a collective investment fund in the country.

Binance's decision could be indicative of regulatory challenges or strategic shifts within the company. This move might impact Binance's expansion plans in the Middle East and could signal a broader trend of crypto companies facing regulatory hurdles in various jurisdictions.

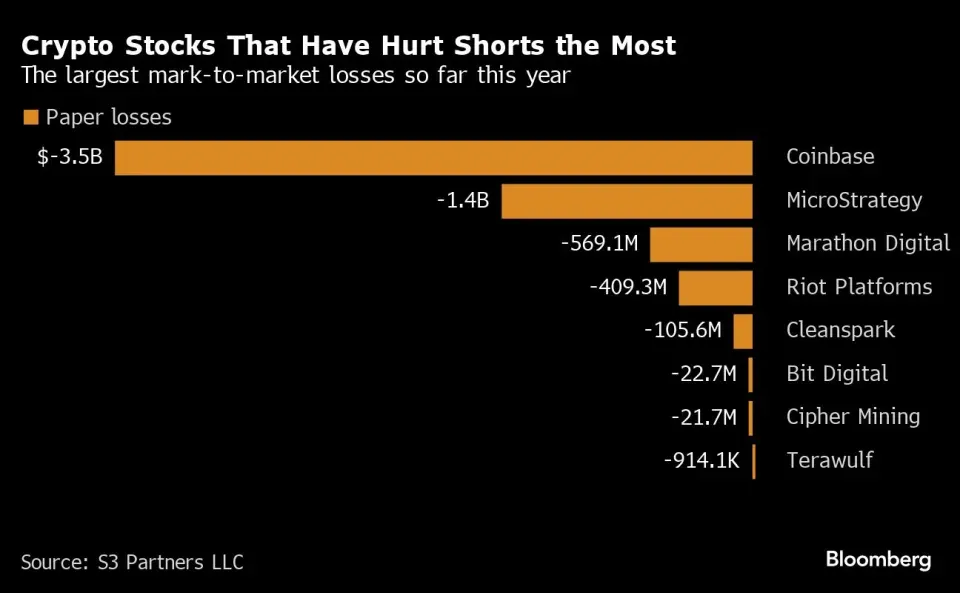

Bitcoin’s Rally Burns $6 Billion for Short Sellers

According to data from S3 Partners LLC, traders who have been speculating on the decline of crypto-related companies such as Coinbase Global Inc., MicroStrategy Inc., and Marathon Digital Holdings Inc., have suffered collective paper losses of $6 billion this year.

The significant losses are primarily due to the rapid rise in Bitcoin's price, which strongly influences stocks related to the crypto sector. This situation highlights the close correlation between Bitcoin's price and the valuation of crypto-related stocks.

These stocks act similarly to utility tokens in the crypto market, where the price of many utility tokens is also closely linked to Bitcoin's price fluctuations. Just like stocks, these utility tokens reflect the operational health of the projects they represent.

For instance, OKB, the utility token of the OKX exchange, frequently mirrors the movements in Bitcoin's price, demonstrating this correlation. The research on OKB underscores how its performance is tightly coupled with Bitcoin's price changes, illustrating the interconnected nature of the cryptocurrency ecosystem.

This overall trend points towards the growing acceptance and maturation of cryptocurrencies and may encourage investors to re-evaluate their strategies. It suggests a potential shift towards more diversified portfolios and innovative investment approaches. The Bitcoin rally, apart from affecting short sellers, could also stimulate further interest and investment in the sector, contributing to its growth and development.

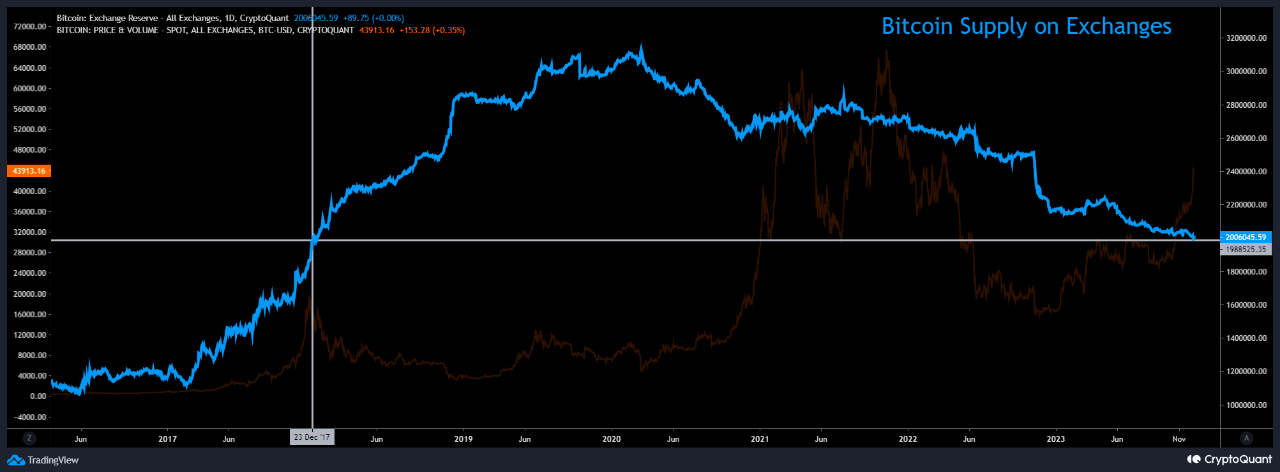

Bitcoin Supply on Centralized Exchanges Drops to 2017 Levels

The supply of Bitcoin on centralized exchanges reached its lowest point in six years.

The reduction in Bitcoin supply on centralized exchanges suggests that more holders are moving their Bitcoin to private wallets, possibly indicating a trend towards long-term holding rather than short-term trading. This could be interpreted as a sign of maturing in the crypto market, with investors increasingly viewing Bitcoin as a store of value.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()