Restaking's New Option and Binance's Determination on Compliance

EigenLayer and restaking

What is restaking?

Restaking enables staked ETH to be used as cryptoeconomic security for protocols other than Ethereum, in exchange for protocol fees and rewards.Why is it great?For token holders, restaking offers the opportunity to re-utilize their staked coins, thereby enhancing yield generation by staking a single asset multiple times. As for dApp developers, restaking increases the security of DApps that rely on Actively Validated Services (AVS) modules for security.

What is EigenLayer?

EigenLayer provides three types of staking: Liquid Staking, Superfluid Staking and Restaking. The major difference between these options is whether we are going from L1→DeFi or from DeFi→L1.

- Liquid Staking allows various liquid staking tokens (LST) provided by Lido or Rocketpool, to be staked.

- Superfluid Staking allows the staking of Liquidity Provisioning (LP) tokens.

- Restaking can be Native Restaking, LST Restaking, ETH LP Restaking and LST LP Restaking. In the current phase, restaking is available for both natively staked ETH and liquid staked tokens like stETH, rETH, cbETH, and LsETH.

Why is EigenLayer great?

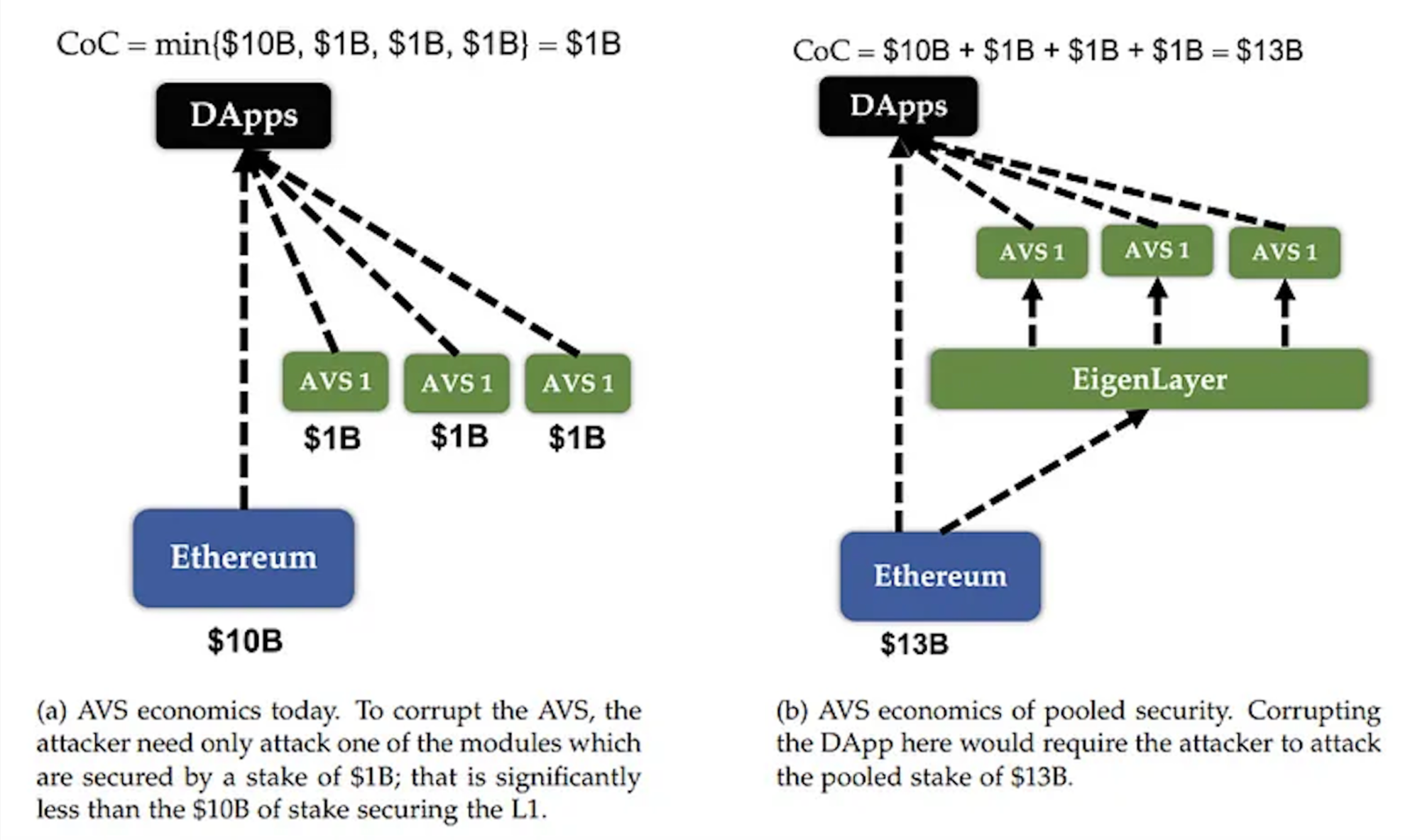

EigenLayer has developed its own slashing mechanism for crypto economic security fundamental of Cost of Corruption (CoC), where the EigenLayer smart contract holds the withdrawal credentials of Ethereum Proof-of-Stake (PoS) stakers. If a staker who has restaked on EigenLayer is found to have engaged in adversarial behavior while participating in Actively Validated Services (AVS), their ETH holdings will be subject to slashing and subsequently frozen. This means that the staker's ETH will be prevented from further participation in any AVS on EigenLayer.

According to data from DefiLlama, EigenLayer has been setting up airdrop expectations since the end of 2023, leading to a significant increase in Total Value Locked (TVL) to $1 billion.

Recently, EigenLayer announced on Twitter the temporary removal of the staking cap until February 9th. As a result, the total value locked (TVL) immediately doubled from $2 billion to $4 billion. The protocol stated that this temporary removal is “paving the way to a future” where all staking caps will be permanently eliminated.

Binance's zero-tolerance policy for Launchpool insider trading

It is widely known that news about exchange listings can be highly profitable for individuals who possess insider information. In 2022, Coinbase's former managers were charged due to their involvement in such activities (source: https://www.sec.gov/news/press-release/2022-127).This week, there is a rumor circulating that a particular project is set to be listed on Launchpool, which has even caused a significant increase in the price of BNB.

The Launchpool did not occur. Meanwhile, Binance co-founder Yi He, who currently serves as the prominent public figure of Binance due to CZ's restriction from discussing Binance on Twitter, shared a message on Twitter emphasizing the importance of maintaining confidentiality within the relevant teams. It was stated that only one warning would be given before getting fired if any information was leaked. Additionally, a public channel was established, and a commendable reward was offered for reporting any breaches of confidentiality.

Zhusu closing OPNX and opening OX.FUN

Zhu Su and his partners (Kyle Davis, and ex-Coinflex founders) opened a 'crypto-claims' exchange on April 2023, now announced a hasty shut down in 2 weeks. (Customers were advised to settle their positions by Feb. 7 at 08:00 UTC and withdraw their money by Feb. 14.) And they are migrating to another name OX.FUN , and the new business would be trading crypto derivatives. The only difference to the OPNX is that OPNX's main instrument is Claims + Perps, and the new OX.FUN is only trading derivatives.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()