New Waves of DeFi or Echoes of Last Bullish Market?

Uniswap proposes a major tokenomics shift, potentially tying $UNI to protocol earnings. Meanwhile, BTC ETFs see a surprising trend reversal with their first net outflow. In the stablecoin arena, Ethena Labs' USDe stirs debate: a true innovation or a mirror of LUNA/UST?

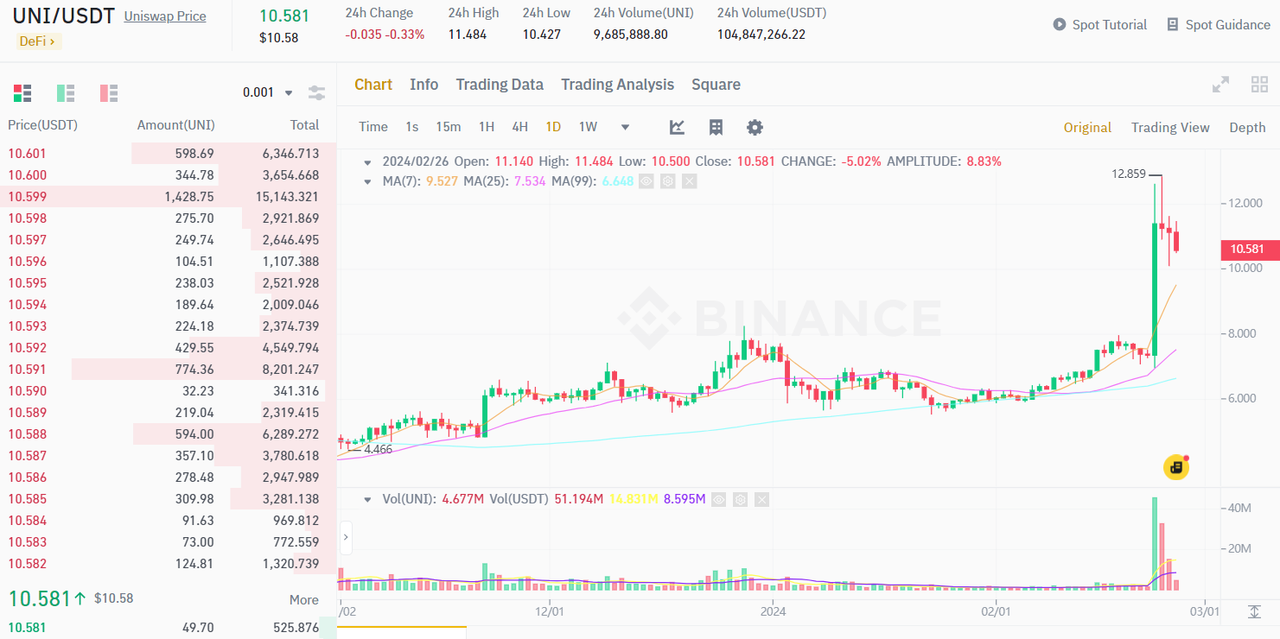

$UNI tokenomics proposal

$UNI (token of Uniswap) has been a pure governance token since its launch. In other words, holding UNI has nothing to do with Uniswap's protocol trading fees captured, and it's huge (~2 million USD per day).On Feb. 23, there's a community proposal by Erin Koen (governance lead of UNI foundation), which basically means staking UNI can share Uniswap protocol income.

Erin's proposal sounds almost like an early announcement (consider the proposal's level of detail, it has to be studied and decided already), but why was this not implemented before?

- Staking $UNI and sharing income might put $UNI into the definition of a security, and issuing security has to be regulated by SEC. Meanwhile Uniswap's owner and core members of Labs are based in the US, so they have to carefully obey US laws.

- The potential income shared to $UNI holder, must come from the trading fee captured from Uniswap procotol, and hence reduce the incentive of liquidity providers, and reduce the competitiveness of Uniswap protocol.

The vote shall end on March 1st. 'Biggest week in Uniswap Protocol Governance... ever?' - said Erin in his tweet.

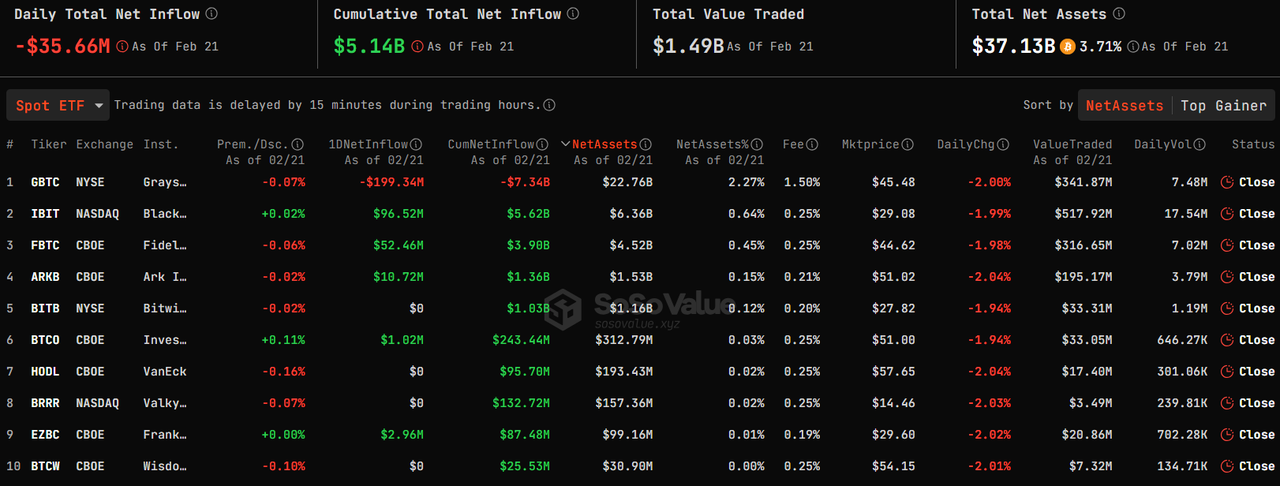

BTC ETF net outflow

Since Jan.25, there's 17 consecutive trading days that money inflows BTC ETF.Feb. 21 is the 1st day net outflow since then, with daily outflow $35.66 million.

Could be due to the GBTC liquidation from Genesis Trading.

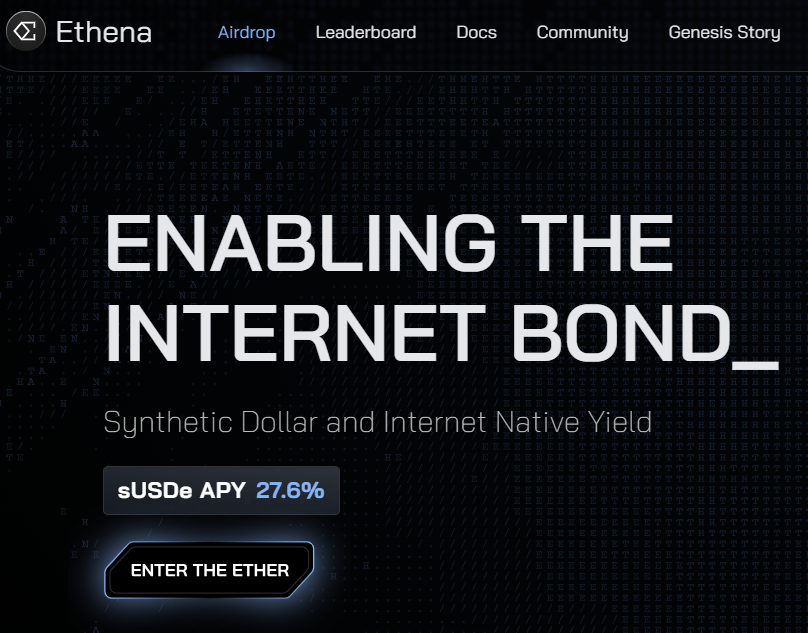

sUSDe does not seem to be another LUNA/UST

The newly launched Ethena Labs is offering a 27% yield on its stable coin USDe once staked. Official document says Ethena Labs manages the issuance and redemption of a delta-neutral synthetic dollar, USDe, crypto's first fully-backed, onchain, scalable, and censorship-resistant form of money.

Is this another LUNA/UST? I think it's not. This is not a new thing though (there was UXD protocol doing exactly the same thing, and Arthur Hayes' blog), where the risks are explained by themselves.

Mechanic Example:

- A user deposits ~$100 of stETH and receives ~100 USDe atomically in return less any execution costs to execute the hedge.

- Slippage & execution fees are included in the price when minting & redeeming. Ethena earns no profit from minting or redeeming USDe from users accessing the product.

- Ethena Labs opens a corresponding short perpetual position for the approximate same dollar value on a derivatives exchange.

- The assets received are transferred to an "Off Exchange Settlement" provider. Backing assets remain onchain and off-exchange servers to minimize counterparty risk.

- Ethena Labs delegates, but never transfers custody of, backing assets to derivatives exchanges to margin the short perpetual hedging positions.

It's a good thinking from Ethena Labs to democratize funding rate arbitrage (if 1bp per 8h, it'll be annualized ~10%) plus staked ETH's yield (annualized 3-4%), so USDe should not be another LUNA/UST ponzi. However, public understanding suggests that this strategy is unlikely to yield a 27.6% annualized return; a more realistic expectation, based on calculations, would be around 15% annually.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()