New Era of Regulatory Market, Binance $4 Billion Settlements and OKX License Progress

Blast by BLUR

Blast, an ETH L2 developed by BLUR, is known for its proactive airdrop. During the initial launch of its NFT marketplace, the airdrop attracted significant attention from Opensea users.

Furthermore, Blast is introducing a points system through which new users can earn rewards by staking ETH or stablecoins to its bridge. It's worth noting that the withdrawal feature from the bridge will be available after the Blast Mainnet launch in February. Market participants may speculate about potential future airdrop initiatives based on the points system.

Additionally, since BLUR has been very active on Upbit spot market, so just this week Binance announced listing of BLUR with zero listing fee.

Binance settled with US with 4 billion?

Initially, there were rumors that Binance attempted to settle with U.S. regulators with a $4 billion payment. This phase likely involved considerable market speculation and uncertainty.

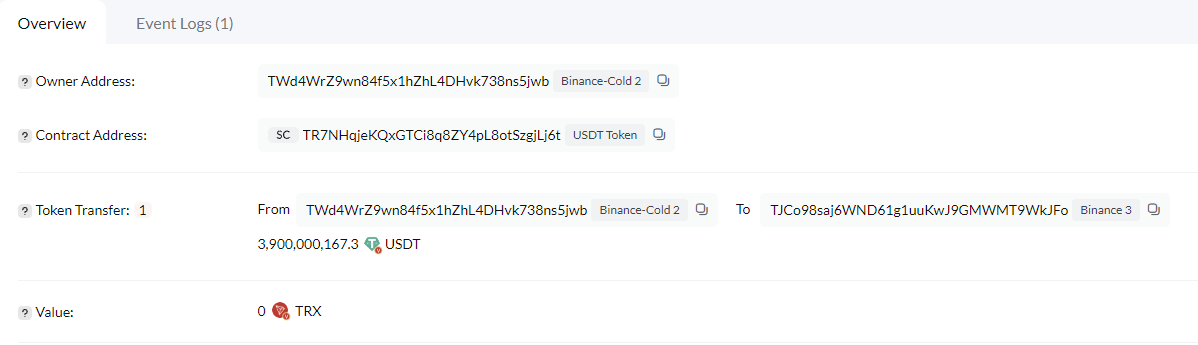

Observers noted significant transactions from Binance's hot wallets, which might have indicated movements related to the settlement or other financial adjustments by the company.

The confirmation of the $4.3 billion settlement with U.S. regulators came after these initial rumors and observations (Source: https://www.reuters.com/markets/us/us-authorities-set-unveil-settlement-with-binance-source-2023-11-21/). This news would have provided clarity to the market, reducing uncertainty.

The market reacted positively to the news of the settlement. Specifically, the value of Binance's native token, BNB, did not suffer, indicating that investors saw the settlement as a positive resolution or at least not a detriment to Binance's future prospects.

After this settlement, there's speculation about whether this is just the beginning of more regulatory actions. A key question is whether other countries will follow the U.S.'s lead in tightening regulations on cryptocurrency exchanges, especially regarding compliance with anti-money laundering and sanctions laws.

Coindesk bought by Bullish

Bullish, a company led by former New York Stock Exchange President Tom Farley, announced on Monday that it has acquired the crypto-focused media company CoinDesk.

The acquisition, completed through an all-cash deal, marks Bullish's ownership of 100% of CoinDesk. The financial details of the transaction were not disclosed. Notably, Digital Currency Group, the parent company of CoinDesk, acquired the media company in 2016 for $500,000.

Who's Bullish: https://coinmarketcap.com/academy/article/what-is-bullish-eoss-new-exchange

There is ongoing speculation about the future of CoinTelegraph, given recent changes in ownership for media entities such as CoinDesk and theBlock.

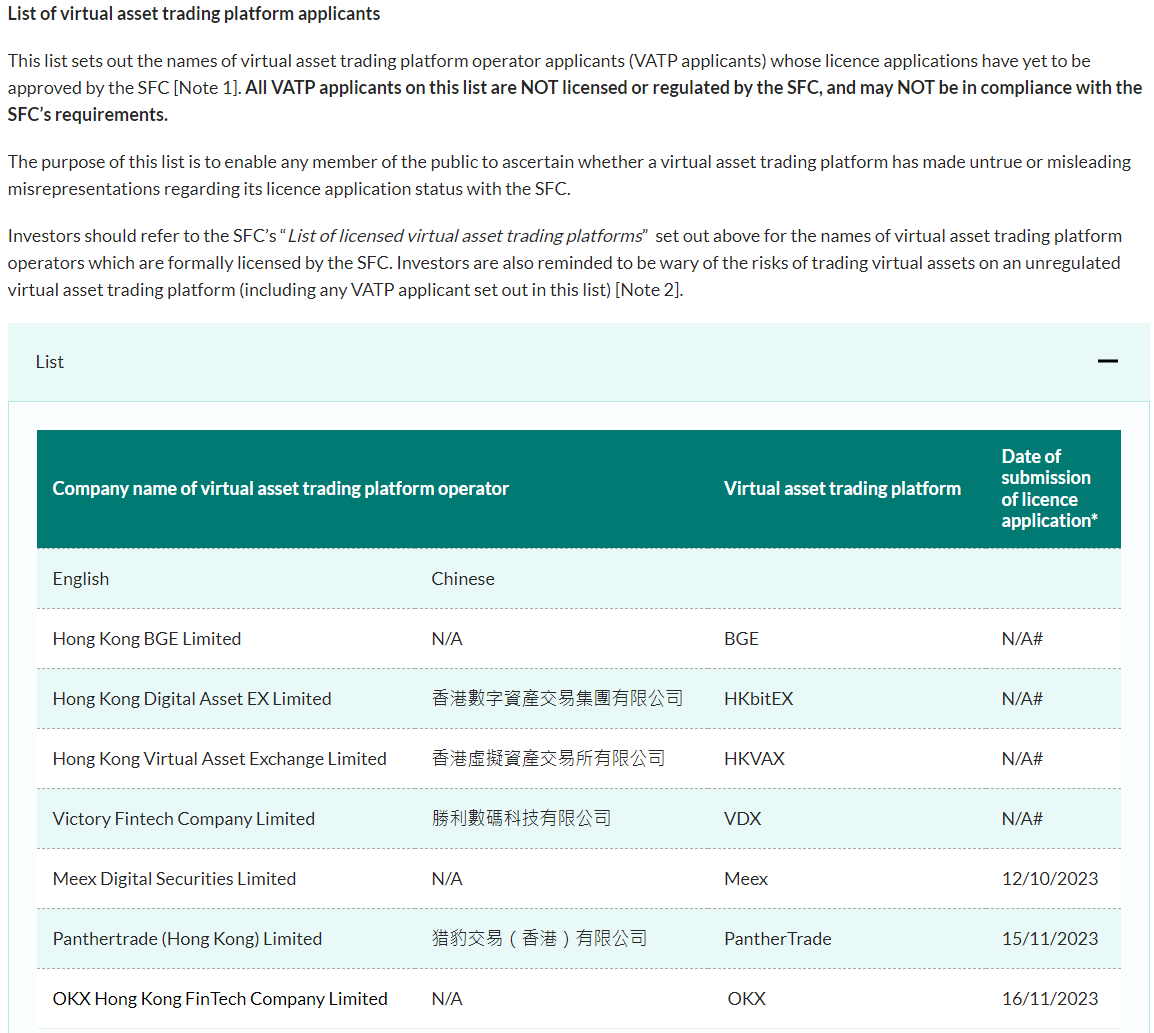

OKX officially appears as Hong Kong license applicants

OKX finally shows up on the list: https://www.sfc.hk/TC/Welcome-to-the-Fintech-Contact-Point/Virtual-assets/Virtual-asset-trading-platforms-operators/Lists-of-virtual-asset-trading-platforms

OKX has a strong operations hub in Hong Kong, and their Global Chief Commercial Officer Lennix Lai is a Hong Kong native. There is optimism that OKX could potentially attain the necessary license to operate HKD pairs in Hong Kong by 2024.

Insurance on digital asset custody

Hong Kong-based HashKey Exchange, a licensed virtual asset exchange, has announced a partnership with OneInfinity by OneDegree, a virtual insurance company. OneInfinity will provide comprehensive virtual asset insurance covering both cold wallets and hot wallets to HashKey Exchange.

It remains to be seen what the insurance cost will be. It is worth noting that in the past, Hidden Road Partners charged 4% annually for insuring their loans. This may have been feasible for their institutional clients, but it would likely be challenging for retail investors, even with a lower rate of 1% annually.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()