Microsoft Rejects Bitcoin Investment Proposal: Saylor's Effort Falls Short

OKX launched OKSOL on Dec 11, 2024, letting users stake SOL and receive OKSOL at a 1:1 ratio while maintaining liquidity. Microsoft shareholders rejected a Bitcoin investment proposal. Binance relaunched its Web3 Wallet with a $5M+ airdrop starting Dec 10, 2024.

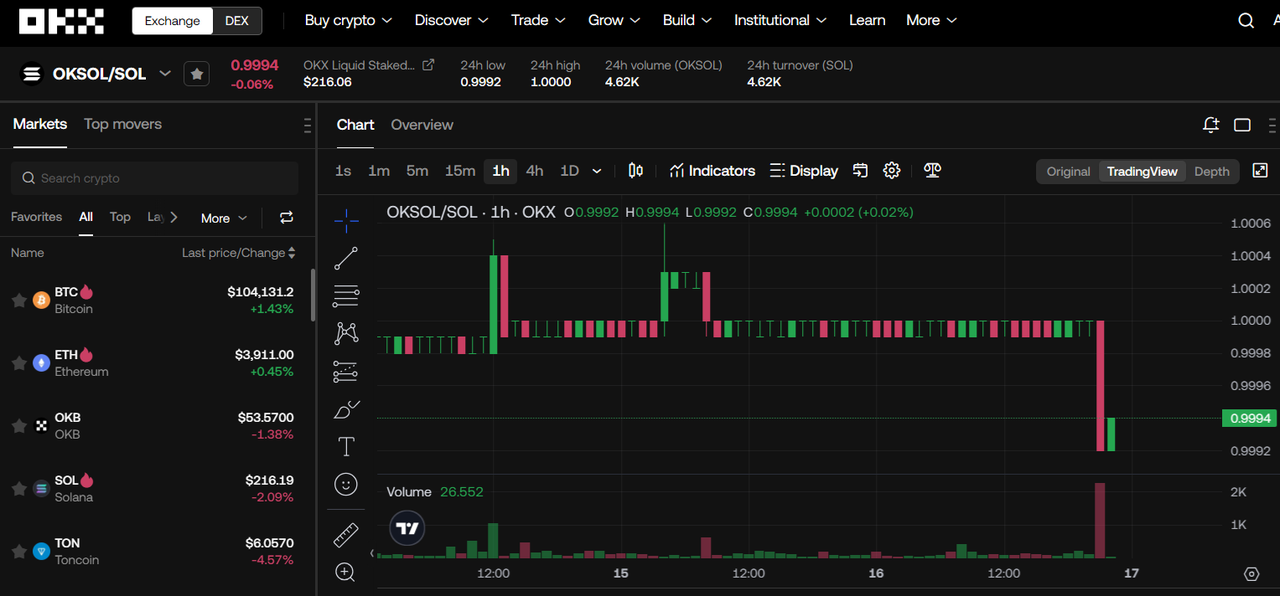

OKX follows staked SOL

OKX launched the SOL liquid staking token OKSOL on December 11, 2024.OKSOL is a Solana liquid staking token developed by OKX, representing the SOL staked by users on OKX. By staking SOL, you'll receive OKSOL at a 1:1 ratio. Holding OKSOL allows users to enjoy native staking and MEV rewards while maintaining liquidity. OKSOL can be used as collateral or for trading, while the original SOL remains staked. This provides a flexible solution for users who want to participate in staking without losing liquidity.Seems it's a similar model like OKX's BETH rather than Binance's WBETH, as the rate to SOL is constant at 1:1 rather than growing with staking yield.

Microsoft shareholders vote down Bitcoin treasury proposal

Microsoft shareholders have voted down a proposal to force the board to specifically evaluate investing some of the company's assets in bitcoin, even after a 3-minute presentation by Michael Saylor, executive chairman of Bitcoin Development Company MicroStrategy (MSTR).Microsoft told investors in a proxy filing before the vote, that "Microsoft's Global Treasury and Investment Services team evaluates a wide range of investable assets to fund Microsoft's ongoing operations, including assets expected to provide diversification and inflation protection".It 's said that volatility is the key factor for voting down. Corporate treasury applications "require stable and predictable investments to ensure liquidity and operational funding".The replay is at: www.virtualshareholdermeeting.com/MSFT24

Binance relaunching Web3 wallet

Binance is relaunching the Binance Wallet (formerly the Binance Web3 Wallet).To promote Binance wallet, Binance is launching a $5M+ airdrop carnival (starting Dec 10, 2024).

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

Comments ()