'Mayday' on dApps

Deribit fully supports USDT

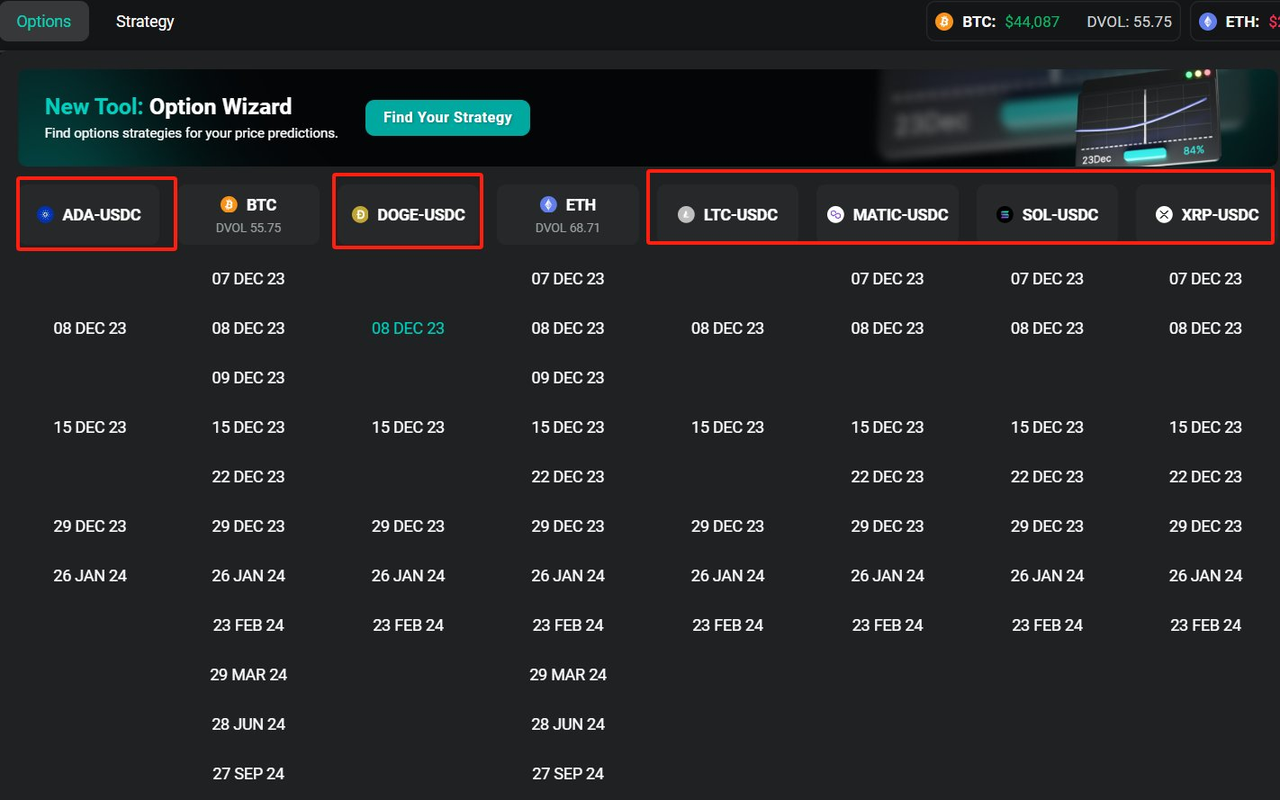

Deribit, a prominent institutional exchange, is broadening its offerings to accommodate both institutional and retail clients. Deribit initially started with non-stable and pure options, with a focus on coin-denominated BTC and ETH options. As part of its growth, the platform has gradually introduced support for USDC, launching USDC spot and perpetual contracts. Recognizing the importance of USDT, Deribit now fully supports USDT, allowing it as collateral and offering USDT spot and perpetual contracts. This marks a significant move towards welcoming more retail users to the platform.

Looking ahead, Deribit aims to further expand its offerings by launching USDC margined options for more altcoins, as demonstrated on its testnet.

Mayday on dApps

Sushiswap's CTO, Matthew Lilley, recently posted a warning on Twitter:

Do not interact with ANY dApps until further notice. It appears that a commonly used web3 connector has been compromised which allows for injection of malicious code affecting numerous dApps.

Lilley further explained:

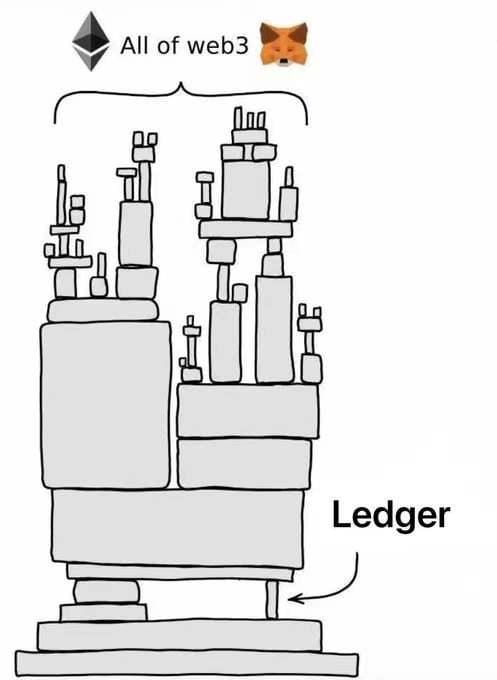

In short, Ledger made a chain of terrible blunders.

1. They are loading JS from a CDN.

2. They are not version locking loaded JS.

3. They had their CDN compromised.

Ledger library confirmed compromised and replaced with a drainer, potentially rectifying the situation. Users are suggested to wait and avoid using dApps until Ledger teams confirm that they have mitigated the attack.

Note:

- Holding funds in a Ledger cold wallet without using dApps involves no risk

- Writing code to directly interact with blockchain smart contracts, bypassing the UI, also carries no risk

- However, avoiding the Ledger connector does not guarantee safety, as it is integrated with many dApps

- It's important to note that 1Token's DeFi solution remains unaffected by this incident. All DeFi-related modules have been functioning normally since last week

S&P rating on stables

S&P Global Ratings announced the launch of its stablecoin stability assessment, which aims to evaluate a stablecoin's ability to maintain a stable value relative to a fiat currency.

The analytic approach considers 3 buckets:

- Asset quality risks (credit, market value, custody risks)

- Overcollateralization and liquidation mechanisms

- Five additional areas (governance, legal and regulatory framework, redeemability and liquidity, technology and third-party dependencies, and track record)

Results (Data source: CoinMarketCap, Dec.13, ranked by market cap)

Stablecoin | Issuer | Market Cap (bn$) | S&P rating | Meaning |

USDT | Tether | 90 | 4 | constrained |

USDC | Circle | 24 | 2 | strong |

DAI | MakerDAO | 5.3 | 4 | constrained |

TUSD | ArchBlock | 2.6 | 5 | weak |

FDUSD | First Digital | 1.1 | 4 | constrained |

FRAX | Frax Finance | 0.65 | 5 | weak |

USDP | PAX | 0.41 | 2 | strong |

GUSD | Gemini | 0.15 | 2 | strong |

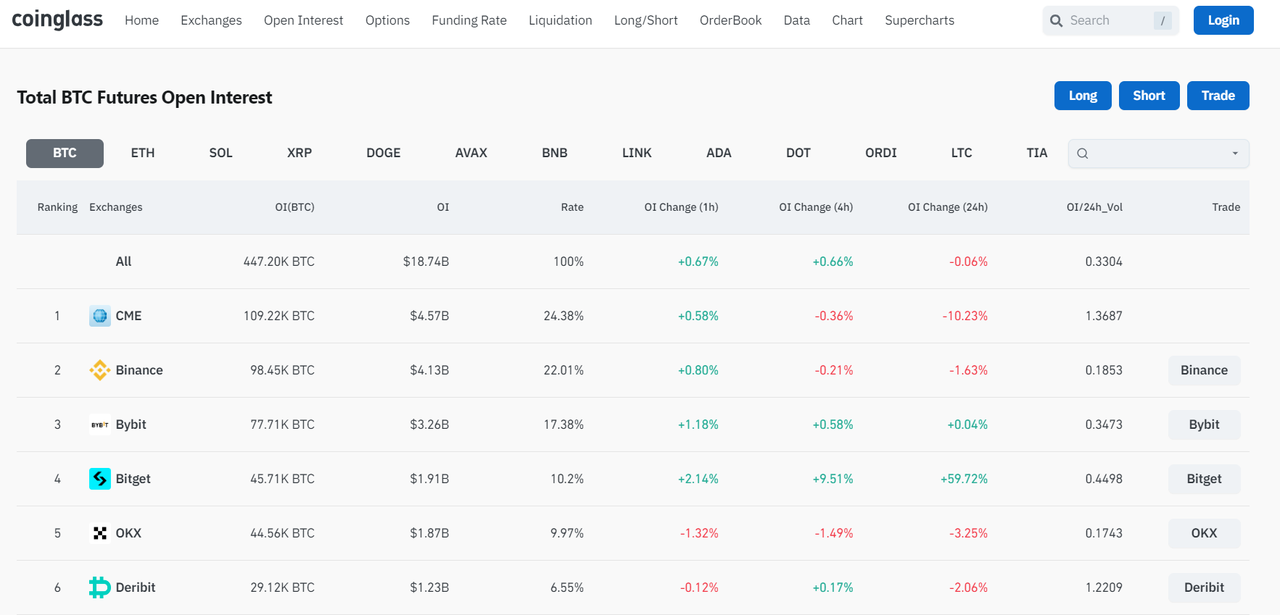

CME Bitcoin OI drops by 10%

CME Bitcoin open interest has experienced a reduction of 10%, which currently surpasses the open interest of a second-tier exchange.

According to Coinglass, CME still leads the BTC futures contract OI ranking, with ~109k BTC compared to Binance (~98k BTC), accounting for 24.4% of the market.

This reduction in open interest may be due to some CME futures traders are closing their positions before Christmas, with the potential intention of rolling their positions to January next year.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()