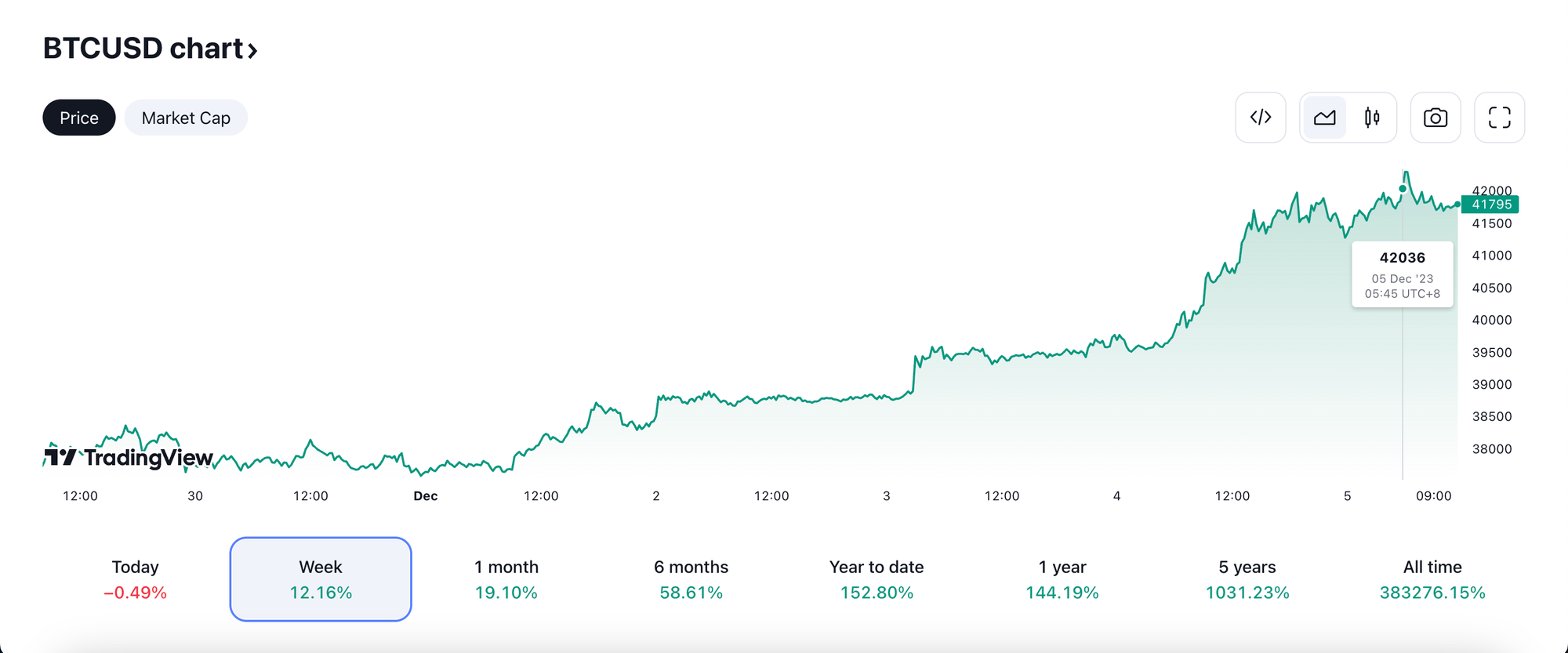

CME is very long, Bitcoin hits $42,000

BTC climbed above $42K

Bitcoin price hits $42,000 again, for the first time since April 2022.

Matrixport's forecast for Bitcoin's price suggests a potential rise to $63,140 by April 2024, followed by a projected increase to $125,000 by the end of the year.

It is worth noting that historically, strong performances by Bitcoin have been observed to positively impact altcoins.

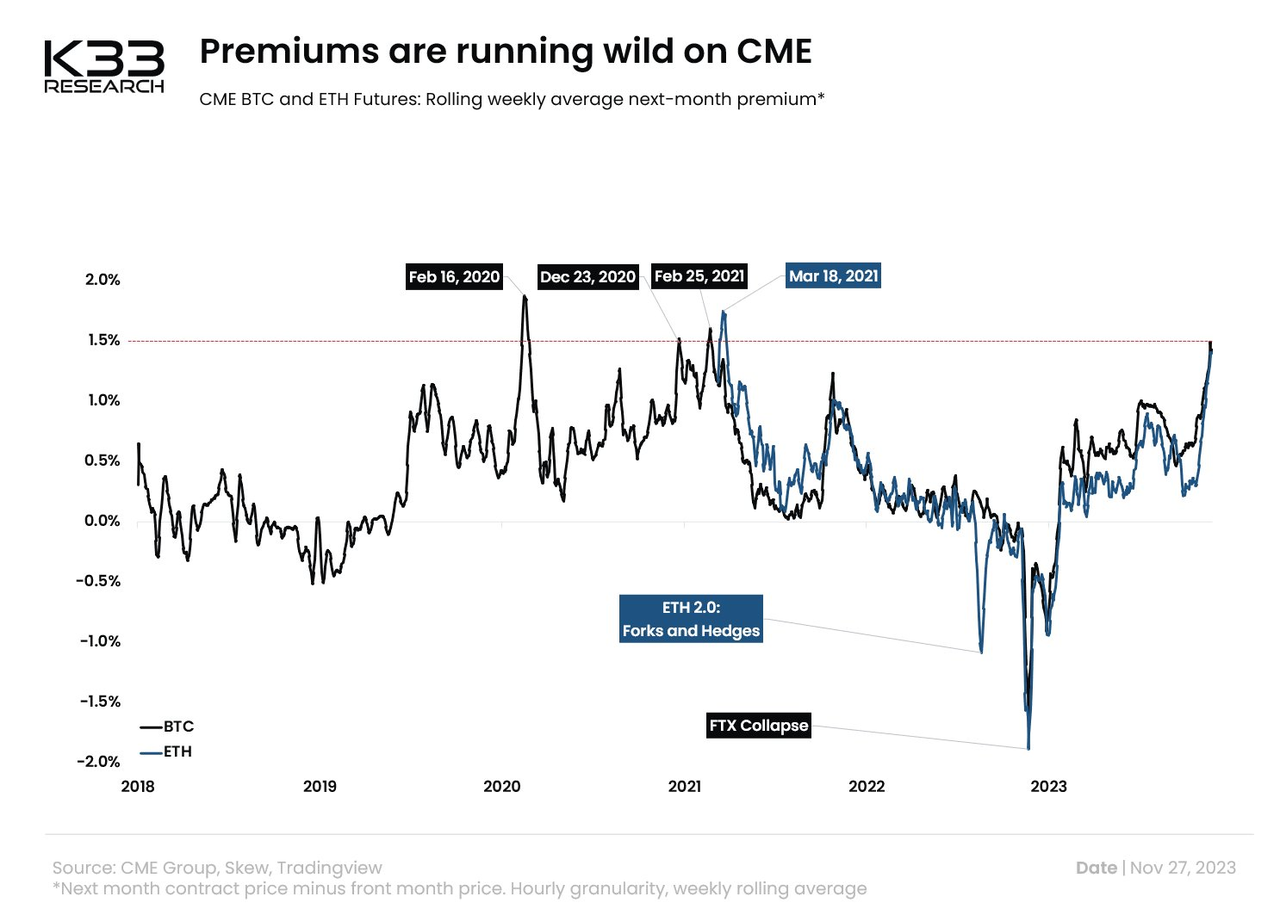

CME is very long

CME is very long. ATH OI, massive premiums.

BTCs next month contract has only traded on wider premiums vs. its front month contract on three occasions since its launch.

Feb 16, 2020. Dec 23, 2020. Feb 25, 2020.

ETHs next month premium has only been greater once, Mar 18, 2021.

– Research Tweet from K33 Research

Why CME data matters – since November 2023, its Bitcoin Futures have surpassed Binance in terms of the largest open interest.

What means to the market, future basis trading should come back. Future basis arbitrage between spot and dated futures was popular till 2021, then taken over by funding rate arbitrage between spot and perpetual swap, since it's much less traded than perpetual swap and thus less profitable. The current trend suggests that there is a potential for future basis arbitrage to regain popularity.

Open letter from new Binance CEO

My focus will be on:

1) reassuring users that they can remain confident in the financial strength, security and safety of the company

2) collaborating with regulators to uphold high standards globally that foster innovation while providing important consumer protections

3) working with partners to drive growth and adoption of Web3

– Binance’s new CEO Richard Teng

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()