Latest Market Digest

Covering CW9, CW10 and CW11

CW11

MGX Invests $2 Billion in Binance

In a record-setting move in the industry, the Abu Dhabi-based technology investor MGX has invested $2 billion in Binance, the world's largest cryptocurrency exchange. The deal was announced on March 12, 2025, representing the largest investment in a cryptocurrency company to date and the first institutional investment in Binance.

This means an umbrella to protect Binance now. Will any other government background investors follow? Rumors say that Trump’s family is in talks to buy a stake in Binance US, while CZ denied this in a recent X https://x.com/cz_binance/status/1900194883891322948.

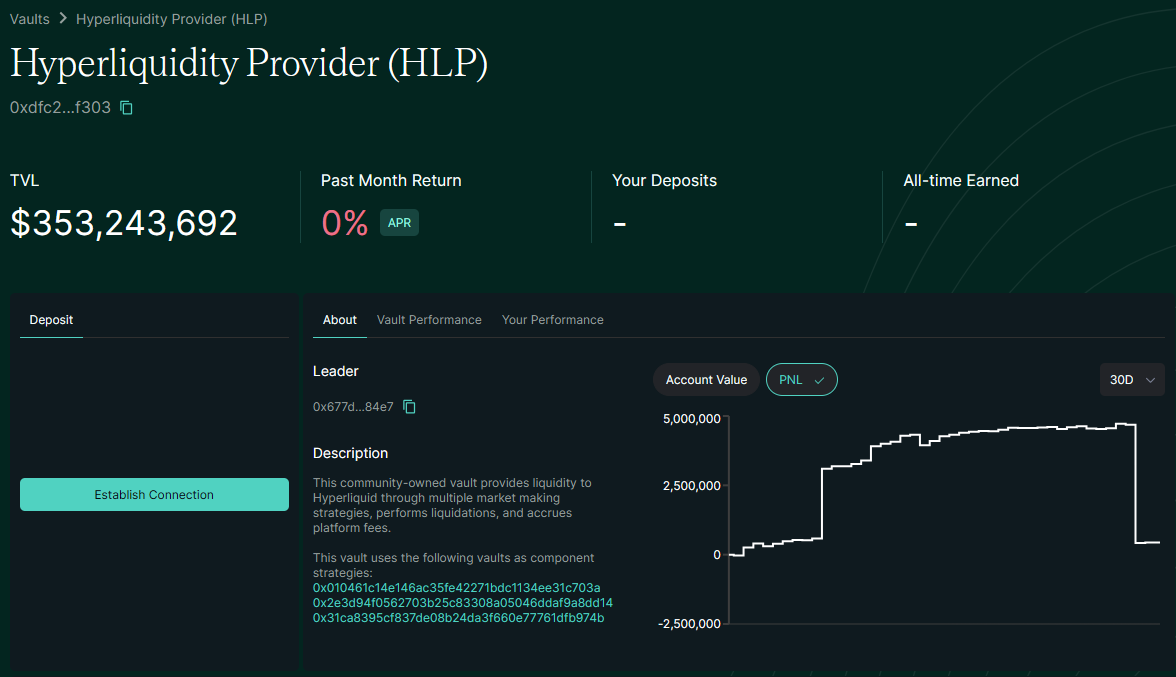

Hyperliquid HLP vault loss

A whale wallet on Hyperliquid opened a $200 million long trade on ETH (4.3 million USDC, 50x), withdrew unrealized profit and hence caused margin below maintenance requirements. led to a $1.8 million profit for the user but a $4 million loss for Hyperliquid's Hyperliquid Provider (HLP) vault.

Sounds terrible but it's just waiving this vault's 1 month profit. There should be more people trying to play with this rule, so the vault should be more profitable and more risky in the mean time.

Hyperliquid explained in the latest X, that it's not a protocol exploit or hack. And to discourage high risk traders, max leverage will be updated for BTC and ETH to 40x and 25x respectively to increase maintenance margin requirements for larger positions. From this perspective, they have to learn from those top CEX's risk protection, but once Hyperliquid implemented those, to what extent it's a DEX or CEX?

BUIDL reaches $1B

BlackRock's BUIDL token, issued with Securitize and backed by U.STreasuries, has surpassed $1 billion in assets, boosted by a $200 million allocation from crypto protocol Ethena.

Previously Ethena has launched its new stablecoin, USDtb, backed primarily by BlackRock’s BUIDL fund. The stablecoin will hold over 90% of its reserves in BUIDL, a tokenized money market fund that invests in U.S. government debt, cash, and repos, with the remaining reserves held in stablecoins and tokenized Treasury products.

USDtb will function similarly to traditional stablecoins like USDC and USDT, where every issued token is backed by reserve assets.USDtb is designed to reduce this risk by acting as a reserve asset for USDe during unfavorable market conditions, which is now...

CW10

Trump and Whitehouse crypto summit

President Trump has been busy in crypto. This week he did

- Nominated BTC, ETH, XRP, SOL and ADA as crypto strategic reserve

- Signed executive order for U.S. strategic bitcoin reserve

- Hosted Whitehouse crypto summit

Trump might secure a place in this weekly channel.

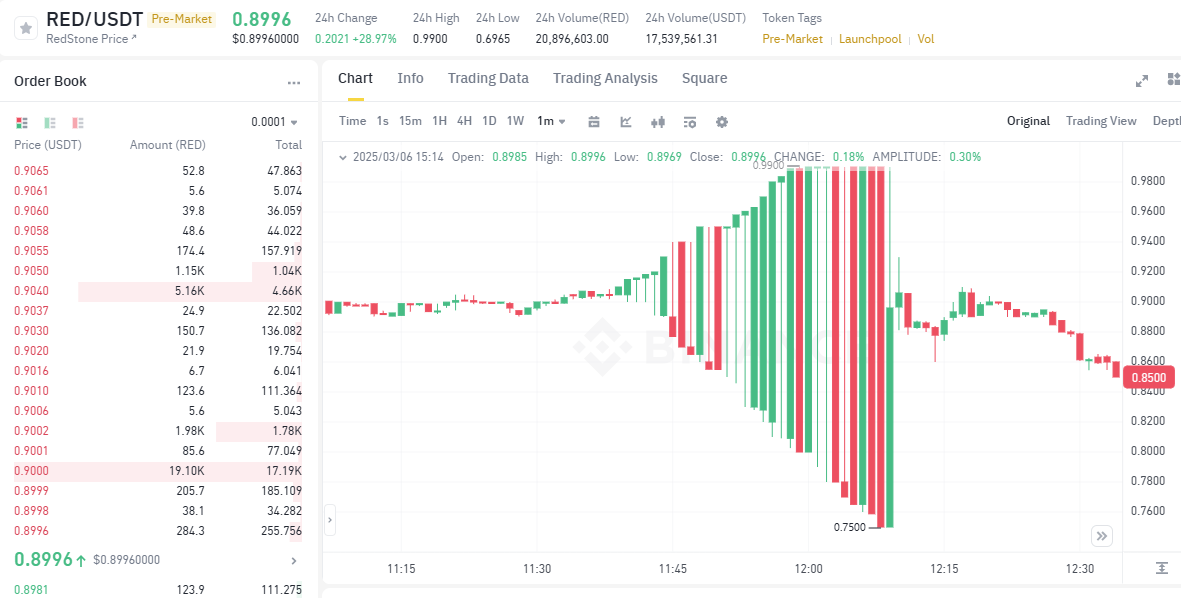

Binance suspended RED listing

The project team RedStone has been strange, one of them being market maker offline for a while causing weird candles.

Also the community protested that with even with several airdrop tasks done, most of the addresses not but 4,000 are finally eligible to airdrop.

Binance explains in the announcement, due to the RedStone (RED) project team changing the expected community airdrop amount ratio at the last minute, Binance has decided to suspend spot trading of RedStone (RED) until further notice. Binance later announced that it has offboarded and forbidden any further market making activities by the Market Maker on Binance. Rumors saying there are 2 market makers involved

Coinbase stock on chain

There are constantly new about getting Coinbase stock $COIN onchain to trade.

Now it comes https://x.com/BackedFi/status/1898024225257963665

Tokenized Coinabse $COIN stock on Basechain available now. Users can swap on Cowswap with liquidity on AerodromeFi. The $wbCOIN <> $USDC pair is live now. 1:1 backed, freely transferable, and a legal claim to the value of $COIN stock.

CW9

SEC dropping multiple lawsuits

This week, the new SEC under President Trump dropped lawsuits of

- Gemini

- Uniswap

- Coinbase

- Metamask / Concensys

Where only the Coinbase lawsuit dismissal is publicly announced by SEC, others are annouced by the companies themselves.

Meanwhile, not SEC but DOJ agreed to resolve OKX Seychelles (Aux Cayes FinTech Co. Ltd.) with a penalty of $84 million.

Citadel Securities plans market-making in crypto exchanges

Market-making giant Citadel Securities is reported by Bloomberg of looking into becoming a liquidity provider for major crypto exchanges, such as Binance, Coinbase and Crypto.com. Citadel initially plans to set up market-making teams outside the US.

It comes as US firms anticipate a market boom under the Trump administration. However, the extent to which Citadel becomes an active market maker will depend on how the regulatory environment shapes up in the US over the next few months.

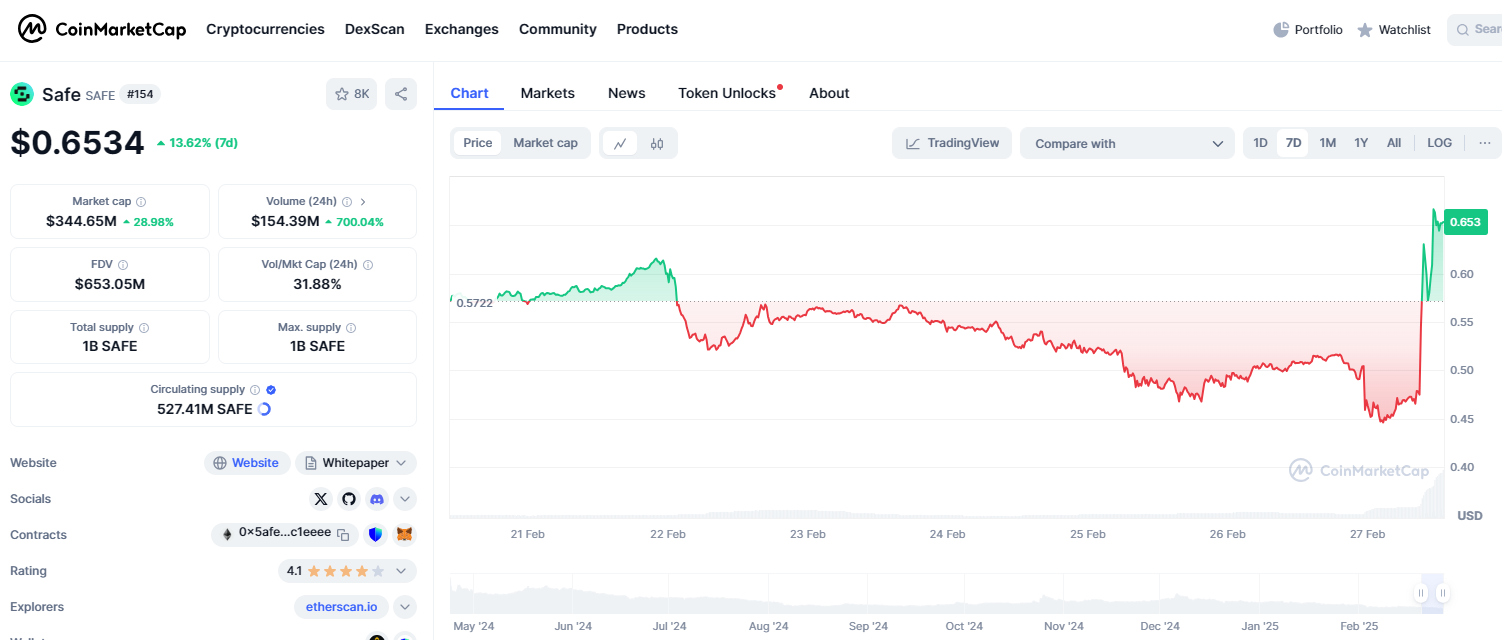

Bybit hack rootcause is SAFE{Wallet} UI

Bybit announcement: https://x.com/benbybit/status/1894768736084885929

Report link: https://docsend.com/view/s/rmdi832mpt8u93s7

SAFE announcement: https://x.com/safe/status/1894768522720350673

My take:

- Multisigs mechanism is still safe, UI can be hacked in this case and SAFE likely need to take ~50% of the loss (that costs the total FDV of SAFE token)

- Besides UI, there will always be more cases. In the decentralized world is absolutely safe, everybody has to keep their safety mechanism as safe as possible, so as not to become the next target of professional hackers

SAFE{Wallet} should expect to lose their largest clients, however SAFE token price surprisingly goes up after the hack

Meanwhile, Binance and OKX both announced that they are not using SAFE wallet.

1Token's Service

Serving 60+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()