Industry Trends in Flux: Bybit Hack, Tether Regulatory Void, and HK SFC Crypto Regulatory Roadmap

Bybit experienced a hack resulting in the loss of $1.46 billion in ETH and related tokens by Lazarus Group. Tether remains unaligned with the EU's MiCA framework. Hong Kong SFC has published the "ASPIRe" roadmap to enhance crypto asset regulation.

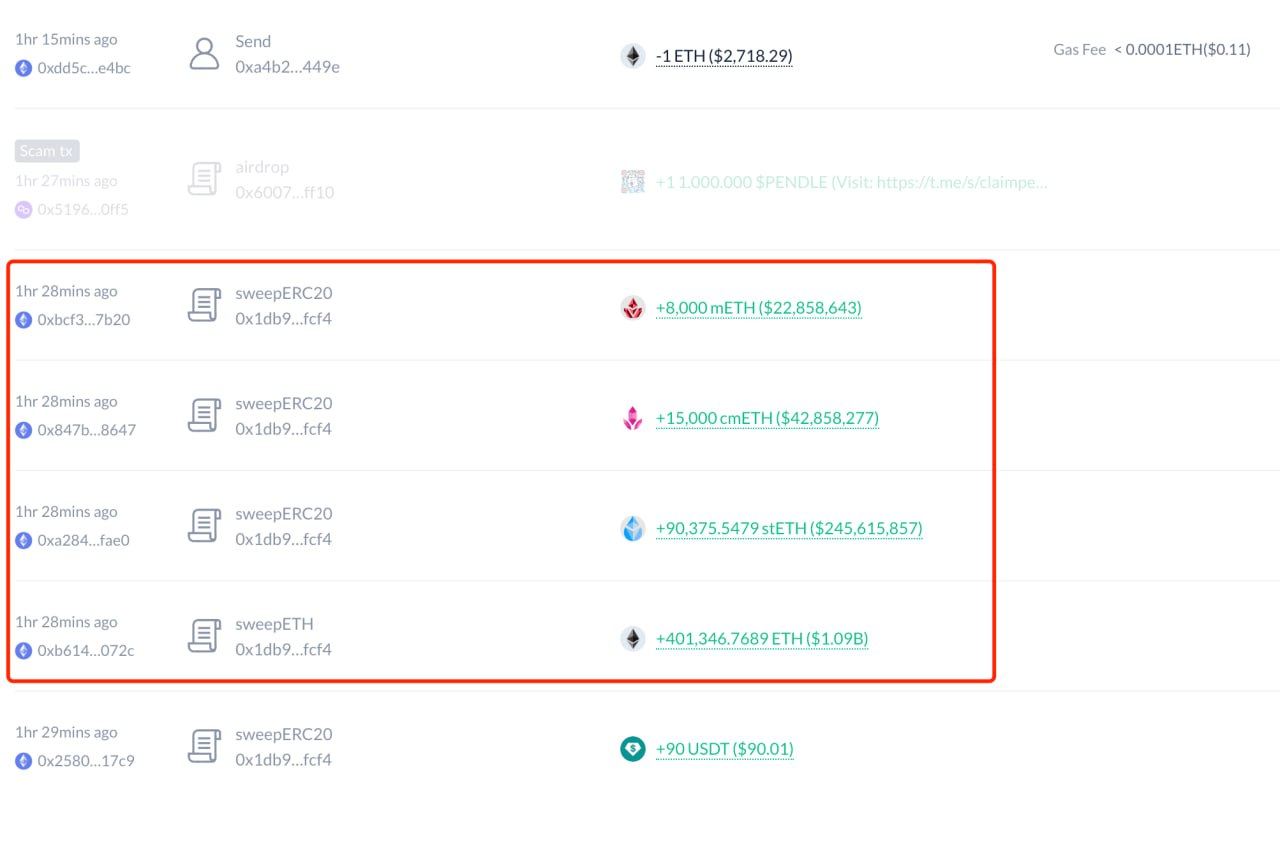

Bybit hacked $1.46bn worth ETH

According to @zachxbt, Bybit was hacked. $1.46 billion worth of $ETH, $stETH, $cmETH, and $mETH outflow from Bybit.

According to CoinMarketCap, #Bybit had $16.2B reserve assets before being hacked, and the stolen $1.4B assets accounted for 8.64%.

This attack on Bybit is identified to be performed by the LAZARUS GROUP of North Korea, making the Kim family 14th largest ETH holder (0.42% of supply), more than Fidelity, Vitalik, and 2x what the Ethereum Foundation holds.

Bybit CEO Ben Zhou and team committed full recovery of assets (estimation to 1 year's Bybit profit as of current ETH price), and other partners are lending ETH to cover the loss so that Bybit does not need to buy immediately from the market. The trading continues, and it does not look like another Mt.Gox or FTX.

Whether ETH chain will roll-back to deny this hack is still under discussion, but it seems unlikely.

Tether still not MiCA compliant

Ten firms are currently approved to issue stablecoins in the European Union under the supranational organization’s Markets in Crypto-Assets (MiCA) regulatory framework.

According to Patrick Hansen, senior director of EU strategy and policy at Circle, the list includes Banking Circle, stablecoin issuer Circle, crypto.com, Fiat Republic, Membrane Finance, Quantoz Payments, Schuman Financial, Societe Generale, StabIR and Stable Mint.

Hong Kong SFC crypto asset regulatory roadmap

Feb.19 2025, the Securities and Futures Commission of Hong Kong (“SFC”) published a comprehensive regulatory roadmap, titled "A-S-P-I-Re" (“ASPIRe Roadmap”), to address the evolving challenges in the virtual asset (“VA”) market in Hong Kong, such as fragmented regulatory approaches, uneven liquidity distribution, and more.

"A-S-P-I-Re" Roadmap for a Resilient Virtual Asset Ecosystem

Pillar A (Access) – Streamline market entry through regulatory clarity

Pillar S (Safeguards) – Optimising compliance burdens without compromising security

Pillar P (Products) – Expand product offerings and services based on investor categorisation

Pillar I (Infrastructure) – Modernise reporting, surveillance and cross-agency collaboration

Pillar Re (Relationships) – Empower investors and industry through education, engagement and transparency

1Token's Service

Serving 60+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()