Hong Kong Paves Way for Spot Bitcoin ETFs

Binance Will Launch USDC-Margined Perps

Binance Futures will launch the USDC-margined BTC, ETH, BNB, SOL, and XRP Perpetual Contracts starting from 2024-01-03 12:30 (UTC) with up to 125x leverage.

Despite the legal challenges faced in the US, Binance has chosen to proceed with these derivatives, alongside their Launchpad series, which may appear to some as a continuation of their active approach seen in 2021.

Hong Kong Bitcoin SPOT ETF

In 2022, the Hong Kong SFC approved the first Bitcoin ETF based on futures contracts, CSOP Bitcoin Futures ETF (Stock code: 3066) and CSOP Ether Futures ETF (Stock code: 3068).

This event has generated significant interest in the regulatory space. It is widely anticipated that the US SEC will make a decision by January 10th on the spot bitcoin ETF application submitted by Ark Investment Management and Swiss cryptocurrency asset manager 21Shares.

The Hong Kong SFC is also expected to take a similar approach. In a recent circular jointly issued by the securities regulator and the Hong Kong Monetary Authority, the city's de facto central bank, it has been reported that they are prepared to authorize funds with direct exposure to virtual assets, including spot virtual asset ETFs.

One of the notable contenders in this space is Pando Finance.

Trending Coins

The three hottest coins currently in the market are

- Bitcoin, with an upcoming ETF launch in a few weeks

- Solana, whose price has been consistently rising since October

- ORDI, which has gained significant popularity within the Chinese-speaking community but is not as well-known in the Western market

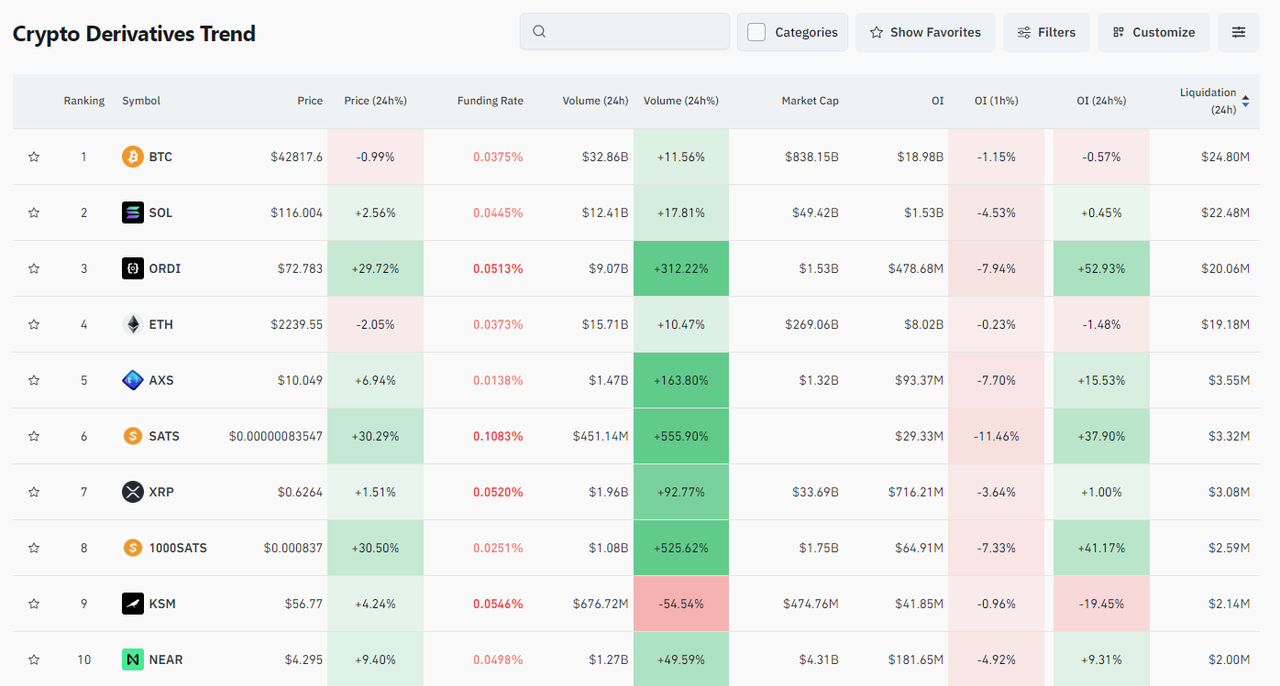

And how to quantify the popularity of these coins? Coinglass shows the derivatives trend, highlighting that the highest number of liquidations occur on BTC, SOL, and ORDI, with ETH following closely behind.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()