FTX finally begins repayments — $16B set to roll out, but at 2022 prices

LIBRA takes a nosedive, Binance realizing income, and FTX is finally paying out.

LIBRA rug

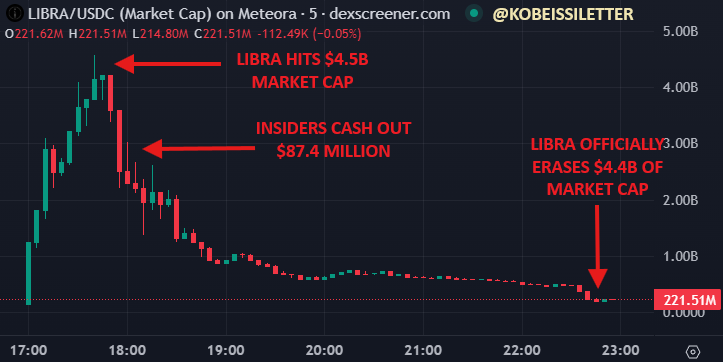

The launch of Libra (LIBRA), a cryptocurrency once endorsed by Argentine President Javier Milei (then Javier Milei distanced himself from the LIBRA meme coin after initially endorsing it in a now-deleted tweet.), turned into a financial catastrophe within hours.

The Libra token briefly rose to a peak market capitalization of $4.56 billion at 10:30 pm UTC on Feb. 14 before falling over 94% to the current $257 million market cap in just 11 hours since the token debuted for trading on decentralized exchanges. Meanwhile KIP Protocol, the LIBRA team has cashed out $107M! 8 wallets related to the $LIBRA team have obtained 57.6M $USDC and 249,671 $SOL($49.7M) by adding liquidity, removing liquidity and claiming fees.

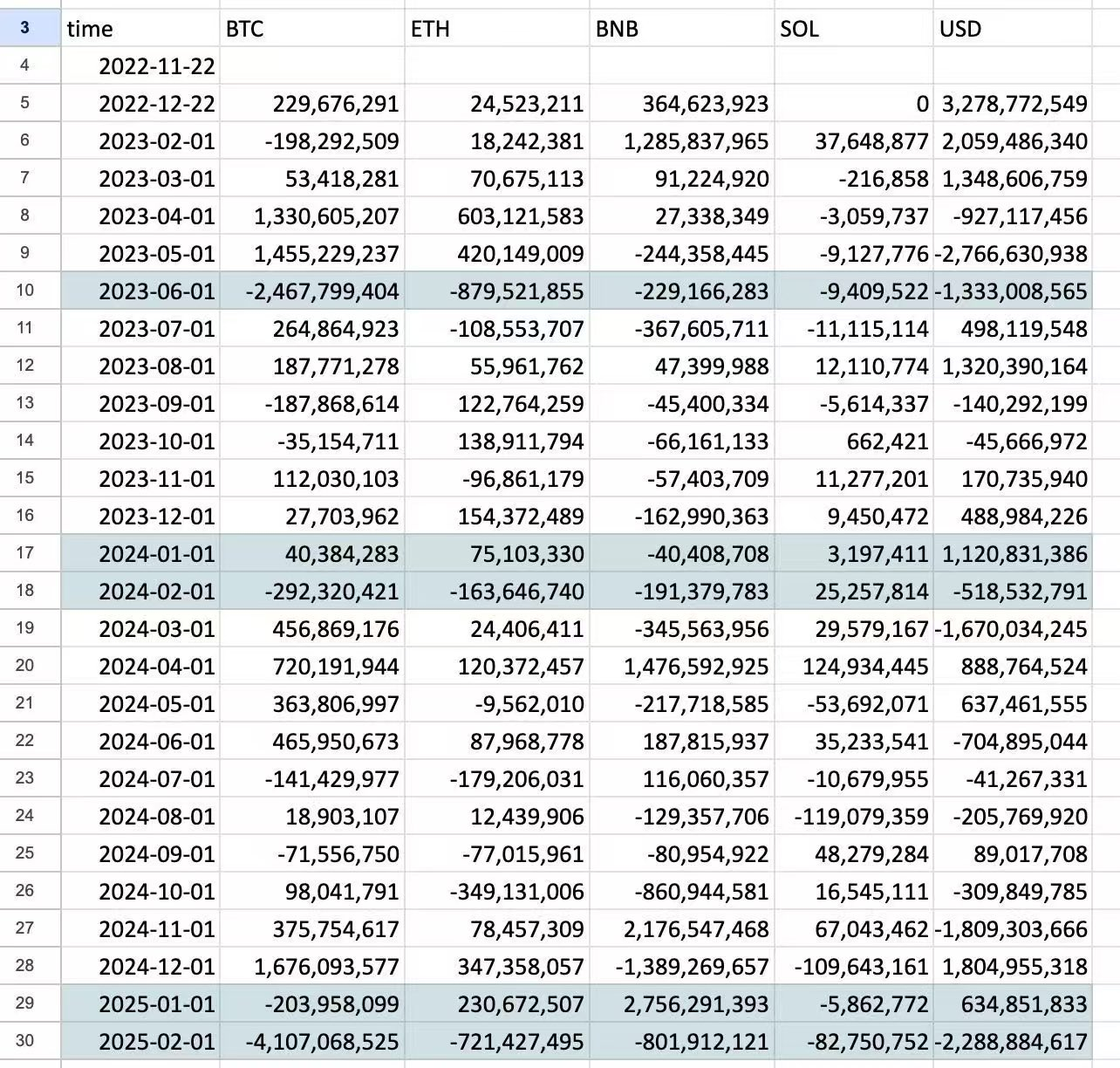

Binance realizing income

Analysis of Binance's reserve done by AB Kuai.Dong shows that Binance is realizing their income https://x.com/_FORAB/status/1889183557085716761

Similar selling happened in June 2023 and February 2024

FTX to start repayment

https://x.com/Cointelegraph/status/1889247573724000363

FTX to start $16B creditor repayments on Feb. 18, 2025, with $6.5-$7B in the first phase. Payouts based on Nov 2022 prices.

Some KOLs are disclosing below schedule:

Claims <$50k: 1st Distribution: 18 Feb 2025, 10pm ET

Claims >$50k: $17bn+ ~ Q2 25 likely: No date set yet

1Token's Service

Serving 60+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()