FIT 21 Act for Digital Asset Regulation

The House passes FIT 21 Act for digital asset regulation, MetaMask plans Bitcoin integration, and ETH spot ETF approval chances rise to 75%, indicating significant crypto advancements.

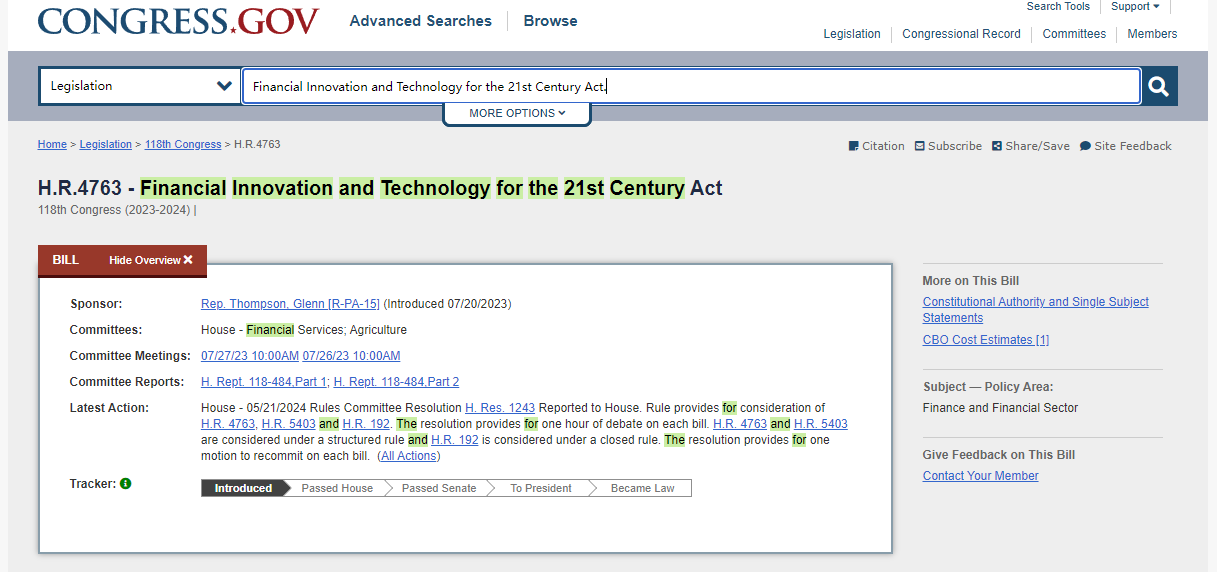

21st Century Act (FIT 21) pushing forward

The House passes the Financial Innovation and Technology for the 21st Century Act (FIT 21), marking years of incredible effort on both sides of the aisle to establish a comprehensive federal framework for digital assets.

Key target of FIT 21 is to establish a regulatory framework for the issuance and trading of digital assets by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). In other words, which coins should be classified as securities (hence regulated by SEC), and which coins should be classified as commodities (hence regulated by CFTC).

According to the bill, a blockchain qualifies as decentralized if its control is not unilateral, and meanwhile no issuer or affiliated entity should hold more than 20% of the asset or its voting power.

It's still not done deal till now. In order to become law, the Senate would have to pass the bill, and so far, the Senate Banking Committee has not indicated any plans to consider similar legislation.

Metamask coming to BTC chain

MetaMask's Ethereum wallet is the gateway for more than 30 million monthly active users into the Web3 world of decentralized applications and non-fungible tokens, or NFTs.

Now MetaMask is working to integrate native bitcoin (BTC), according to two people familiar with the matter. The exact timeline is unclear, but one person said access could arrive in MetaMask within the next month. Another person said the exact Bitcoin functionality is not yet set in stone, but features could initially be limited and expanded over time.

ETH spot ETF approval expected?

According to @EricBalchunas Senior ETF Analyst for Bloomberg, the chances of ETH spot ETF approval is now up from 25% to 75%, due to increasing political issue (Is Joe Biden seeking votes from the crypto industry?)

The deadline for VanEck's approval is the first one to come, which is May 23rd.

His colleague, James Seyffart tweeted that 5 of the potential ETH spot ETF issuers that have submitted their Amended 19b-4's in May 22. (Fidelity, VanEck, Invesco/Galaxy, Ark/21Shares, & Franklin all submitted via CBOE)

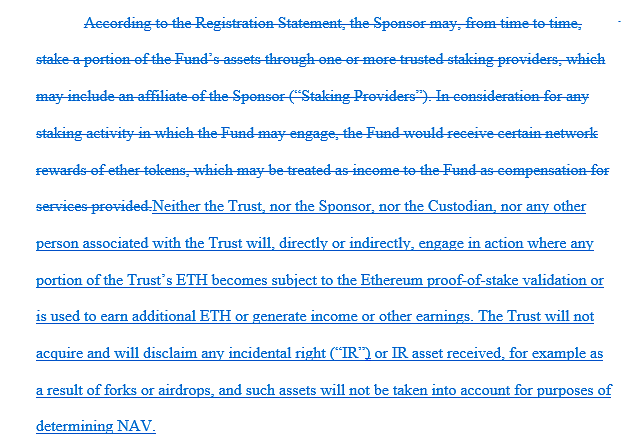

A common change of all issuers, is that the staking language has been removed, and very clear language that the Fund's ETH cannot be staked by anyone has been added.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()