Fannie & Freddie to Explore Crypto in Mortgage Risk Models

CW 26. The FHFA has directed Fannie Mae and Freddie Mac to evaluate crypto as a reserve asset in mortgage loan risk assessments. Coinbase will launch nano Bitcoin and Ether perpetual-style futures in the U.S. Circle’s stock hit a peak valuation exceeding USDC’s market cap.

Coinbase US perpetual futures

Coinbase is launching two perpetual contracts for trade date July 21:

- nano Bitcoin Perpetual-Style Futures (0.01 BTC)

- nano Ether Perpetual-Style Futures (0.10 ETH)

US Perpetual-Style Futures are designed as long-dated futures contracts (5 year expirations) with 24/7 trading hours with funding rate mechanism to keep futures prices closely aligned with spot markets, where funding accrues hourly and is settled twice daily during designated cash adjustment periods. Max. leverage allowed is not yet disclosed.

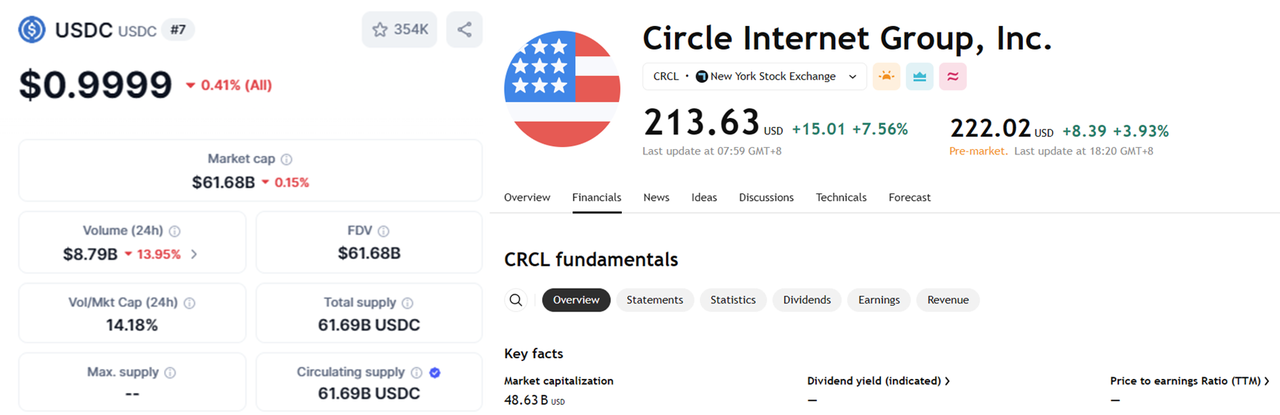

Circle FDV vs USDC FDV

The peak price of Circle stock this week reached $298.

The corresponding FDV of Circle stock is $65 billion, while USDC's total supply is under $62 billion.

https://finance.yahoo.com/quote/CRCL/

Fannie & Freddie ordered to consider crypto as mortgage asset

Federal Housing Finance Agency director William J. Pulte ordered the two government-sponsored enterprises to prepare to consider crypto for mortgage loan risk assessments.

Pulte told both of the government-sponsored enterprises (GSEs) in a letter on Wednesday to “prepare a proposal for consideration of cryptocurrency as an asset for reserves in their respective single-family mortgage loan risk assessments, without conversion of said cryptocurrency to U.S. dollars.”

Which cryptocurrencies will be allowed is not yet determined.

1Token's Service

Serving 60+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()