ETH storm is on the way?

Blast Mainnet's launch faces user backlash over high fees, Nigeria disrupts Binance with executive detentions, and Ethereum's ascent indicates potential market volatility.

Blast mainnet launch and dispute

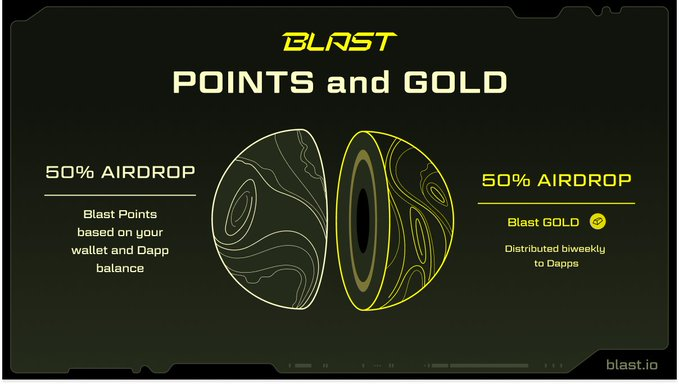

Blast announced Mainnet launch and its further awarding program, planning to share 50% of the airdrop to users via Blast Points and the other half via Blast Gold (Dapps). The Blast Gold airdrop will be distributed to Dapps on a biweekly basis.

It looks beautiful to users, there's yield from Blast Points and Blast Gold, besides the protocols' native yield and potential protocol airdrop, but the concern is the high bridging cost to mainnet, and the previous airdrop yield being diluted due to new Dapps incentive.From the discussions on X, airdrop hunters expessed strong disagreement with Blast's approach, because the bridging cost will ruin the yield of small farmers. Merlin seems to be their next target.

Nigeria halting Binance

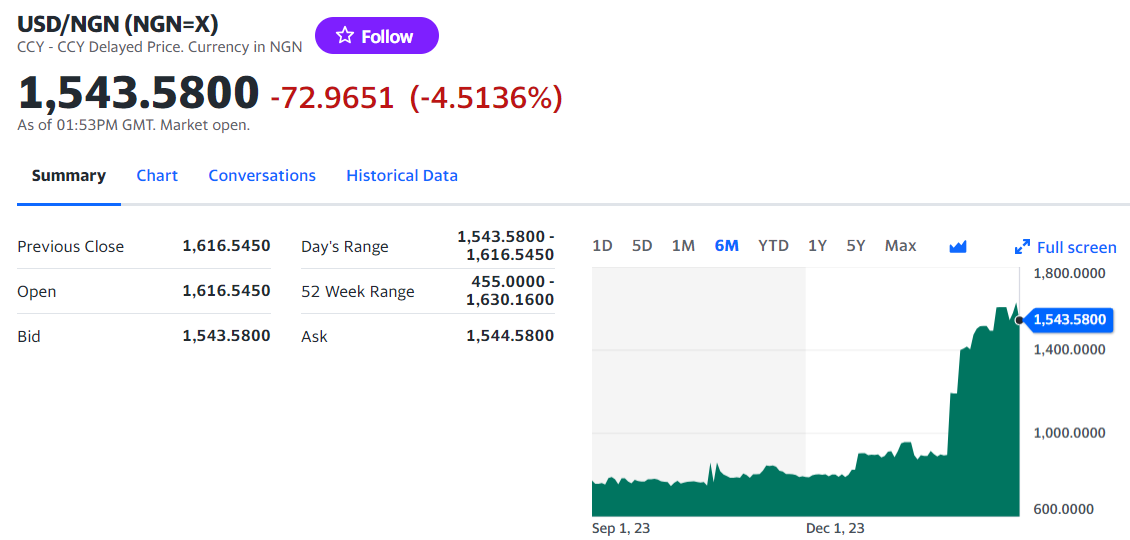

Nigerian national currency Naira (NGN) has devalued significantly against USD since beginning of the year 2024.

Central bank Governor Olayemi Cardoso claimed that crypto platforms facilitates illicit flows, and Binance Nigeria in the last year alone moved $26 billion dollars worth of untraceable funds.Nigerian authorities have taken action to crypto trading platforms, blocked Binance and other crypto trading platform like Coinbase, Kraken... to halt what it described as continuous manipulation of the forex market and illicit movement of funds.

Two senior executives at Binance flew to Nigeria following the country’s decision to ban several cryptocurrency trading websites, and detained in Nigeria by the office of the country’s national security adviser and their passports seized, according to FT's source. The Nigerian government has reportedly demanded a minimum of $10 billion from Binance.

Binance has removed NGN from it's peer-to-peer on/off ramp zone, not sure how long can Binance still keep BTC/NGN and USDT/NGN pairs on the exchange order book.

ETH storm is on the way?

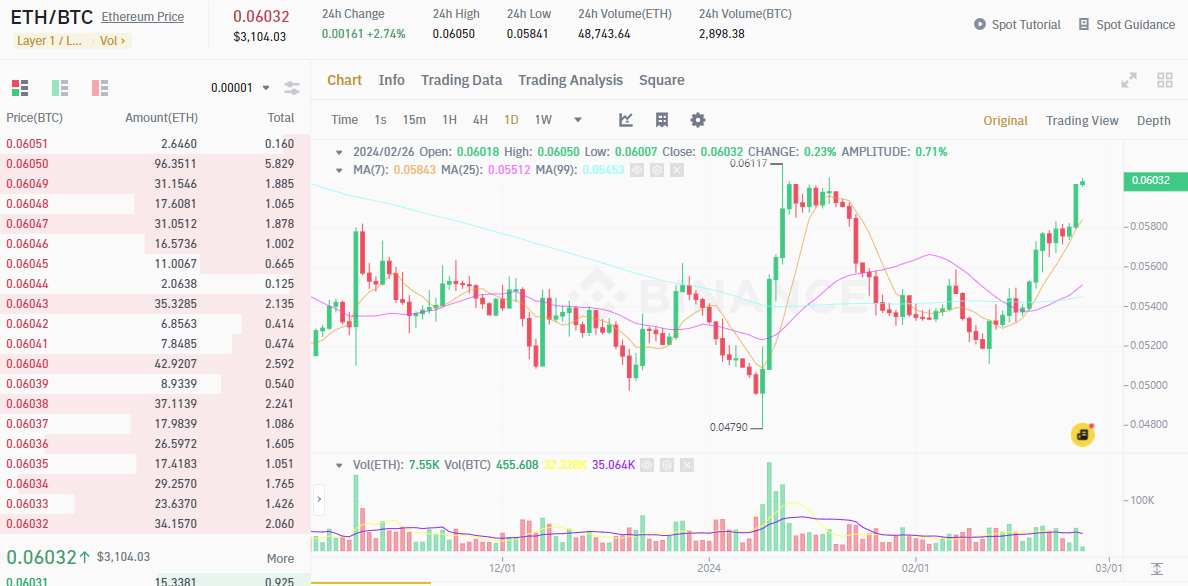

ETH has been stronger than BTC since Feb., apparently from ETH/BTC price it's over 0.06 again.

Other things worth attention

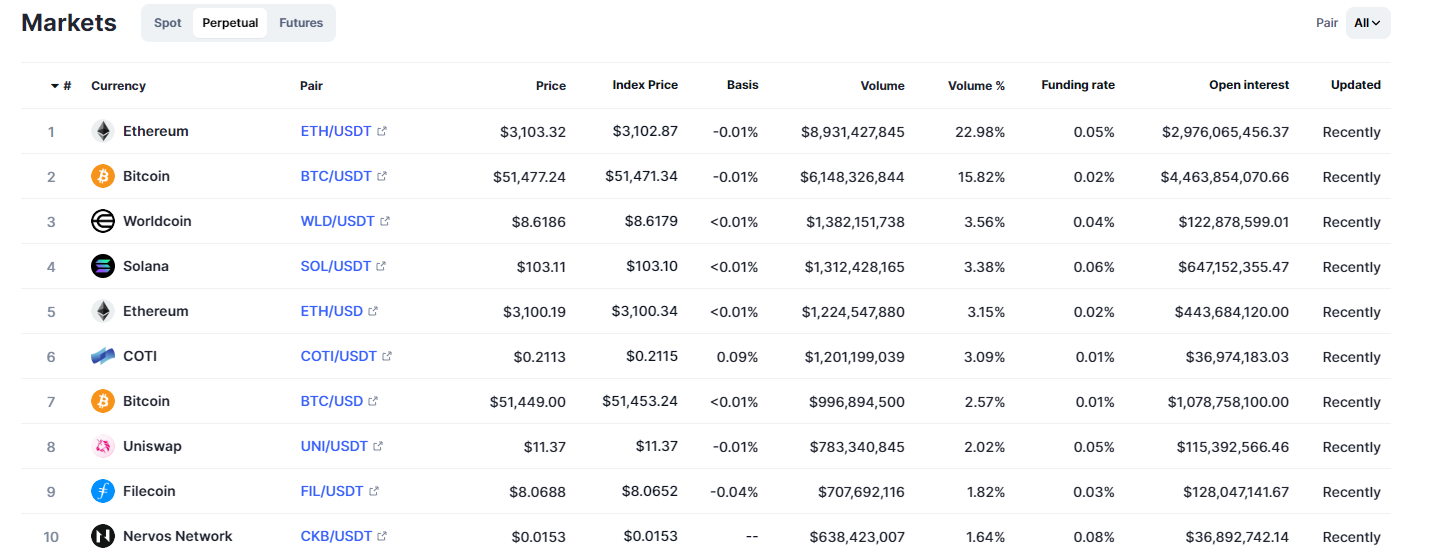

- On Binance, both ETH/USDT perp and ETH/USD perp are trading at higher volume of BTC

- ETH volatility index is increasing to a high level.

- EigenLayer, Blast, Merlin... Those recent Layer 2 and restaking protocols locked over 10 billion USD of ETH.

There should be a big price fluctuation coming, either rises sharply or falls sharply. I tend to be bullish considering the consistent capital inflow into the crypto market.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()