ETH Spot ETFs See $1.11B Inflow on Launch

BlockFi’s plan for full customer refunds is approved. ETH Spot ETFs launched with high trading volume. dYdX is negotiating a sale of its v3 software.

BlockFi approved for full refund

The US Bankruptcy Court for the District of New Jersey approved the company’s plan on Thursday, allowing BlockFi to repay 100% of customers’ funds. The crypto lender sought court approval to monetize $874.5 million in claims against FTX at a massive premium to their face value. The court’s approval means customers can now expect a full refund of their assets.BlockFi indicated that the final distribution of assets to its U.S. customers could begin within 90 days. However, international clients might have a longer wait due to regulatory challenges. One thing not answered yet, is that in the beginning BlockFi announced to repay in-kind, but with such price increase in the past 12 months, will BlockFi still be able to repay in-kind?

ETH Spot ETFs start trading

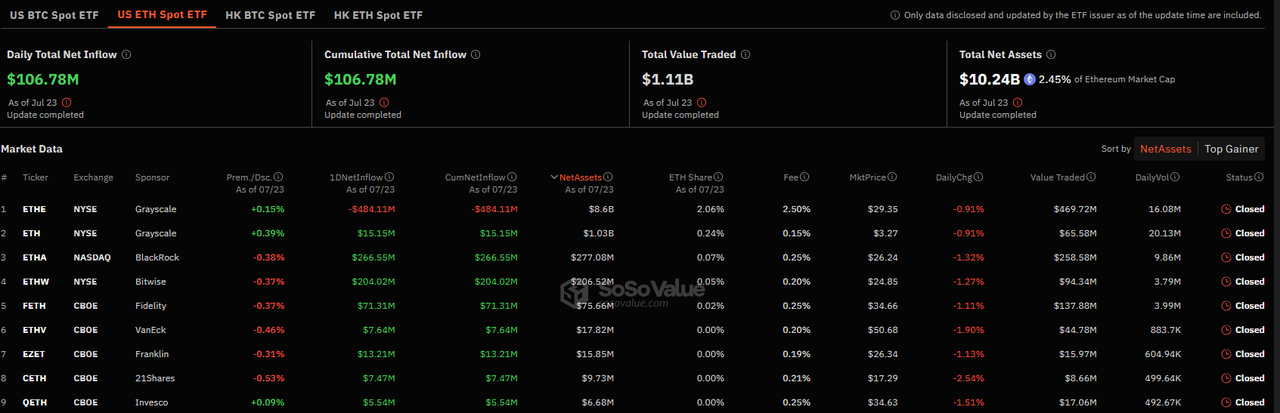

1st day data - $1.11 billion volume, while net inflow is $106 million. So 90% of the volume is by day traders or arbitrage traders?

dYdX v3 exchange on sale

According to Bloomberg, dYdX Trading Inc., the developer of the namesake decentralized finance exchange, is in talks to sell some of its (v3) derivatives trading software for an undisclosed amount to a consortium that includes some of the biggest market makers in crypto. Wintermute Trading Ltd. and Selini Capital are among the potential buyers of the dYdX v3 software, said two of the people, who asked for anonymity because the talks haven’t been made public. Now dYdX is running v3 (ce-de-centralized) and v4 (fully decentralized) exchange in parallel.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()