ETH spot ETF underperforms and firms try to spur inflows

ETH Spot ETF struggles and TONCOIN finally lists on Binance. Meanwhile, 47 crypto firms apply for licenses under Turkey's new regulations.

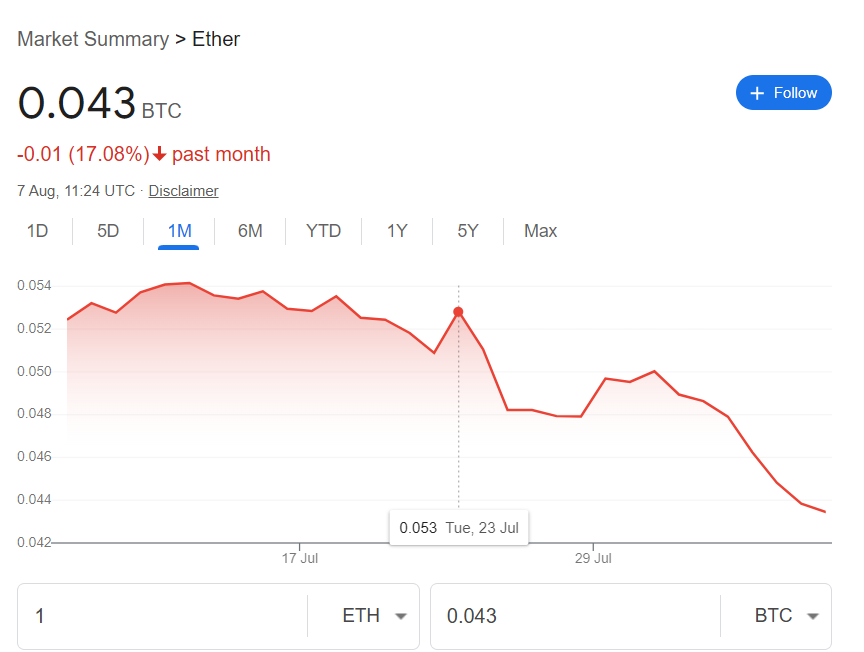

ETH spot ETF doing negative price impact

You might blame the recent market drop on the overall market (even the US equity market dropped by over 10%)But ETH is clearly weaker than BTC, due to the outflow of Grayscale ETH is much stronger than the inflows of its fellows (data seen from https://sosovalue.com/assets/etf/us-eth-spot )

Meanwhile, Grayscale, Bitwise and NYSE American ask for rule change to allow options on spot Ethereum ETFs. The Exchange believes that offering options on Ether ETPs, including the Bitwise Ethereum ETF, the Grayscale Ethereum Trust (ETH), and the Grayscale Ethereum Trust Mini, will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.

TONCOIN finally listed on Binance spot

TONCOIN (TON), the token of the chat tool Telegram, has been on CMC top 10 coin for several months, while the spot is only on OKX.

A few months ago, Binance listed TONUSDT perpetual swap, now finally listed the spot https://www.binance.com/en/support/announcement/binance-will-list-toncoin-ton-with-seed-tag-applied-abba626aa0974b828f91c166bdc12afd. I assume there was ongoing negotiation on listing fees, and now the agreement must be settled.

Also, there are numerous gamefi developers now working on Telegram ecosystem, which might bring additional attention to this coin, though already priced-in.

Turkey crypto license applicants

Turkey has been a very active retail market for crypto trading platforms. With the implementation of the “Law on Amendments to the Capital Markets Law,” which came into effect on July 2 aiming to provide a regulatory framework for crypto asset service providers in Turkey, 47 cryptocurrency companies have applied for licenses under new regulations announced by Turkish Capital Markets Board (CMB).

According to the CMB, this influx includes well-known exchanges such as Bitfinex, Binance TR and OKX TR. However, notable exchanges like Coinbase, Bybit, KuCoin, MEXC and Gate.io have not yet applied for licenses.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()