ETH liquidity falls 20 percent after spot ETF launch

ETH liquidity has decreased by 20% on centralized exchanges since the spot ETF launch. Polygon migrates MATIC to POL, and major exchanges enter Solana liquid staking.

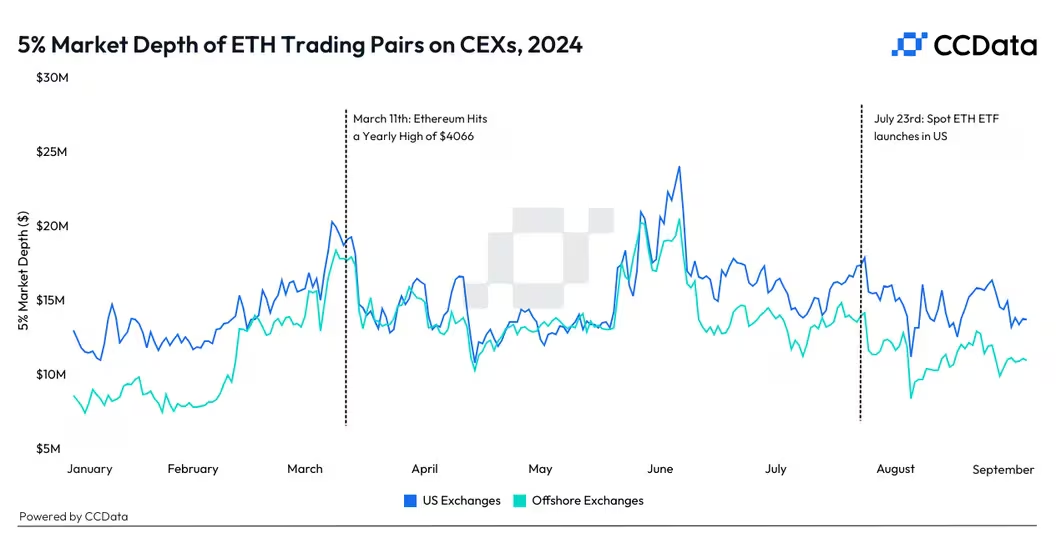

ETH market liquidity dropped by 20% since spot ETF launch

According to research from CCData (published on Coindesk), Since the ETFs' introduction, the average 5% market depth for ETH pairs on U.S.-based centralized exchanges has declined by 20% to roughly $14 million. On offshore centralized venues, it's dropped by 19% to around $10 million. In other words, it's actually now easier to move the spot price by 5% in either direction, a sign of reduced liquidity and increased sensitivity to large orders.

"Although the market liquidity for ETH pairs on centralized exchanges remains greater than what was at the beginning of the year, the liquidity has dropped by nearly 45% since its peak in June," Jacob Joseph, a research analyst at CCData, told CoinDesk in an interview. "This is likely due to the poor market conditions and the seasonality effects in the summer, often accompanied by lower trading activity."The measure refers to the amount of buy and sell orders within 5% of the mid-market price for an asset. Greater depth indicates strong liquidity and lower slippage costs. CCData considered the 5% market depth for all ETH pairs on 30 centralized exchanges.

Polygon migrating MATIC to POL

On September 4, the Ethereum scaling network Polygon will complete a migration from its longstanding MATIC token to POL (1:1), as part of the Polygon 2.0 roadmap.Why migration - The POL migration is to set the groundwork for Polygon 2.0, the roadmap for Polygon’s evolution into a zero-knowledge Ethereum Virtual Machine (zkEVM) system, complete with its own network of interoperable application-specific blockchains. In subsequent updates, POL will be employed to secure other blockchains within Polygon’s broader “aggregated” network, aka the “AggLayer,” which is a core component of Polygon 2.0.What to do with MATIC - MATIC holders on the Polygon proof-of-stake chain do not need to do anything ahead of the POL migration, according to Polygon. Their tokens will be converted automatically to POL. Meanwhile, MATIC holders on the Ethereum network may migrate their tokens to POL via the Polygon Portal Interface.

Binance, Bybit and Bitget entering Solana staking

According to Bybit, Bybit has launched bbSOL, the world's first exchange-backed liquid staking token (LST) for Solana. This innovative product allows users to earn staking rewards while retaining liquidity, opening new avenues in decentralized finance (DeFi).According to theBlock, Binance will unveil a Solana staking product by the end of the month, which will allow users to continue using their collateral while earning staking rewards.Similarly Bitget tweeted about BGSOL.For all exchange liquid staking SOL, the idea is to enable users to stake SOL tokens via the exchange (the real SOL is still on exchange's balance sheet), to earn a portion of fees paid out by the network and mint a liquid staking token that can be used while those underlying tokens are locked up.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()