ETF Approval: Impact of Overconfidence on Market Dynamics

Delisting privacy coins

Just days after crypto exchange OKX announced the delisting of top privacy coins Monero (XMR), Zcash (ZEC) and Horizen (ZEN), Binance has added these coins to a list of tokens at risk of being delisted.

What are privacy coins?

Privacy coins are cryptocurrencies with privacy-enhancing features designed to boost anonymity and reduce traceability. Privacy coins employ different methods to conceal the identities and transaction histories of their users. However, nothing is completely anonymous, thus investigators with advanced tracing capabilities can follow the movement of privacy coins.

Why do they get delisted?

Hypothetically this might be against AML/CFT obligations. Privacy coins' transactions are technically more resistant to being tracked than normal blockchain-based cryptocurrencies, so exchanges delist these untraceable coins in order to avoid regulatory complications.

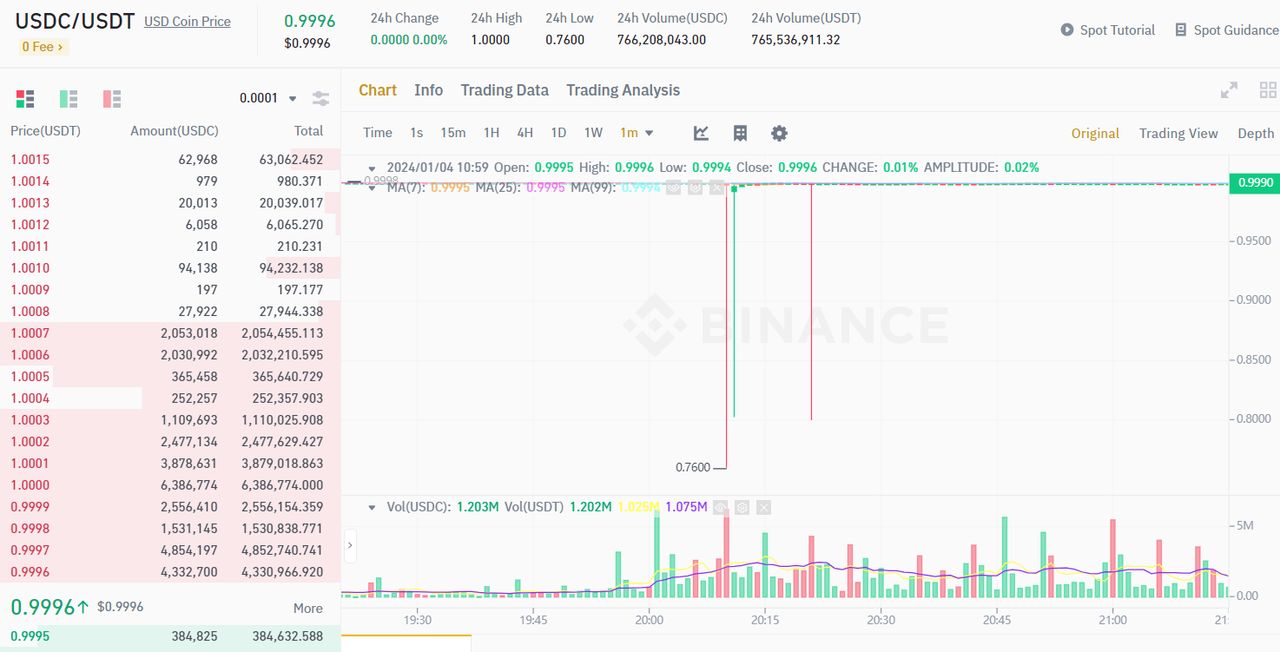

USDC dropped in the BTC dump?

From 1-minute chart, there are 3 big USDC dumps to 0.76 USDT once, and 0.8 USDC once.

It is possible that some large traders are using USDC as cross-margin collateral for USDT-Margined futures, and triggered liquidation.

In an hour's time, Binance announced that they will postpone the launch of USDC-Margined BTC, ETH, BNB, SOL and XRP perpetual contracts.

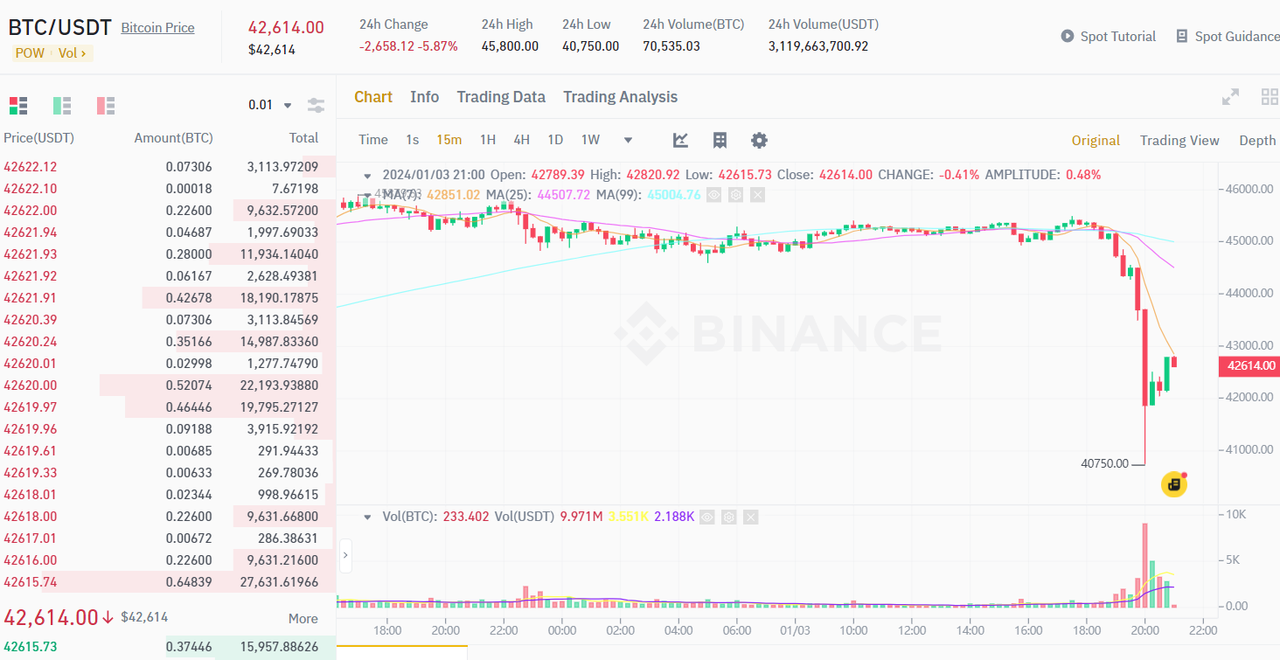

Market scared by Matrixport research

The market is now too confident about Bitcoin spot ETF approval, meanwhile too sensitive if it does not happen. This is clearly seen from the price trend after Matrixport research's article: Why the SEC will REJECT Bitcoin Spot ETFs again.

The article says:

We believe all applications fall short of a critical requirement that must be met before the SEC approves. This might be fulfilled by Q2 2024, but we expect the SEC to reject all proposals in January.

Within 30 minutes after the article was published, the market experienced a slight decline, followed by a more significant drop after 1 hour, resulting in a notable 10% decrease.

There have been concerns raised about Matrixport's research, with some suggesting that it may present conflicting viewpoints in a way that could potentially influence the market. Jihan Wu, the founder of Matrixport, has addressed these concerns on social media, providing clarification and addressing any perceived discrepancies in the company's research:

Markus did not give conflicting opinions on the same day. One opinion was shared on Tuesday and the other on Wednesday.

Markus revised his viewpoint, which is a strength in a dynamically changing market. This ability to swiftly adjust opinions is valued by Matrixport clients.

TRB pump and dump

Obviously, there's market manipulation.

The majority of individuals expressed discontentment with this situation.

- Those who have leveraged directional positions are liquidated

- Those who shorted TRB from the peak are auto-deleveraged and forced to take profit

- Those who tried to make arbitrage between Binance and OKX are either liquidated or charged very high funding fee

It seems like the only winners are whales. (Source: https://twitter.com/spotonchain/status/1740590392163402137 )

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()