DeFi Milestone: DEX Volume Surpasses CEX

On January 20, CFTC and SEC Chairs will step down, with Behnam advocating for CFTC crypto oversight and Gensler criticizing the industry's noncompliance. Meanwhile, Solana surpassed Ethereum in DEX trading volume at $4B, and DEX trading now exceeds 20% of CEX volume, signaling rapid growth.

Vacancies for SEC and CFTC chairman

CFTC Chair Rostin Behnam has announced a January 20 departure from his chairman role, on the same day as Securities and Exchange Commission Chair Gary Gensler, the two top U.S. markets regulator jobs will be open for appointment from the next president.Their last words:CFTC Behnam: Another early endeavor that has dominated every season of my tenure is addressing the gap in regulation of the cash markets for crypto or digital asset commodities. I have repeated myself often and at every opportunity. My position has not changed, and I will continue to advocate for the CFTC to fill this gap if Congress so chooses—even after I have moved on. Full script at https://www.cftc.gov/PressRoom/SpeechesTestimony/opabehnam49SEC Gensler: But in this (crypto) field, it is rife with bad actors... I’ve been around finance for over four decades and everything in the markets trade on a mixture of fundamentals and sentiment. At any given time, I’ve never seen a field that’s so much wrapped up in sentiment and not so much about fundamentals... It’s a field that built up around noncompliance, and I’m proud of what we’ve done. I think there’s still work to be done, particularly saying about these 10 or 15,000 alternative coins that they’re and the intermediaries themselves.

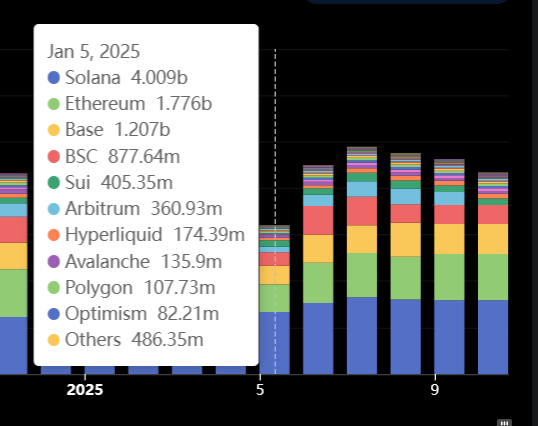

Solana beats Ethereum+L2s in DEX trading volume

The Solana network has surpassed Ethereum and Base combined in 24-hour decentralized exchange (DEX) trading volume, according to data from DefiLlama.According to DefiLlama, daily trading volume across Solana-based DEXs at $4 billion on Jan. 5, versus nearly $1.8 billion for Ethereum and $1.2 billion for Base, and $0.36 billlion for Arbitum, Ethereum’s most popular layer-2 scaling networks.

Meanwhile, a Solana user paid a $200,000 priority fee to be among the first to buy a new meme coin “AI Deborah” at transaction https://solscan.io/tx/3FurqVVT25iF2oNb7c8Dv6hmhKaKSoKoTdPqyFXMgiqS1B3WZHPon7gaPrZ2w46MBrd5gGAfgNLhZV1BQBrm2wq4Three minutes later, the user sold the entire position https://solscan.io/tx/mrWAzEvRXBQSJPKPCYnd4eGBFMnkeo4KTkzkyBv7QWBjohcjhFC6dg2Wmt8zoARTQG3XEJp9eSGGVDNdcnoNrvL for just under $8,000 with $89,000 loss, besides fee loss.

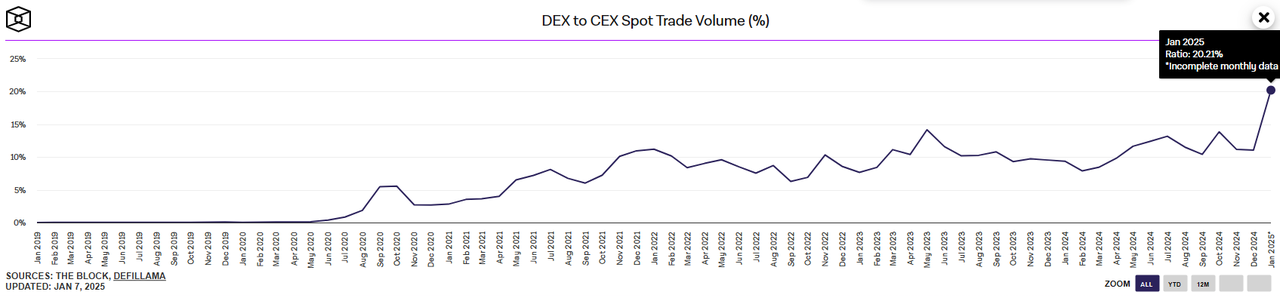

DEX volume surpasses 20% CEX volume

According to https://www.theblock.co/data/decentralized-finance/dex-non-custodial/dex-to-cex-spot-trade-volume, spot trading volume of DEX is growing fast compared to CEX, and now surpasses 20% of CEX volume.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

Comments ()