CZ exits Binance leadership after early prison release

CZ is set to be released from prison early this Friday, marking a permanent exit from Binance's leadership; Binance introduces pre-market spot trading with token purchase limits to manage trading pressures; Celestia's announced $100 million fundraising resembles an OTC trade with a vesting schedule.

CZ leaves prison on Friday

According to Fortune Crypto, CZ will be released from prison this Friday, 2 days ahead of his official release date (if a release date falls on a weekend, inmates leave custody early).

Previously known, CZ will exit from Binance's leadership permanently, according to current Binance CEO Richard Teng.

Binance pre-market spot trading

Binance announced pre-market spot trading, which is “actual tokens,” not derivatives like OKX pre-market futures. Obviously, it's a good tool to balance the huge buying and selling pressure when trading starts with below limitations:

- Purchase limitation: Binance Pre-Market users are subject to a maximum holding limit of tokens, which may differ for each qualifying Launchpool project. If a user's current Spot account holdings exceed the maximum holding limit, they will not be able to purchase additional tokens in the Pre-Market. (Please note: User spot holding amount include balance in wallet and unfilled order )

- Selling limitation: There are no limitations on selling.

Binance will announce when a Launchpool project is available for pre-market trading and its start date. Users can continue subscribing to Launchpool as usual. Once pre-market trading begins, all Binance users can trade the "pre-market" tagged tokens. Binance said the pre-market period will close at least four hours before the official spot trading, with a separate announcement for the listing.

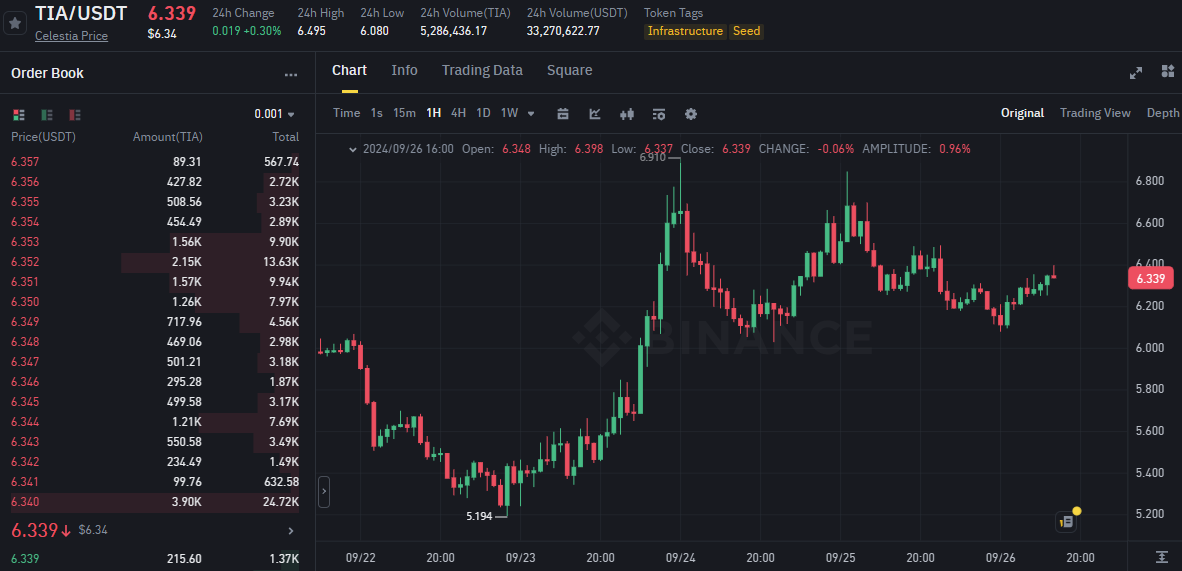

Celestia fundraising or OTC?

On Sept 24, Celestia announced $100 million fundraising at https://x.com/CelestiaOrg/status/1838277760789418231.

With more info disclosed, it looks more like an OTC trade with quick vesting, where 1/3 will be free for sale by end of October 2024, and the rest will be vested linearly in the next 1 year.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()