Crypto Funds 101: Funding fee arbitrage strategy

In this research, you will discover comprehensive insights into funding fees and their market impact, effective arbitrage strategies, risk management techniques, and practical case studies.

In crypto, the most popular quant strategy type is called market neutral arbitrage. Within the market neutral arbitrage strategy family, the most traded strategy is funding arbitrage (or funding rate arbitrage, or funding fee arbitrage). The idea of funding arbitrage is to capture the income from perpetual funding fee, while keeping the position fully hedged to ensure yield regardless of market up or down.

It's mostly used as fixed-income like vehicle, for flexible use and stable yield, and it can be based on BTC, ETH as well as stablecoins.

Foundamentals

What is funding fee

The Perpetual swap gained initial popularity in crypto from BitMEX, due to its 100x leverage.

Binance Tutorial has a good introduction.

"Traditional futures have an expiration date leading to settlement, where prices converge with the spot price. Perpetual contracts, primarily offered by crypto-derivative exchanges, differ in that traders can hold positions indefinitely.

Hence, unlike the traditional settlement, perpetual futures use a mechanism known as the funding rate to ensure that their prices align with spot prices regularly and mitigate price divergence.

In essence, the funding rate is a fee exchanged at set intervals (typically every 8 hours) between traders holding long and short positions for a trading pair. This fee adjustment modulates the price, ensuring regular convergence between futures prices and index prices.

Funding fees are payments to or from traders based on the difference between perpetual contract markets and spot prices. Crypto funding rates, recalculated periodically - with Binance Futures doing so every eight hours, prevent prolonged price divergence between the markets.

Funding Fee = Funding Rate x Position Notional Value

Where:

- Funding Rate is the periodic rate (could be positive or negative) determined by the difference between futures prices and spot prices.

- Position Notional Value is the size of the open position in the futures contract."

Funding fee is typically charged every 8 hours. The default funding rate is 0.01% (a pre-defined interest rate) which is annualized to be ~10%.

In extreme cases, it could be 4 hours, or even 2 hours to slow down speculation, to ensure the peg to spot.

How does funding arbitrage work in the crypto industry

To put in a very simple way

- When the coin's funding fee is positive, short perp and long spot in the same quantity

- When the coin's funding fee is negative, long perp and short spot (here the margin borrowing interest rate must be lower than funding rate to be able to justify the trade)

The typical way of trading funding arbitrage is to fund the trading account with USDT, and buy spot with USDT and short perp on USDT margined perps.

Some allocators choose to invest into funding arbitrage by BTC and ETH, or even Binance WBETH and OKX BETH. In such case, the trading strategy must borrow USDT from the exchange (borrowing allowance is less than the value of the coin), and pay interest. So the yield is much lower than USDT denominated funding arbitrage.

However, even though the strategy's principal is USDT, to increase further leverage (open more spot positions) after USDT is used up for buying spot, the manager will need to pay interest for the further USDT borrowed.

Expected yield and risk

Funding arbitrage features a stable yield and extremely low drawdown. The current market size (value of capital running funding rate arbitrage) is over $20 billion, of which around half is USD stables like USDT and USDC, and the other half is coins like BTC and ETH...

Yield

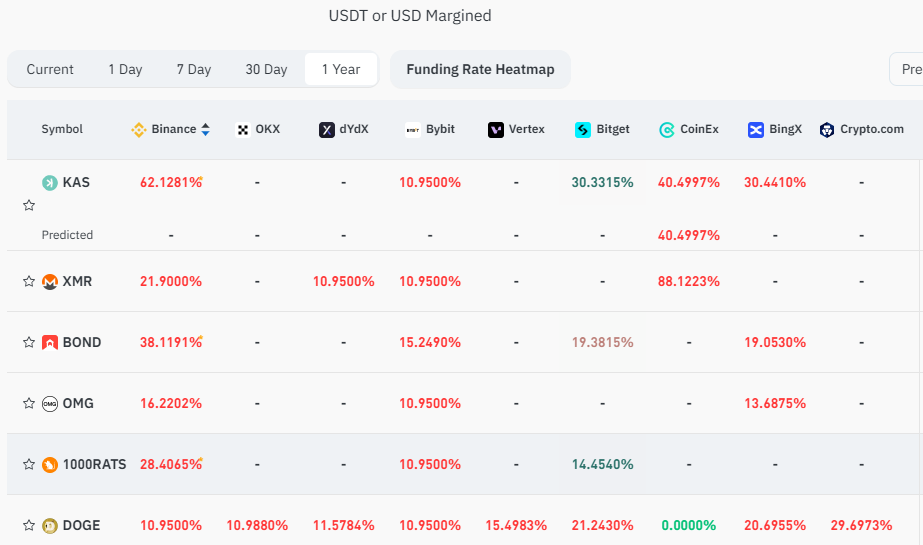

The gross yield of USDT arbitrage can be a wide range of 5% to 70% annualized, because it really goes with the market - Coinglass is a good source to see the recent funding data https://www.coinglass.com/en/FundingRate , it means if you short XMR perp in the last 365 days, the total funding gains are 21.9% of the initial principal assuming 1x leverage.

With the public market data, we can see the typical funding fee gross return should be a range of 10-30% annualized (considering there's extra leverage to enhance yield, but meanwhile strategy has to open position on lower funding instruments to avoid over concentration). Rough estimation of coin denominated arbitrage is half of the yield of USDT arbitrage (due to collateral haircut, and interest for borrowing USDT).

The drawdown is typically temporary, means it will be recovered once the perp-spot price gets pegged. If the manager makes a mistake that gets liquidated or ADL, the drawdown can reach 2%. So overall, the Sharpe Ratio and Calmar Ratio of funding arbitrage are both quite high (5-10).

Risks

Market neutral is not equal to risk free. Besides the counterparty risks (if you still remember FTX...), there's also trading risks.

Now top 3 perpetual exchanges (Binance, OKX, Bybit) have launched portfolio margin mode, trading risk has been lower than before to trade with hedged positions. But still there are trading risks even though the program is doing as intended.

Short squeeze on perpetual

Market neutral strategy could be liquidated if too much leveraged and too concentrated.

Imagine there's a token called ABC. I aim to earn the next funding fees and the $1 price difference when ABC-USDT spot and perp, when ABC spot is 100 USDT, and ABC-USDT perp is 101 USDT.

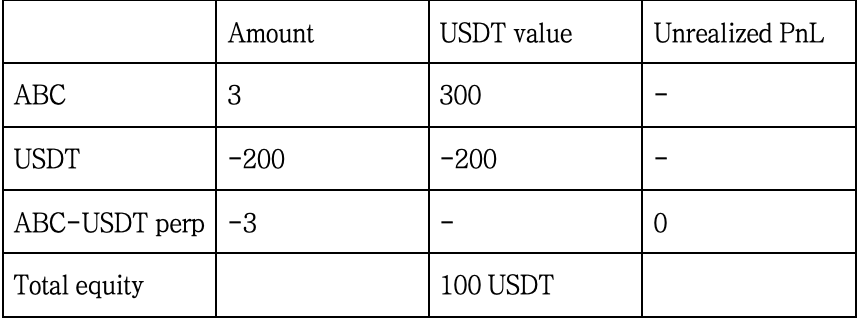

I have 100 USDT equity. To enhance my earning, I open position of 3 ABC spot (300 USDT after borrowing 200 USDT) and short notional 3 ABC on ABC-USDT perp. This is my holding:

After a while, ABC price suddenly pumps. In this case, what usually happens is that both spot and perp goes up significantly, but perp with its higher level of speculation will increase more than spot in a short time frame (till arbitragers fill the gap). Suppose at a certain moment, ABC spot goes up to 200 USDT, while ABC-USDT perp goes to 235 USDT. Now my holding becomes

It's seems quite unusual, but in a short squeeze this could go even further. As the liquidation on perp's short position is essentially market order long trades. Also, during volatile market conditions, the order book depths will be less than usual, making the price swing in a wide range.

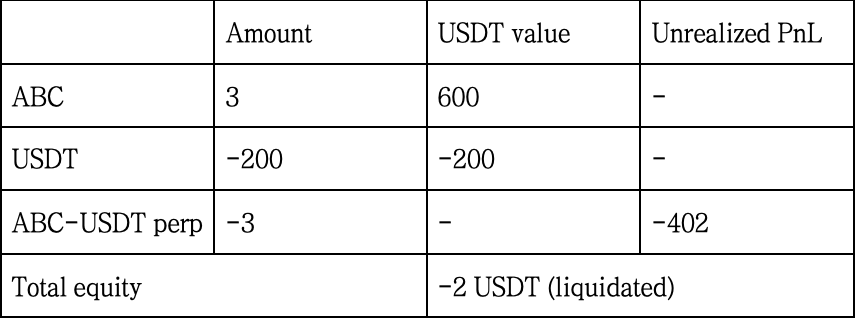

An extreme case happend on Gate POGAI coin on 2024 April 17 (the perp has been delisted 3 weeks after the pump and dump but luckily I found something from chat history where the spot was at most 0.0012 USDT while perp reached 0.002 USDT). Even if on the previous day you were holding a fully hedged portfolio, where the gross exposure on POGAI (and POGAIUSDT perp) was only 15-20%, in the pump and dump if you don't act immediately, your gross exposure on POGAI will go up to 60-70% since the price went up by 10x in 24h. And such short squeeze on perpetual swap will kill the whole portfolio.

And in reality, and all non-stable coins has a haircut as collateral in portfolio margin accounts. E.g., under Binance rule https://www.binance.com/en/futures/trading-rules/perpetual/portfolio-margin/collateral-ratio , market price of 100 USDT BTC is regarded as 95 USDT, while 100 USDT of BOND is regarded as 10 USDT. When exchanges determine liquidation, they use collateral value not market value. So you really need to keep enough collateral buffer on top of the maintenance margin.

Auto DeLeverage (ADL)

What's ADL? Imagine there's only 2 traders on ABC-USDT perpetual trading pair, you and me. You short 100 USDT notional value of ABC-USDT perpetual with 100 USDT margin (1x long) while I long the notional value of ABC-USDT perpetual with 100 USDT with 10 USDT margin (10x short).

When the ABC token price goes up, you will earn and I'll lose. Suppose price goes up by 10%, my margin has gone 0 (so I'm liquidated by the exchange). If the price of ABC continues to go up, your position should continue to earn more, but no one is there to pay for that extra profit - I'm out and the exchange obviously won't pay from their pocket. So the exchange has to close your position to stop your gain.

The official Binance tutorial https://www.binance.com/en/support/faq/what-is-auto-deleveraging-adl-and-how-does-it-work-360033525471

What's so risky about ADL? Because funding arbitrage is usually running on large capital (single account's gross exposure can reach $100 million). When ADL happens, there will be immediate delta exposure and it can be huge compared to the liquidity of the instrument. The crypto portfolio manager has to either execute a series of taker orders to eliminate the delta exposure where they face an immediate 5% slippage loss on liquidating that spot position, or passively wind down the position where the delta risk lasts more than 10 hours and hence brings unpredictable PnL.

So the manager has to take care of the high ranking of ADL, and promptly reduce the position to avoid ADL. And when ADL happens, they need to detect the position change, and handle the delta exposure with a reasonable combination of slippage and exposure period.

Different styles

There are many managers who run funding arbitrage, what can be different?

Venue: same-venue or cross-venue

With portfolio margin account model, normally funding arbitrage are traded in the same exchange (sub-)account for higher capital efficiency and lower risk.

Some teams trade cross-venue, where usually Binance or OKX vs a smaller venue like Gate or dYdX. Cross-venue strategies are trying to capture mainly price difference rather than funding rate difference. It's less popular than same venue strategy due to higher management costs (for both allocator and manager due to withdrawal permission control), higher risk and lower capacity.

Underlying: large cap or small cap

Large caps like BTC and ETH are much more stable in funding fees, usually positive, and change in small scale.

While usually the highest funding rates happen in small caps, trading small caps would expect higher profitability.

Considering collateral haircut and possibility of price manipulation, trading small caps must follow conservative leverage and concentration, while trading large caps with higher leverage and concentration is generally acceptable. The key indicator is maintenance margin rate.

Instrument: spot vs USDs-M perp vs Coin-M perp

Normally teams trade spot vs USDT perps, due to ease of pricing and liquidity.

Now with increasing liquidity on USDC perps, spot vs USDC perps are also emerging.

Coin margined perps are generally harder to hedge (because coin margined futures contract unit is USD not coins), and market is less active then USDT perps so it's less used. While some aggressive teams trades USDs-M futures vs Coin-M futures to capture the difference of funding rate.

Frequency: active or passive

Active: focus on execution, contiously switch positions from low predicted funding fee to the high funding fee. This style of strategy is actively trading every day, and the average daily turnover is 30-50% and sometimes even above 100% in volatile days.

Passive: focus on statistics, trying to predict funding fees in the next days or even weeks. Only passively adjust position size when the market fluctuates, especially when perp/spot price difference changes significantly. This style of strategy is not trying to trade every day, and the average daily turnover is below 10% and sometimes even below 5% in sideways market.

Execution: maker or taker

Funding arbitrage is trading 2 legs (spot and perp), most teams are executing with 1 leg maker and the other leg taker. It's obviously the standard way because taker fee is expensive and taker bears slippage from bid-ask spread.

Some low turnover strategies use taker on both legs - they don't trade often anyways, so the impact is minor.

Some high turnover strategies explore maker on both legs, while trying to control the delta exposure duration.

Top funding arbitrage managers

Disclaimer: The content of this webpage is only market information sharing, but not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Asia-based

Binquant

Founded in 2018, Binquant focuses on quantitative development and asset management in the digital asset market, and now is one of the largest digital asset manager. Team members graduated from CMU, Peking University, Tsinghua University, and Shanghai Jiaotong University, and have many years of experience in exchanges, traditional hedge funds, and tech companies. The main strategies are market neutral arbitrage, CTA, high frequency, and DeFi. Main clients include hedge funds, VC funds, large financial institutions, family offices, and exchanges for asset accretion.

Bsset

Bsset is a leading digital asset management company specializing in high-frequency trading and market-neutral quantitative strategies. Our experienced team is dedicated to delivering superior alpha to our clients consistently. Using advanced proprietary trading infrastructure and a custom research platform, Bsset identifies and exploits pricing inefficiencies across various instruments. Our main strategies include funding rate arbitrage and spread arbitrage, and high-frequency market making, which reduce execution costs and offer comprehensive risk management. We have a 7*24-hours risk control system that continuously monitors and manages potential risks in real-time.

EU/US-based

Active Digital

Active Digital Asset Management is a quantitative digital asset investment firm, specializing in Separately Managed Accounts (SMAs) across major platforms such as Bybit, Binance, OKX, and HTX, with a global team spanning Australia, the United Kingdom, and South Korea, and employing systematic/automated trend following as well as funding arbitrage. Active Digital Asset Management prioritizes risk management above all else by deploying a sophisticated suite of risk management products, combined with a low-latency execution algorithm that is utilized across all strategies.

Grandline

GrandLine Technologies is a systematic multi-strategy trading firm established in 2018. Grandline specializes in deploying mid-frequency market-neutral strategies across major digital assets on both centralized and decentralized exchanges. With decades of expertise in quantitative portfolio management, the team is dedicated to consistently delivering superior alpha. With six years of live track records, Grandline is recognized for our exceptional research and risk management process, earning accolades from esteemed institutions like Hedgeweek and HFM.

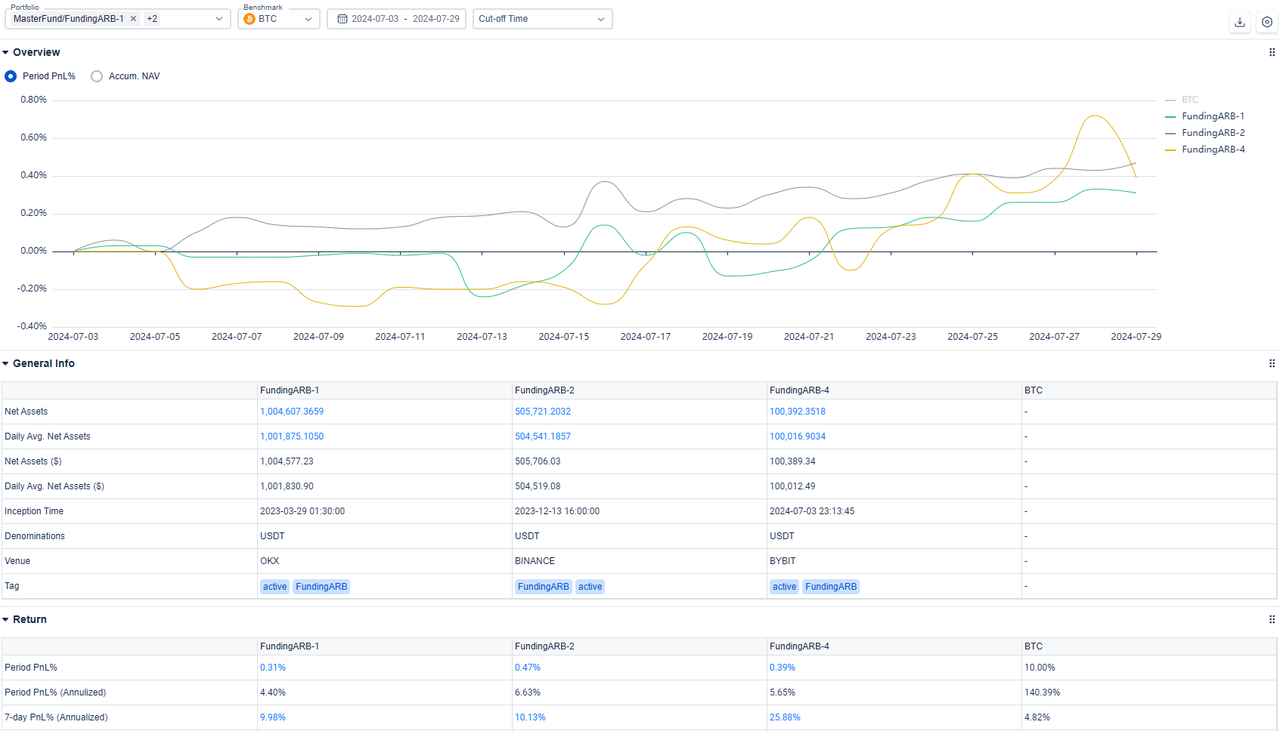

1Token Crypto PMS functions

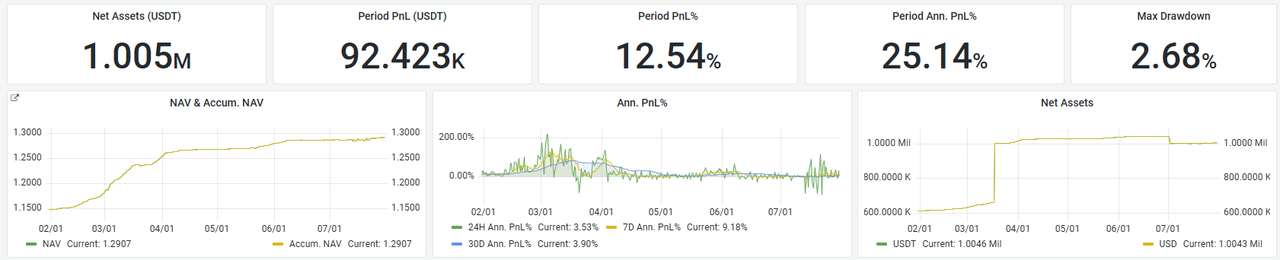

1Token Crypto Portfolio Management System helps allocators and managers track real-time PnL and performance in various denominations,

and full transparency to investment strategies to ensure strategy is running on track, by addressing risk control, performance analysis and operations in crypto quant strategies.

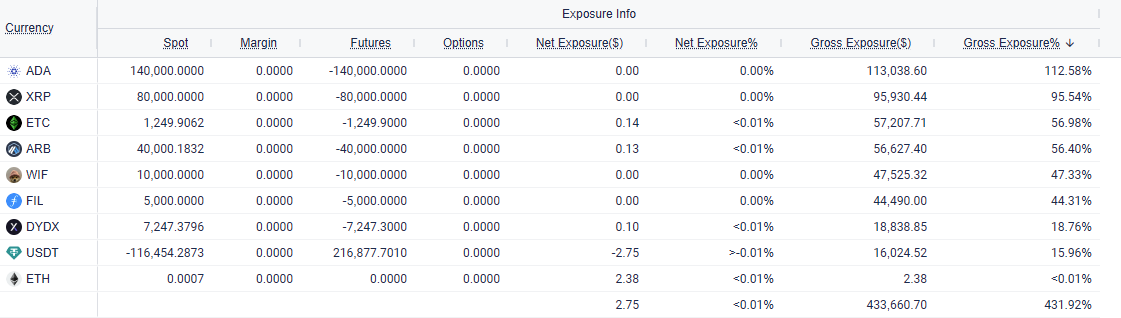

Risk control

To prevent liquidation

Visualize gross and net exposure in table view, to prevent holding on

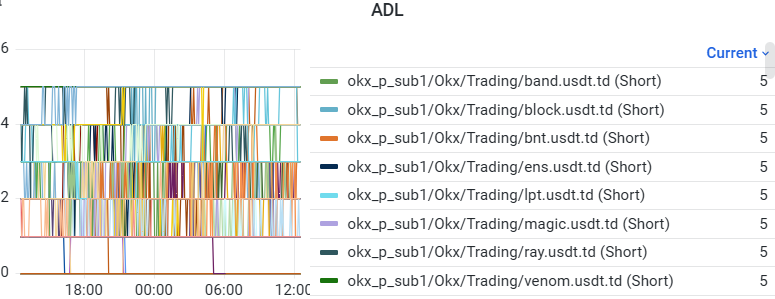

To prevent ADL

Track the ADL ranking of each position, and visualize in graph view.

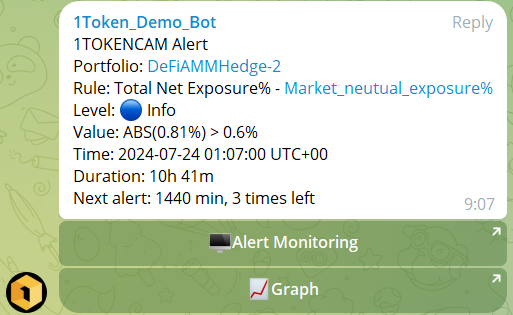

Alert on rule violations

Real-time monitor on dozens of preset rules like drawdown, exposure, leverage, concentration, trading scope... And alert by Telegram, Slack, text message and phone call.

Performance analysis

Performance report

Transparency to trading styles, strategy evaluation like Sharpe ratios

PnL contribution analysis

Position PnL in any given time period

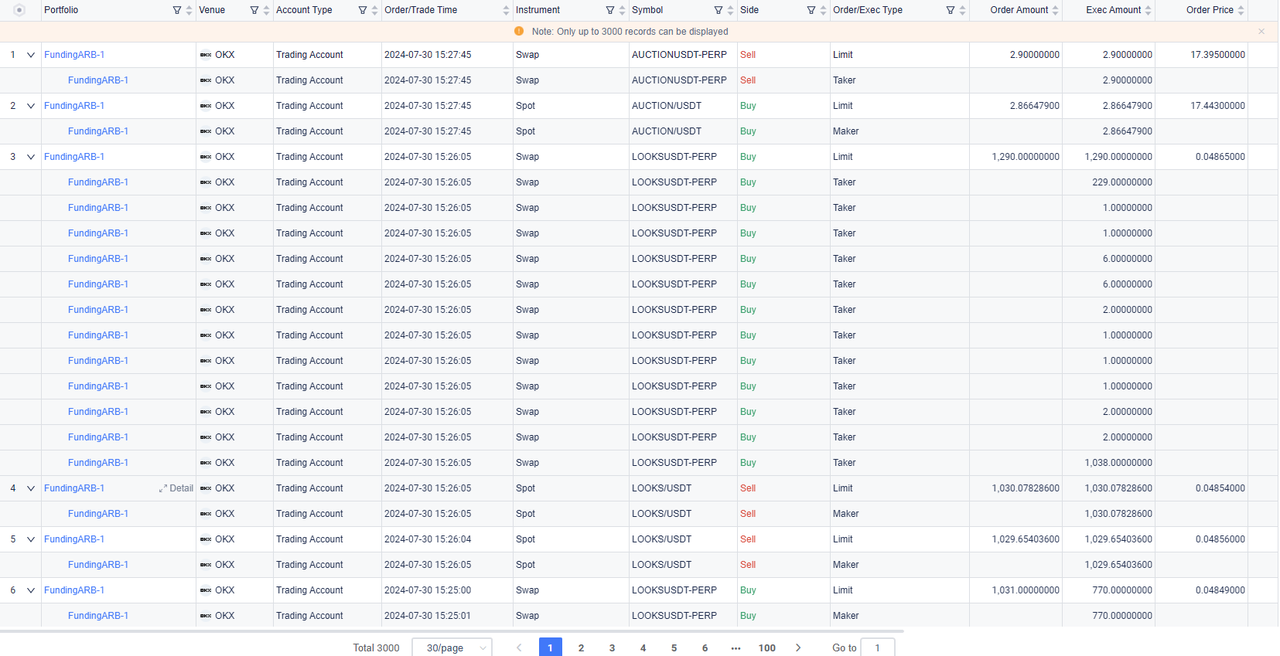

Operations

Recording keeping

Historical hourly snapshot of balance and position, all transactions reconciled with balance and position change

Statistics

Funding fee, trading volume

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()