Coinbase Joins S&P 500, Shares Surge 24%

CW 20. Coinbase will join the S&P 500, replacing Discover, marking a milestone for the crypto industry. Its shares rose nearly 24% on the news. Binance launched a new Alpha Points usage mechanism for TGEs and airdrops. CoinMarketCap unveiled its own launchpad, CMC Launch.

Binance Alpha point starts consumption

A new Binance Alpha Points consumption mechanism where points will be spent when users confirm to participate in an exclusive TGE or claim an Alpha airdrop.

The Binance Alpha Points consumption mechanism was formally introduced on 13 May, 2025. Participation in any event is optional so users can choose whether or not to spend your Binance Alpha Points. Binance Alpha Points are spent immediately when you confirm participation in an Alpha event (e.g., Alpha airdrops or TGEs).

Details see:

https://www.binance.com/en/support/faq/detail/12e7f2e555704f9c8e852d1c1afb032a

Coinbase to join S&P 500

Coinbase Global Inc., the largest US cryptocurrency exchange, will be added to the S&P 500 Index in the latest milestone for the booming digital-asset industry. The company will replace Discover Financial Services in the index prior to the start of trading on May 19.

Announcement from S&P Global:

Coinbase stock jumped nearly 24% as the company was set to become the first and only crypto platform in the S&P 500.

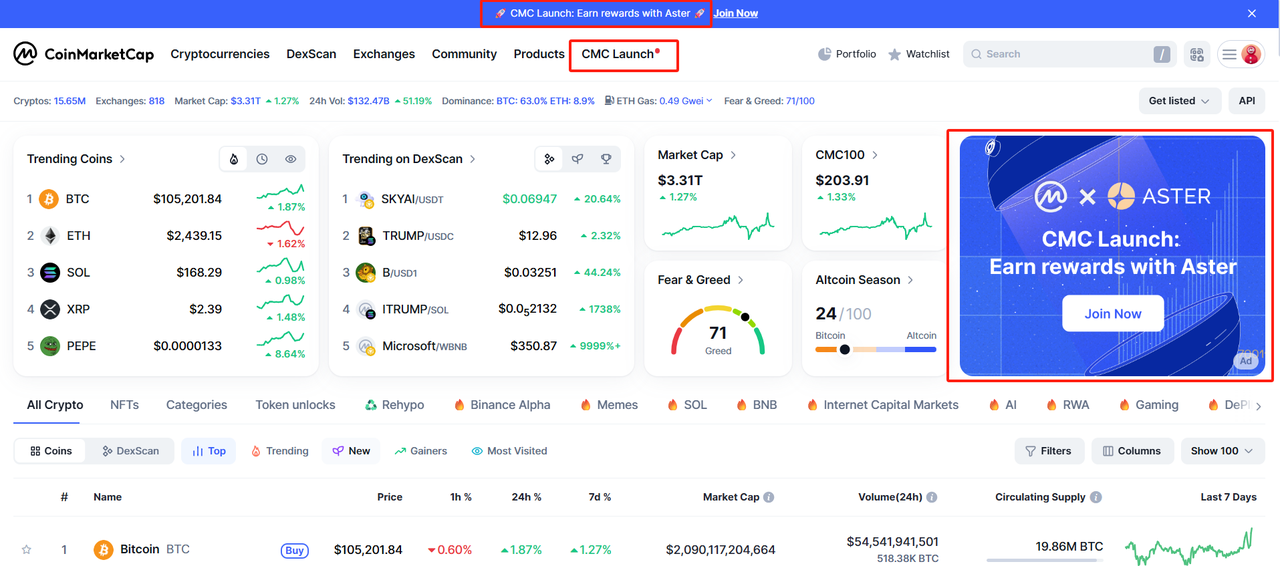

CMC Launch by Coinmarketcap

Coinmarketcap launched their project Launchpad named CMC Launch:

https://coinmarketcap.com/cmclaunch/

Obviously it's big for them as it's shown multiple times on the home page.

1st project is https://x.com/Aster_DEX/ backed by YZi Lab.

1Token's Service

Serving 60+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()