Coinbase and Binance launch MiCA-compliant EUR stablecoins

Coinbase and Binance introduce MiCA-compliant EUR stablecoins with zero-fee trading options. Meanwhile, the SOL spot ETF faces approval challenges. Binance's DOGS listing sparks retail interest.

Coinbase and Binance listed different EUR stablecoins

Coinbase will enable conversions between the fiat euro and the euro-pegged stablecoin EURC at a 1:1 ratio in supported jurisdictions on Aug. 28. EURC is pegged to the euro's value, just like USDC is designed to be pegged to the dollar's value. According to an email from Coinbase, EURC is compliant with the European Union's new Markets in Crypto Assets regulation, commonly known as MiCA. The conversions available on Coinbase Advanced will have no associated fees.

On the same EUR stablecoin topic, Binance will List Eurite (EURI) and promote it by 0 fee trading campaign, which is also a MiCA compliant EUR stablecoin.

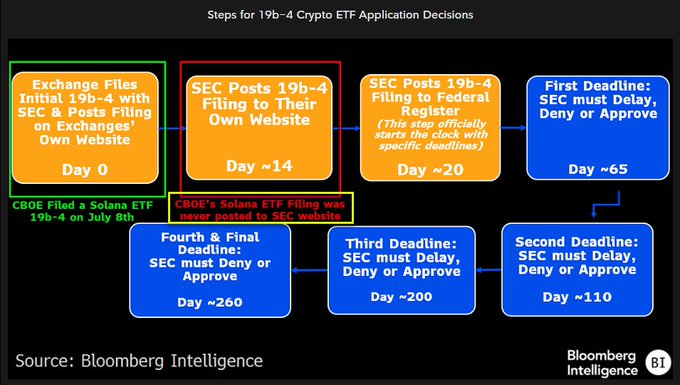

SOL spot ETF unlikely coming

According to Eric Balchunas, the Solana ETF filings never made it past Step 2 (the SEC failed to ack them).

So the exchanges withdrew 19b-4s though the issuers' S-1s are still active.

Unless there's change in leadership, SOL spot ETF is unlikely approved.

DOGS listed on Binance

Who can say no to active retail flow? Binance joins the other large exchanges to list DOGS and put on Launchpool. With TON, NOT and DOGS all listed on Binance, it almost seems like a honeymoon between Binance and TON.

There will be an overlapping period with TON's launchpool where by default 50% staked BNB goes to TON and 50% BNB goes to DOGS.

TON: Aug.15-Sept.3

DOGS: Aug.23-Aug.25

My personal guess on the price trend will be similar to NOT, where it'll be dumped hard in the beginning, then price will go up.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()