CFTC Considers Stablecoins as Collateral in U.S. Derivatives

CW 39. The CFTC is considering stablecoins as collateral in U.S. derivatives. In Korea, Naver plans to acquire Upbit’s operator Dunamu. Meanwhile, UXLINK disclosed an $11.3M breach, triggering token losses and a sharp price drop.

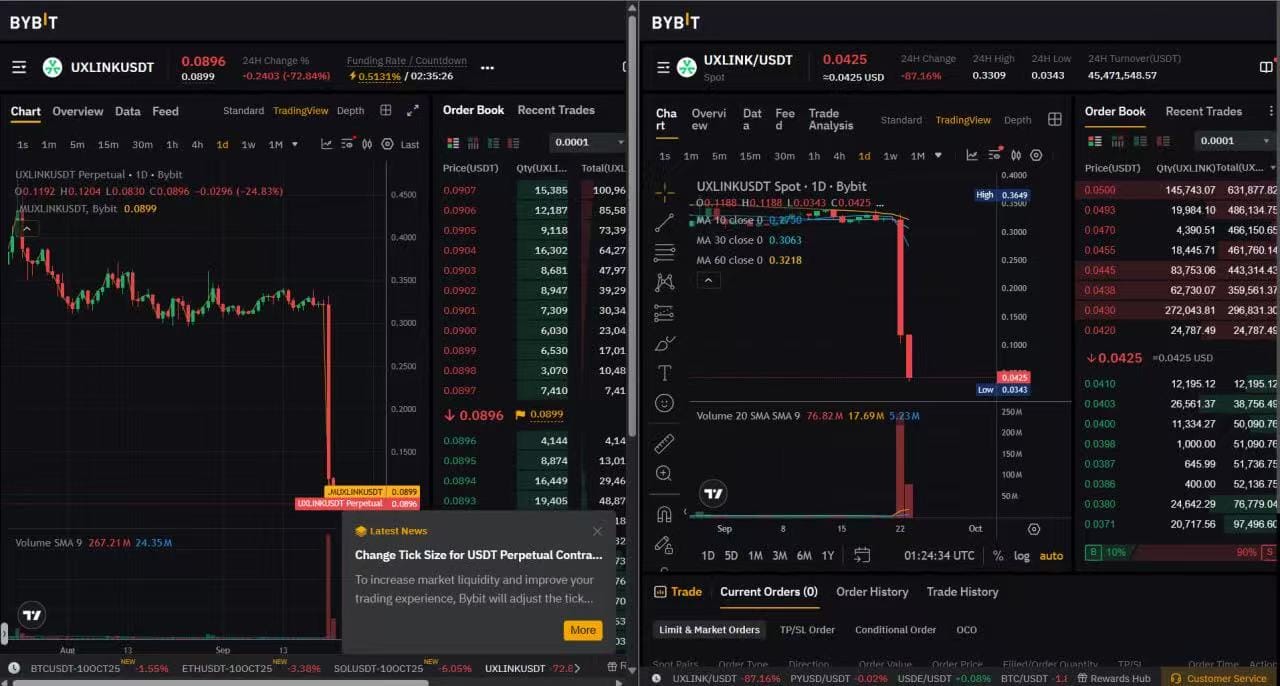

UXLINK security breach and token dump

UXLINK, a blockchain-based social infrastructure token, reported a security breach in its multi-signature wallet today, with stolen funds of $11.3 million in various cryptocurrencies, subsequently moved to exchanges.

https://x.com/lookonchain/status/1970330298568319083

Meanwhile the hacker also minted massive amount of UXLINK, causing a price crash of UXLINK token and big difference in spot and perp price.

Stablecoins to be collateral in US derivatives markets

Acting CFTC Chair Caroline D. Pham has announced an initiative to let stablecoins be used as tokenized collateral for the first time in U.S. derivatives markets.

The move follows the February Crypto CEO Forum where this idea was discussed among leaders of all the major stablecoin firms, and also builds on the President’s Working Group recommendations.

The CFTC is seeking public feedback until Oct. 20 on valuation, custody, settlement, and rule changes needed to make tokenized collateral work.

Naver acquiring Upbit

Naver Financial, the fintech arm of South Korean tech conglomerate Naver (often called the “Google of South Korea”, with search engine, email hosting service, blogs, maps and a mobile payment processor), is reportedly forging ahead with a plan to acquire Dunamu, which operates Upbit, the country’s largest crypto exchange in terms of trading volume and customer base, amid plans for a stablecoin project and expansion into the digital finance sector.

Naver will acquire Dunamu by making it a subsidiary via a share exchange, and board meetings to approve the stock swap will happen soon, South Korean news agencies Yonhap News and Chosun reported on Thursday, citing industry sources.

1Token's Service

Serving 70+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

All-in-one support designed for allocators, portfolio managers, and institutional investors seeking transparency and control.

Comments ()