CEXs & TradFi Movements Boost Institutional Crypto Investments

Binance allows large crypto funds to custody assets in banks

Accoding to FT report, Binance has begun to allow some larger crypto traders to keep their assets at independent banks, including Switzerland’s Sygnum Bank and Flow Bank.

Previously, Binance clients could only hold their assets either on the exchange or through custodian Ceffu, which US regulators described as a "mysterious Binance-related entity".

According to 1Token’s knowledge, it is true that crypto hedge funds are actively seeking such arrangements, and Binance's institutional department is open to third-party custody solutions. However, Binance, as a group company, is currently hesitant due to concerns that widespread adoption of these solutions may hinder the growth potential of Ceffu's business.

Invesco & Galaxy Bitcoin ETF reduces fees to attract inflows

Invesco and Galaxy’s spot bitcoin ETF is ranking at the medium-low among all spot ETFs in terms of AUM.

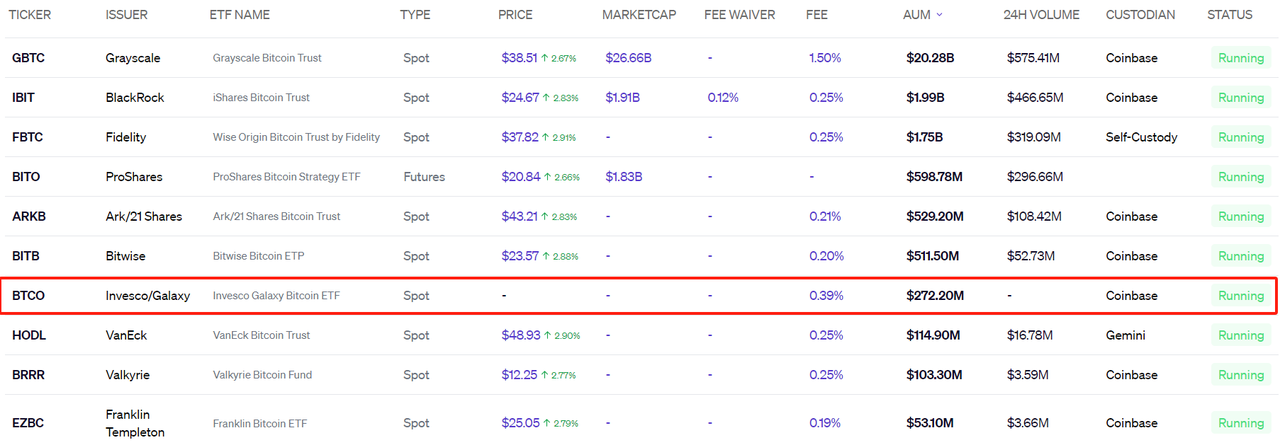

Data before the adjustment:

However, according to a recent SEC filing, the ETF is reducing its fee from 0.39% (which was one of the highest, excluding Grayscale) to 0.25%.

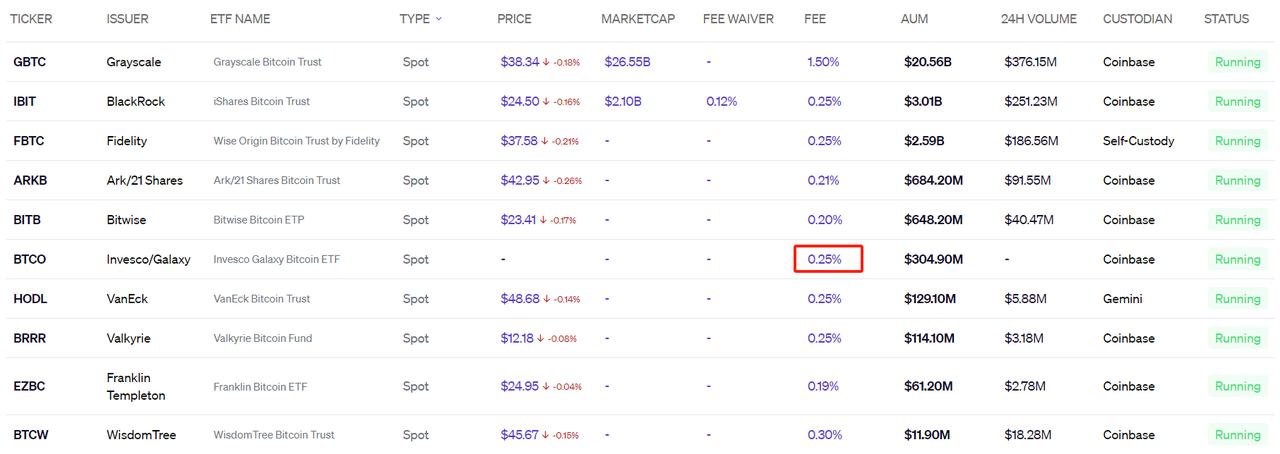

This adjustment will align Invesco and Galaxy's spot bitcoin ETF fee with that of most competitors.

Data after the adjustment:

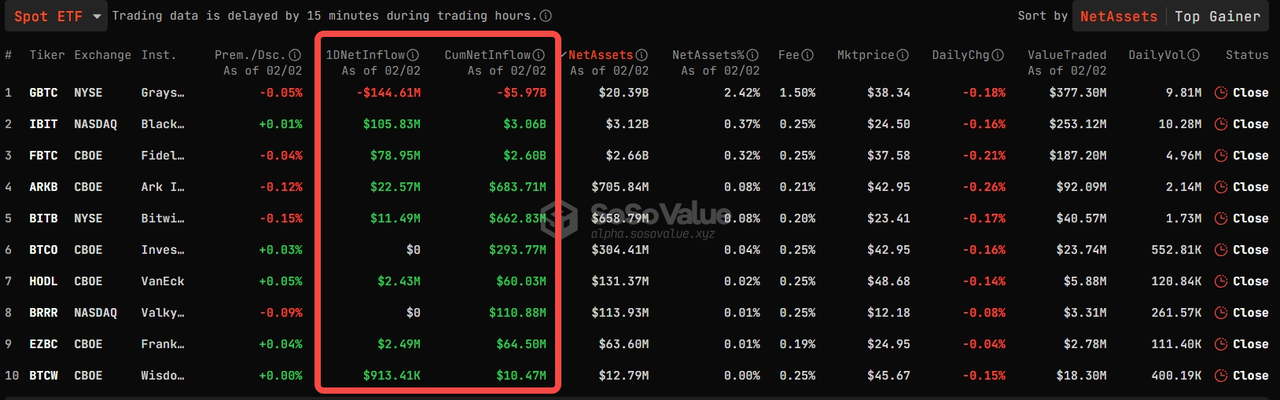

Additionally, the data indicates that BTC ETFs have experienced net inflows for 7 consecutive days, with the outflows from GBTC being fully offset by inflows from the other 9 ETFs.

Source: https://alpha.sosovalue.xyz/?category=ETF

Coinbase to charge fees on USDC to USD conversions over $75 million

Coinbase, the prominent fiat on/off ramp for USDC to USD, has recently announced significant changes to its fee structure:

- Institutional clients will now be subject to a fee of 0.1% for USDC to USD net conversions exceeding $75 million.

- Net conversion is now calculated by subtracting the total USD to USDC conversion volume from the total USDC to USD conversion volume over the past 30 days.

- Members of the Coinbase Exchange Liquidity Program who have qualified for Tier 1 or Tier 2 as outlined in the eligibility criteria are now exempt from USDC Conversion Fees for any month they meet eligibility.

This adjustment may impact large crypto hedge funds that rely on Coinbase as a fiat gateway rather than a trading venue, potentially leading to increased costs. It is also possible that a redemption fee could be introduced to offset these additional expenses.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()