Bitcoin ETFs Generate $4.6 Billion Trading Volume

First day of Bitcoin spot ETF

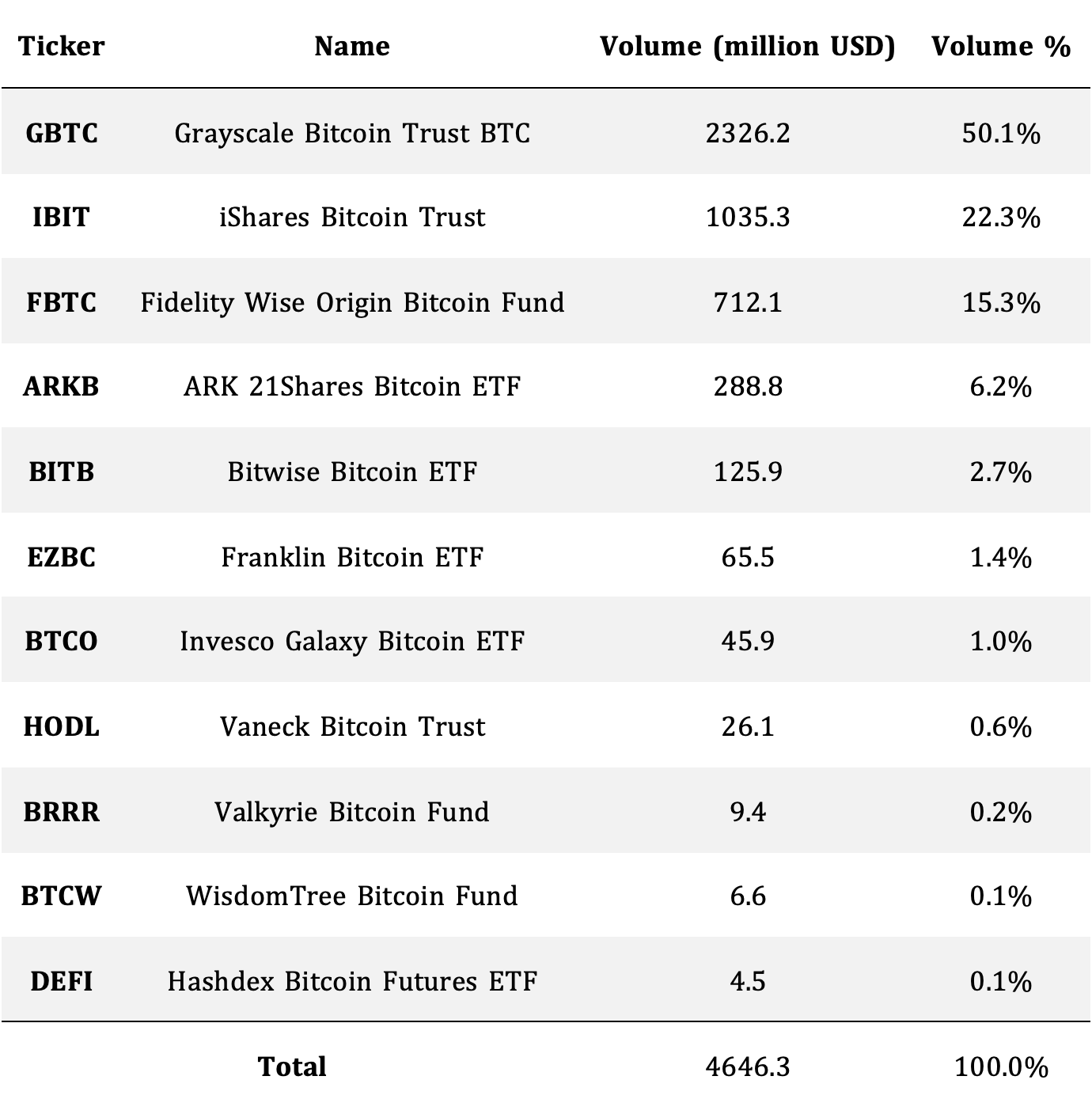

On the first day of trading for spot Bitcoin ETFs, the total volume reached $4.6 billion, indicating strong initial interest.

However, it is worth noting that approximately 50% of this volume came from GBTC. Considering GBTC's higher fee of 1.5% compared to others ranging from 0% to 0.5%, it is possible to infer that a significant portion of investors may consider exiting their positions, prompting questions about the inflow of new money.

The following data represents the performance of the 11 U.S. spot Bitcoin ETFs on their first day of trading, as provided by Bloomberg analyst James Seyffart.

By the way, Blockworks published a very informative summary page: https://blockworks.co/bitcoin-etf

Bitcoin spot ETF approval

BTC spot ETF was finally approved on January 10, 2024.

The fees are quite competitive.

Grayscale slightly decreased from 2% to 1.5%, while Blackrock (iShares Bitcoin Trust/IBIT) is proposing to be 0.12% (and after 12 months to be 0.25%).

Considering the common custody cost in crypto of 0.3-0.5% annually (Check Gemini's custody fee schedule, there should be discount for VIP clients, most of the ETF use Coinbase custody but there's no official fee disclosed in public sources), Bitcoin spot ETF's annual management fee ranging from 0.2-0.5% can be considered favorable for investors.

Of all the coming spot ETFs, Bitwise seems to be the real Bitcoin enthusiast, as they tweeted their plan of donating 10% profit to Bitcoin development organizations like BitcoinBrink, Opensats, HRF, meanwhile they are charging the lowest fee!

Binance taking a rest on Launchpool and FDUSD interest subsidy

The latest XAI's return is around 1% on BNB. That's pretty decent income within a 4-day period, though much lower than previous ones like AI and NFP.

Additionally, Binance has not announced any further Launchpools, and the price of BNB has decreased by 10% from its peak.

The FDUSD simple earn on Binance, meanwhile, has hit an all-time low due to

- The cancellation of the interest subsidy (5% for up to 500k FDUSD)

- Low utilization

FDUSD's poor liquidity makes it unsuitable for trading and is not the direct margin for futures. Currently, the primary utilization for FDUSD is Launchpool.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()