Bitcoin ETF — 'cash only' vs 'in-kind'

Frequent Binance Launchpads ... and fair mode?

Binance is obviously speeding up Launchpad programs:

- There were in total 5 Launchpad projects in whole 2022

- There were in total 6 Launchpad projects till the end of September, 2023

- As for December 19th, there have already been 3 Launchpad projects since October (80 days, where accumulative duration is 54 days, and there's going to be one more)

The most recent project ACE reportedly yielded approximately 3% within five days, depending on the selling price, which equates to an annualized yield of around 150%.

Consequently, there has been a significant increase in the prices of BNB and FDUSD.

Something new is that this project will launch in 'Fair Mode'.

Fair Mode is a new model launched by Binance Launchpool, designed to protect and maximize the interests of the community and retail users, Fair Mode will divide the treasury into two distinct funds:

- Long-Term Treasury Fund (“LTF”) for long-term, strategic uses, e.g., locked in perpetuity and are used to extract staking rewards or other intrinsic benefits after they are vested.

- Short-Term Growth Fund (“SGF”) which is earmarked for immediate, operational purposes, e.g., operational expenditures, liquidity provision, token reward distribution and other operational requirements.

For more details, please refer to Binance research report.

Still mildly bullish

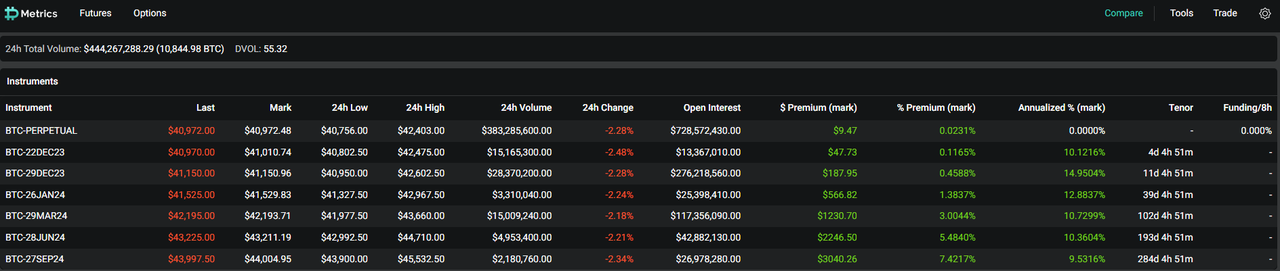

According to Deribit metrics, there remains an approximately 10% annualized future basis on BTC.

What does this mean? By creating a hedged position on BTC, an individual could allocate $41,000 to long 1 BTC, then utilize the 1 BTC as collateral to short 1 BTC future, set to expire on 27th September 2024 at a price of $44,000. With careful risk management to prevent liquidation, as Deribit operates as a portfolio margin account with minimal risk, the potential gain would be approximately $3,000, representing an approximate 7% return over a 9-month period.

It's still mildly bullish because, in 2021, the annualized future basis can be 2-3%, equivalent to about 30% annualized, so compared to that period, the current market is milder.

Bitcoin ETF — cash-only

The launch of the BTC Spot ETF is anticipated to take place in approximately three weeks. Market expectations suggest that an official announcement will likely be made around mid-January.

The last sticking point of "cash-only" vs "in-kind" has been addressed, as practically all the ETF providers have given up on finding a compromise and have acceded to the SEC's "cash only" demand.

What's cash-only?

The SEC is reportedly insisting that BTC ETF transactions - the ones where market makers exchange the underlying asset for new shares or vice versa - be in cash and not "in-kind."

ETFs in traditional markets hold a basket of shares in different companies, and that the issuer relies on market makers partners to ensure the ETF's share price reflects the value of the underlying stocks. This occurs through an arbitrage system that incentivizes the market makers to provide liquidity to ETF secondary market, by subscribing new shares in the ETF with a basket of securities ('in-kind'), which they can then sell the ETF shares at a profit, or, conversely, they can redeem back the underlying securities with shares of the ETF, and sell the securities at a profit. In both cases, the transactions result in the price of the ETF shares aligning more closely with the underlying asset.

While with the coming Bitcoin ETFs, this 'in-kind' model is almost determinedly not going to be adopted by the first batch applicants. Critics say it's going to increase the trading cost of BTC ETFs, and investors are going to pay for it.

OKX Bitcoin Ordinals Marketplace

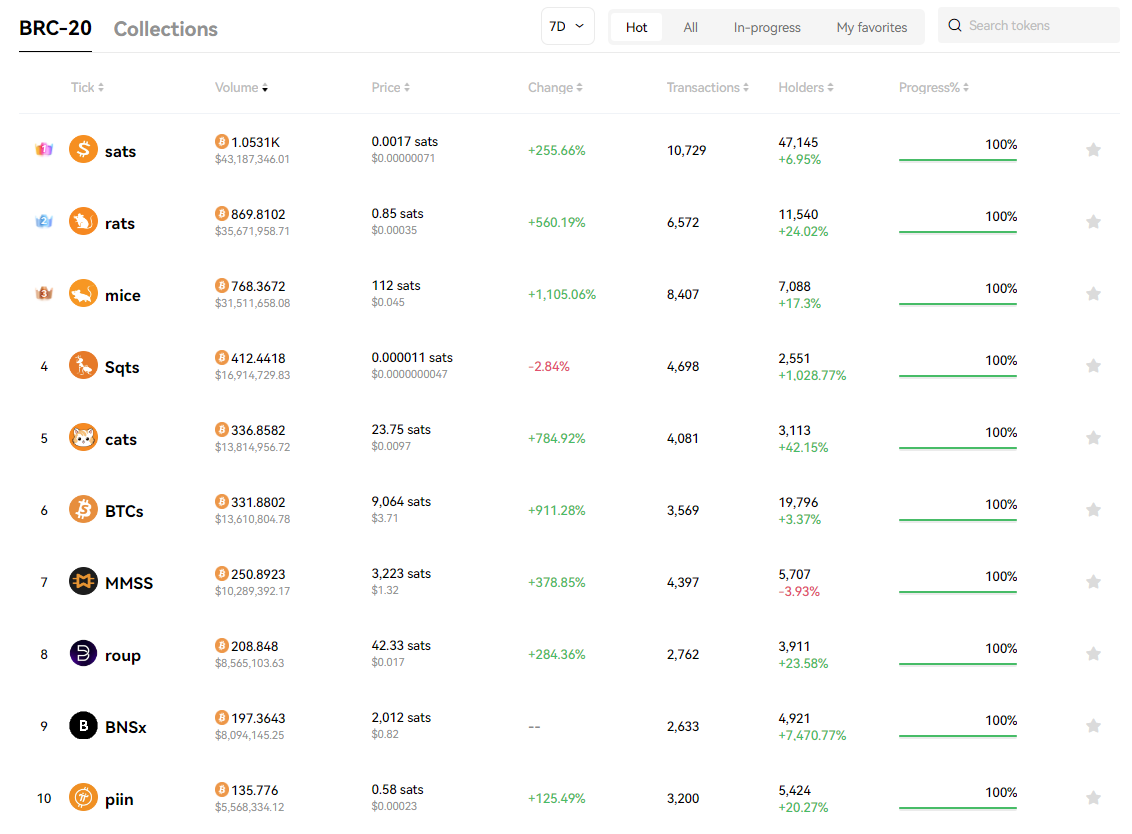

OKX has experienced significant growth in the BRC-20 ordinals space, commonly known as Bitcoin NFTs.

The 7-day trend below shows an upward trajectory, indicating an attractive potential.

However, as with many retail speculations, there has been notable price fluctuation.

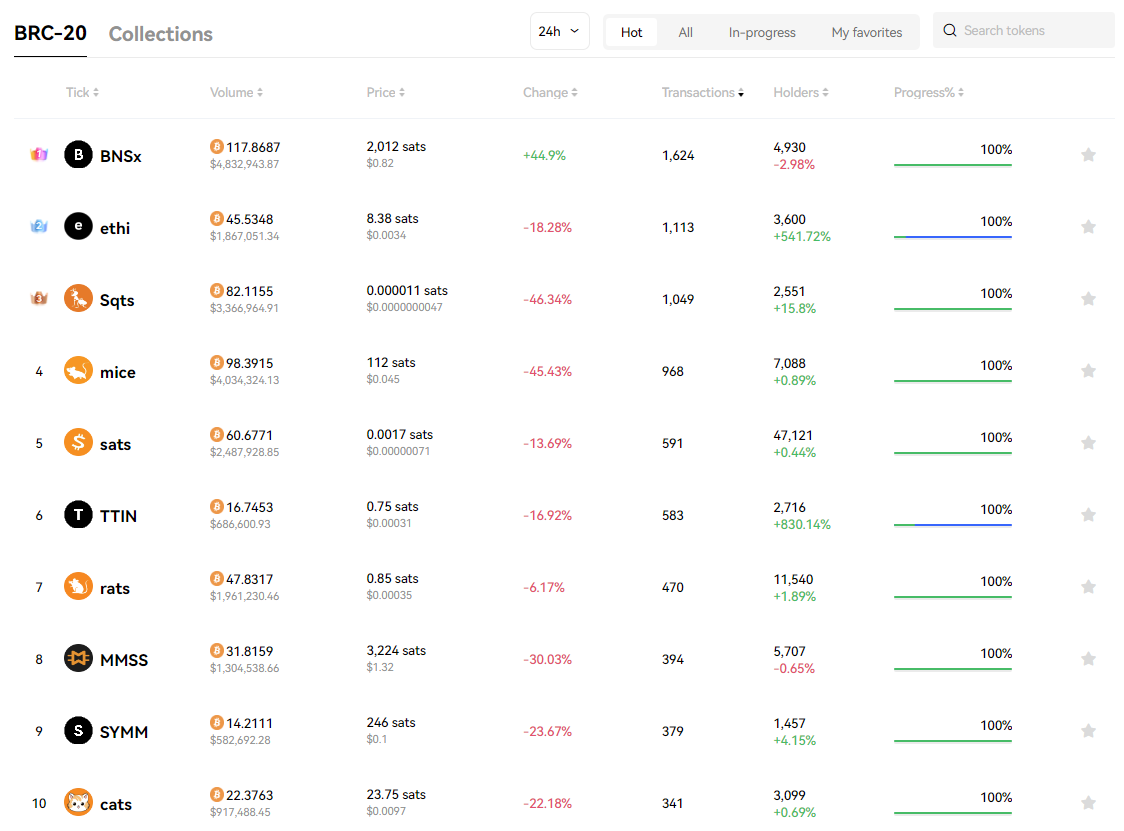

The 24-hour trend below indicates a downward movement, with hopes for potential price recovery in the near future.

Some critics argue that BRC-20 / Ordinals lack official support from BTC core, unlike NFT on ERC-721, leaving their long-term validity uncertain. They suggest that official BTC core developers could replace them, potentially rendering them worthless.

If there's any exchanges who can find a way to make ordinals derivatives, it could offer significant opportunities for institutions, while potentially posing risks to retail users.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology.

1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()