Binance Lists Gold Perpetuals as Regulatory Footprint Expands

CW50 Binance launched XAUUSDT gold perpetuals and added TradFi-perps support in its API, signaling broader asset expansion. The exchange also received full authorization from ADGM. Separately, Terraform Labs co-founder Do Kwon was sentenced to 15 years over the Terra collapse.

Binance lists gold perp

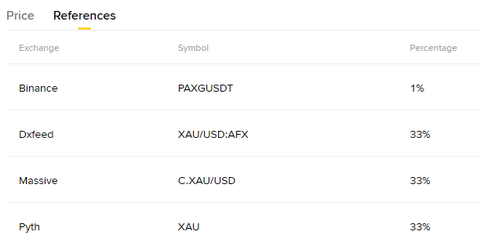

Binance expands its gold trading from PAXG or XAUT to real gold XAU with below index price source

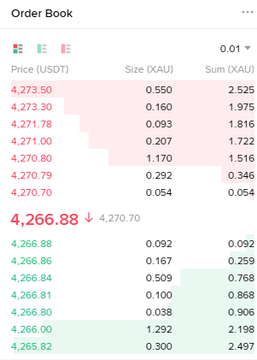

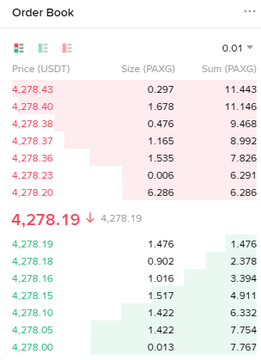

Liquidity is quite poor: https://www.binance.com/en/futures/XAUUSDT

Compared to: https://www.binance.com/en/futures/PAXGUSDT

Binance also added TradFi-Perps agreement contract in its API endpoint, implying more stocks or commodities perpetual swap coming.

Binance fully licensed from ADGM

Binance has received full authorization from the Financial Services Regulatory Authority (FSRA) of ADGM to operate its global platform, Binance.com, under a world-class supervisory framework.

Three licensed entities – an exchange - Nest Exchange Services Limited, a clearing house - Nest Clearing and Custody Limited, and a broker-dealer - Nest Trading Limited – will separately perform trading, custody, settlement, and off-exchange activities, mirroring traditional financial-market infrastructure.

See full announcement: https://www.binance.com/en/blog/regulation/135414587642456580

Do Kwon sentenced 15 years for $40 billion fraud

Terraform Labs co-founder Do Kwon was sentenced to 15 years in prison for his role in a massive fraud that saw roughly $50 billion wiped from the crypto ecosystem over the course of just three days in May 2022.

The sentence, handed down by District Judge Paul Engelmeyer of the Southern District of New York (SDNY), is slightly more than the 12-year sentence requested by prosecutors and much greater than the five-year sentence suggested by Kwon’s lawyers. Kwon must serve at least half of this sentence before he can apply for a transfer to South Korea, where he faces further charges.

See full script: https://x.com/innercitypress/status/1999150597837087172

About 1Token:

1Token is a digital asset investment management platform providing Crypto PMS, RMS, and Portfolio Accounting Software, managing over $20 billion in assets for more than 80 clients worldwide.

All-in-one support designed for allocators, portfolio managers, treasury managers and fund operations and accountants, seeking transparency and control.

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()