Big Sale by Government Moves

South Korea's crypto tax is postponed to 2025. US, Germany, and Mt. Gox Bitcoin sales cause market fluctuations. MiCA allows only regulated stablecoins in the EU, boosting USDC.

South Korea delays crypto tax to 2025

https://www.lexology.com/library/detail.aspx?g=cb4aec8f-f110-4ac6-aa4d-d315ebb32b6d

As one of the most active markets, South Korea has been announcing to implement tax back since 2021 with an initial timing of 2022 Jan.

The laws should have been finalized in early 2023, but then the implementation was kept postponed each year.

We will see if it'll really be implemented in 2025.

Governments and Mt. Gox crashing the market

US and Germany governments have been actively transferring Bitcoin and Ether to Coinbase or OTC (most likely to cash out)

https://platform.arkhamintelligence.com/explorer/entity/germany

https://platform.arkhamintelligence.com/explorer/entity/usg

Also Mt. Gox has been returning Bitcoins

https://platform.arkhamintelligence.com/explorer/entity/mt-gox

Another potential source of selling pressure might come from UK government

https://platform.arkhamintelligence.com/explorer/entity/uk

MiCA coming into effect

Well over 2 years after the Markets in Cryptoassets Regulation (MiCA) was first proposed, it has finally come into effect on 29 June 2023. The most important is the regulation for stablecoins that only regulated stablecoins will be permitted for use within the bloc.

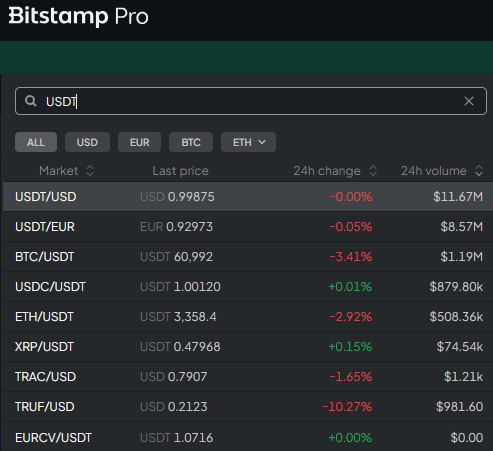

Bitstamp, one of the regulated exchanges, has delisted Tether’s euro stablecoin EURT but kept USDT on the trading book. And Binance has announced to assure users the continuation of USDC in EMEA area https://www.binance.com/en/support/announcement/usdc-is-now-mica-compliant-here-s-how-it-affects-your-binance-account-0d4036736bf344259769aa7cc6f080a4 , while USDT will be in a "sell-only" mode that users cannot buy unaurthorized stablecoins, but they can sell, withdraw or deposit.

USDC is expected to take market share from bigger rival Tether Holdings Ltd.’s USDT. On 2024-07-01, Circle announced that it had been authorized to issue USDC as a MiCA-compliant e-money token (“EMT”), by France’s Autorité de Contrôle Prudentiel et de Résolution (ACPR), part of the Banque de France, making USDC the first major Regulated Stablecoin in the EEA.

1Token’s Service

Rooted from crypto quant trading, 1Token's Crypto PMS, RMS and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 Type2 audit, and provides on-premise deployment to regulated clients.

Comments ()