Besides Bitcoin Halving...

Gemini fully recovers assets in Genesis case, while Binance ensures fund stability by converting to USDC

Again, not going to talk too much about BTC halving, which everybody knows.From history, each halving triggers a bull run, could be that there's economy cycles, could be that there's less selling pressure from miners... The next halving is 4 years later.

Gemini Earn made whole from Genesis

Genesis announced that at this week's hearing, the Bankruptcy Court orally approved the global settlement agreement among Gemini, Genesis, and other creditors in the Genesis Bankruptcy. This marks another milestone in the process to achieve a full recovery of Earn users’ digital assets.

Details in https://www.gemini.com/earn

Looks like everyone is getting 100% recovery in Genesis lending bankruptcy.

Binance SAFU fund conversion to USDC

On April 18, Binance announced convert all assets in SAFU fund into USDC.

Binance's SAFU fund is an emergency insurance fund that was established in 2018 to protect Binance users in extreme situations. Over the years, this value of SAFU fund has been maintained around $1B. With the conversion, the fund will always remain stable at $1B.

Binance annouced its USDC address: 0x4B16c5dE96EB2117bBE5fd171E4d203624B014aa

And Spot On Chain also created a monitor https://platform.spotonchain.ai/en/platform/entity/2099

Binance inflating FDUSD number?

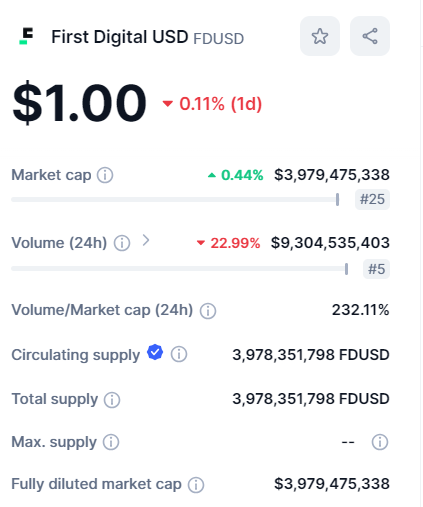

From Coinmarketcap (that collects data from Etherscan), FDUSD circulating supply is 3.9 billion.

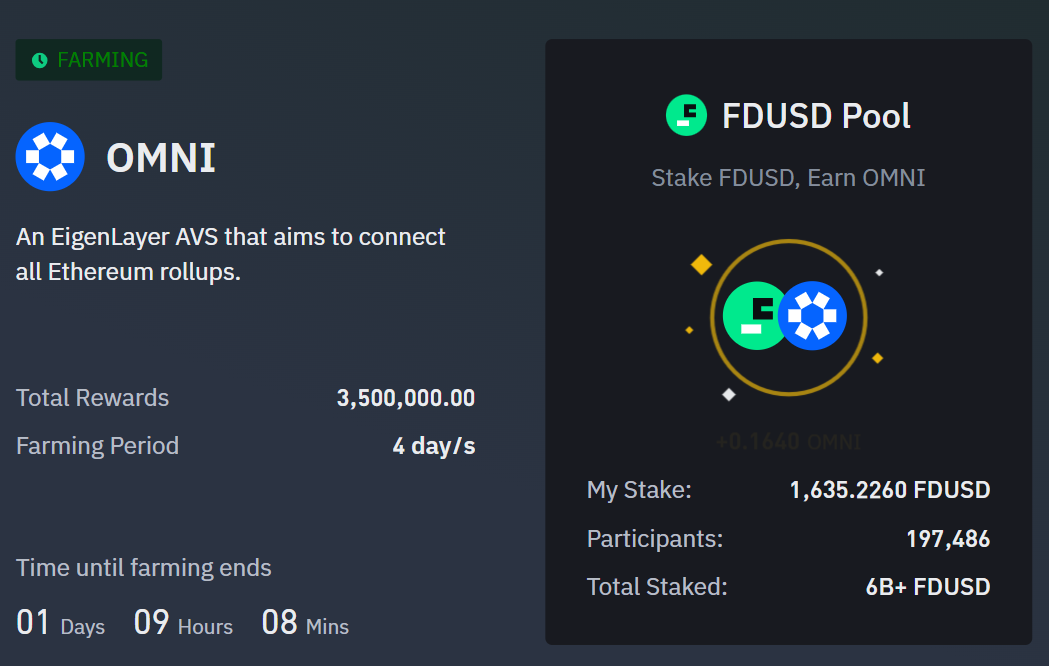

However in Binance, the staked FDUSD is 6 billion

Only explanation is there's much more FDUSD supplied on BSC chain but there's no supply data disclosed on BSCscan.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()