ACT Flash Crash Sparks Binance Leverage Controversy

CW14 Market Digest: ACT plunged 50% in one hour, triggering liquidations, as Binance reduced perpetual leverage while large holders sold. FDUSD briefly depegged after Justin Sun questioned issuer solvency. SEC clarified stablecoins like USDT and USDC aren't securities; USDe remains uncertain.

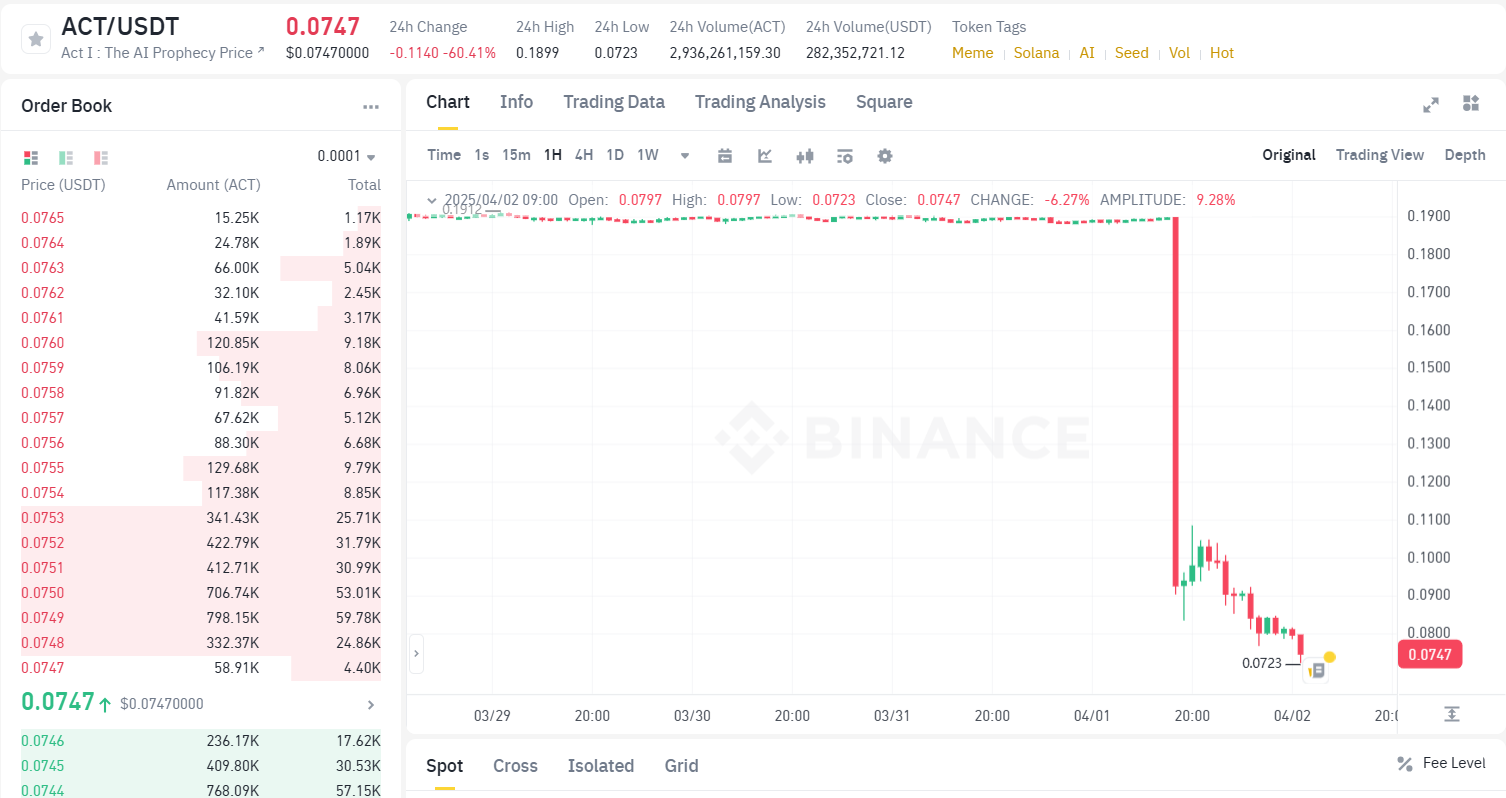

ACT crash on Binance

ACT dropped ~50% in a hour, resulting in bloddy liquidations and ADL.

The market thinks it's due to Binance lower the leverage of ACTUSDT USDⓈ-M perpetual contract and didn't give the market enough time to respond so market makers with higher leverage has to liquidate their positions.

However Binance explained in an announcement later saying it's 4 big users sold their spot holdings, and Binane did not find any single account which made significant profits from this incident. In that case, it would be the market makers cannot open sufficient leverage to trade the sell orders.

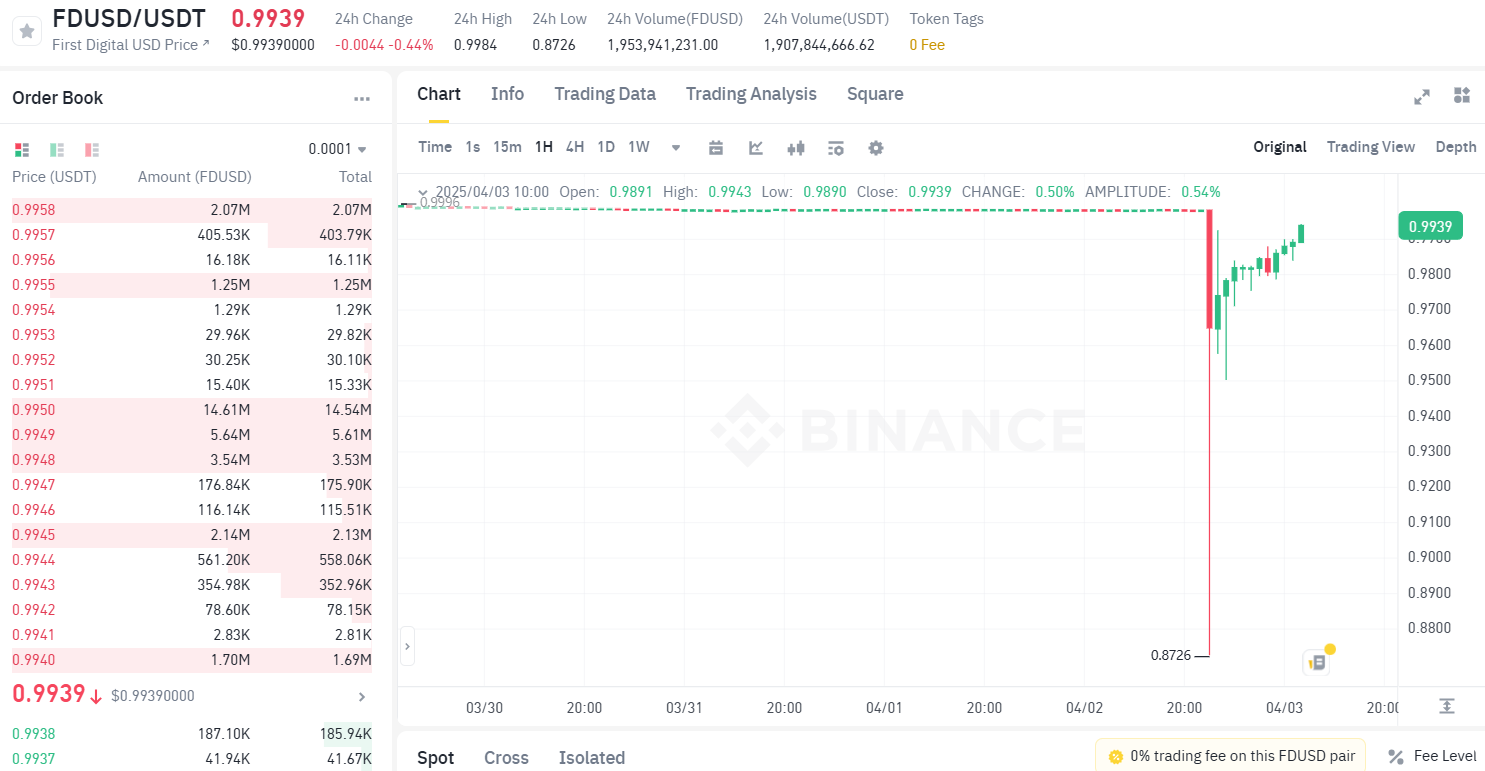

FDUSD depeg

As a response to Coindesk's report on TUSD, Justin Sun posted on X that First Digital Trust, the issuer of FDUSD, is insolvent. According to the discussions on X, it's because when Justin Sun acquired TUSD from Trusttoken via Techteryx, Justin was not the UBO or manager of Techteryx, and Techteryx on their own transferred the real USD to Aira Capital Management/Aria Commodity Finance Fund while First Digital Trust was the custody and First Digital Trust won't return the fund.

The price of FDUSD quickly depegged by 10% in 1 hour, and recovered in a few hours.

Justin Sun announced that he'd publicize more info, but he never responded to the TUSD report, which somehow confirmed the report's content.

Classic Stablecoins are not securities

According to David Sack's X, the SEC has determined that fully-reserved, liquid, dollar-backed stablecoins are not securities. Therefore blockchain transactions to mint or redeem them do not need to be registered under the Securities Act. Full statement: https://www.sec.gov/newsroom/speeches-statements/statement-stablecoins-040425

Under such definition, USDT, USDC, FDUSD should be fine, but USDe should still belong to securities.

1Token's Service

Serving 60+ Clients worldwide, 1Token's Crypto PMS, RMS, and Portfolio Accounting Software has the unique trading know-how and technology capabilities to build:

- Front office (portfolio managers and traders) to view live position and exposure, calculate trading PnL and historical performance.

- Middle office (ops and risk) to maintain portfolios and API accounts, book OTC trades, monitor risk metrics and analyze VaR/STV, generate shadow NAV with investor subscription/redemption/dividend.

- Back office (admin and auditors) to collect and reconcile trades, generate valuation and PnL reporting under FIFO/WAC tax strategy.

Comments ()