Binance Joins AML Alliance, KuCoin Faces US Indictments

A community vote could merge three AI protocols into a $7.6 billion entity, Binance joins the Global Travel Rule Alliance for AML compliance, and KuCoin faces legal challenges over AML law violations and lax KYC protocols.

FET + OCEAN + AGIX = ASI

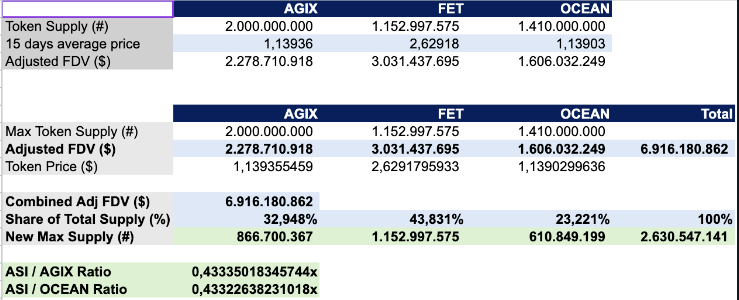

A token merger to the tune of $7.5 billion consisting of artificial intelligence (AI) protocols SingularityNet, Fetch.ai and Ocean Protocol is scheduled for a community vote of approval on April 2. There will be three separate community votes for each individual protocol, with completion of all voting scheduled for April 16.If the proposal receives majority approval from the respective communities, the following will occur:

- FET will be rebranded as ASI, with a total supply of 2.63055 billion tokens

- AGIX tokens migrate to ASI, at a conversion rate of 0.433350:1

- OCEAN tokens migrate to ASI, at a conversion rate of 0.433226:1

If the FDV of all three tokens as of March 26, 2024 were carried over fully into $ASI, it would have a total combined FDV of $7.6 billion USD.

Binance joins GTR Alliance for AML

Binance annouced on March 26, that it's going to join the Global Travel Rule (GTR) Alliance – a global community of virtual-asset service providers utilizing the same solution for complying with one of the key international anti-money-laundering rules.Travel rule has been discussed by different VASP (virtual asset service providers, including meaning crypto providers) and regulatory authorities,The “travel rule” requires VASPs and financial institutions to collect personal data on the participants of transactions and share the sender and recipient data to another VASP or financial institution.The data that VASPs and financial institutions are required to collect includes:

- The name of the originator (sender)

- The originator account number used for the transaction

- The originator’s address or national identity number, customer identification number or date and place of birth

- The name of the beneficiary

- The beneficiary account number.

The difficulty is that blockchain based digital assets by its nature are decentralized. There's not a SWIFT or VISA for digital assets for all regional authorities to regulate. Currently some exchanges are trying to implement travel rule by asking clients to book their receiving address's account KYC, and limit that to some exchanges with travel rule implemented. So Binance has to shown their AML efforts to be able to be acknowledged as one of the qualified reciepients.

KuCoin accused by US regulators

Crypto exchange KuCoin and two of its founders (Gan and Tang) were charged with violating anti-money laundering laws by U.S. federal prosecutors.DOJ's indictment said that KuCoin deliberately avoided U.S. AML and KYC regulations by "falsely representing that it had no U.S. customers when, in truth, KuCoin had a substantial U.S. customer base." The government claims KuCoin allowed its platform to be used for laundering over $9 billion.While CFTC's indictment said KuCoin offers both spot and futures trading services without registration as a futures commission merchant, swap execution facility or designated contract market, and KuCoin didn't implement the CFTC's equivalent of a KYC program.KuCoin exchange token KCS price be like

Seeing the coin outflowing from KuCoin, CEO Johnny Lyu announced an airdrop to retain users and deposits.

1Token’s Service

Rooted from crypto quant trading, 1Token has the unique trading know-how and technology capabilities to build

- Up-to-date and high confidence connection to all crypto trading venues, across DeFi and CeFi

- Top-down, bottom-up crypto P&L calculations, and crypto fund reconciliation of top-down and bottom-up results

- Real-time crypto trading metrics calculation, monitor and alerts tailor-made for different types of crypto funds, crypto FoFs and crypto prime brokers

- T+0 crypto shadow NAV accounting system with subscription, redemption, dividend, cost accruals

1Token has been serving global digital asset managers, crypto fund platforms, crypto fund admins and crypto auditors, to enable them to conduct crypto related business without any concern on technology. 1Token is undertaking SOC2 audit, and provides on-premise deployment to regulated clients.

Comments ()